Ayondo is a limited company based in the UK and has been in operation since 2009. It is quickly becoming one of the leading social trading platform in Europe. Their mission is to ‘revolutionize the retail trading and investment space’. We decided to check out how well they are doing in achieving their mission.

Organization and regulations

Understanding the organization of the company you are about to entrust your money with is obviously a prerequisite for every prudent investor. We decided to look at Ayondo’s corporate organization first.

We found that the social trading services are provided by Ayondo GmbH, a company registered in Germany. Ayondo Markets Limited, registered in England and Wales on the other hand, provides the trade execution service. The latter is the sole provider of the brokerage services. This means that you are not able to choose other brokers when you sign up with Ayondo and that you have to use their brokerage services.

The liability for Ayondo GmbH is covered by DonauCapital Wertpapier AG, which is regulated in Germany by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin). As for Ayondo Markets Limited in the UK, it is regulated by the Financial Conduct Authority (FCA).

Ayondo Markets Limited has been in operation in the UK since 1997. The social trading services have up-to-date, been around for five years. As of the writing of this review (May 2014), we did not find any complaints lodged against the company in the FCA records. So, as far as regulations in the Europe goes, Ayondo has a clean report. We did note however, that Ayondo is not regulated in the US and it does not accept US residents.

Demo accounts

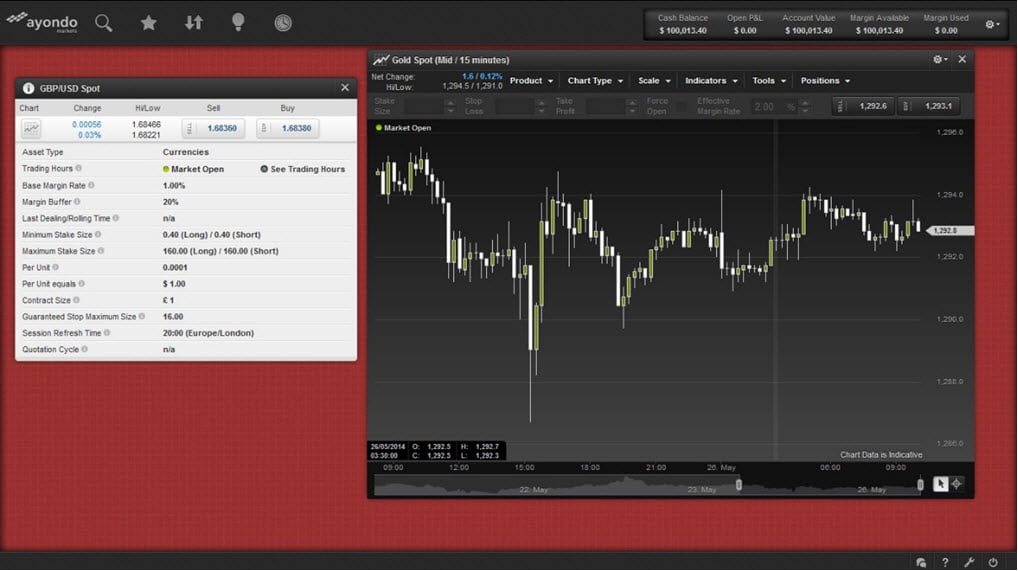

Like most other service providers, Ayondo allows you to open a demo trading account to test out their platform. The demo account is valid for 15 days. It comes preloaded with $100,000 and nearly all the features are available in the live account. Opening the demo account is a straightforward process. We did notice however, that the list of countries available is not complete. The dropdown list where you choose your country of origin is not exhaustive and no explanation for this is given.

Be ready to be patient while opening the account, as it may take a while ( meaning a day or so). In our case, it took an unbelievable twelve hours for the confirmation email to reach our inbox. Clearly, Ayondo could do much better in this area.

Signals providers

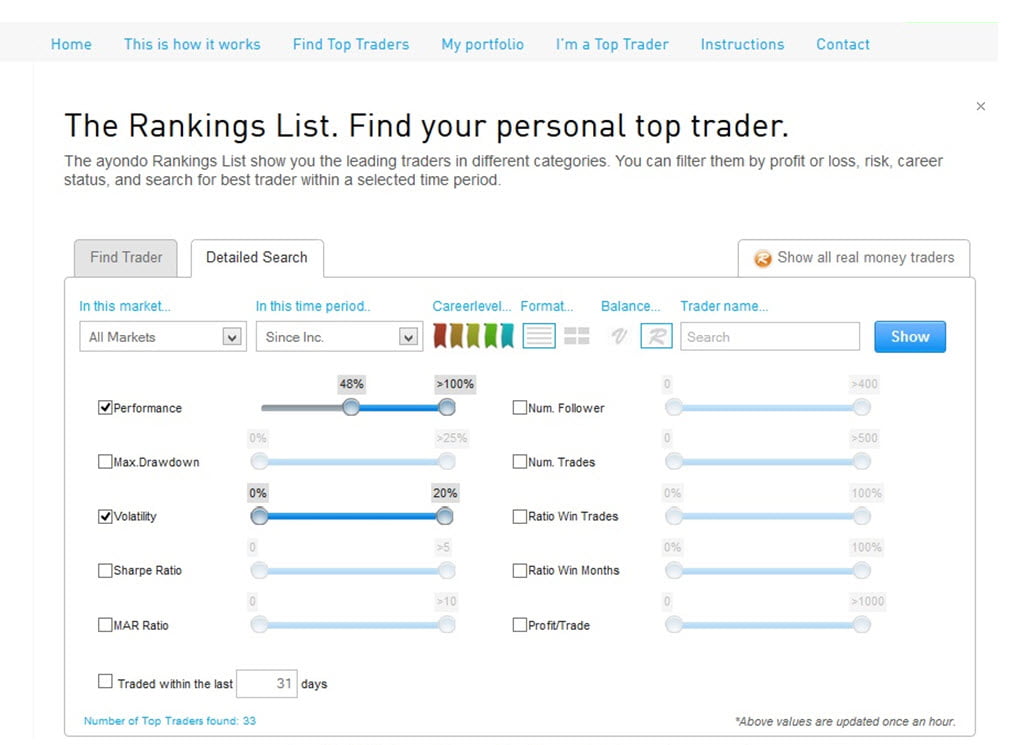

Ayondo allows their ‘top traders’ to act as trade signal providers. You will be pleased to know that the number of signal providers available is now over 1000. That is a lot to choose from and it can be quite overwhelming at first. Ayondo provides a brilliantly intuitive interface to find your perfect ‘top trader’. You can sort them out according to their profits (or losses), number of followers, maximum draw down, trades per month and the volatility of trades.

Ayondo does not allow top traders to publish their strategies. They want traders to be gauged on their actual performances. So if you are looking to find out how your favorite trader takes his trades or their strategies, you will be saddened to know that Ayondo discourages this form of ‘advertisement’. Even though this forces you, the investor, to be objective in making your investment decisions, we feel that it does very little in the way of encouraging ‘social trading’. With that said, it is somewhat difficult to blame Ayondo for taking such measures. There are many strategies out there that may seem great on paper but may eventually burn holes in your wallet. Besides, there is no guarantee that the trader will stick to the strategy that they proclaim to follow. Judging ‘top traders’ solely based on their performance is a much more desirable way to go about it.

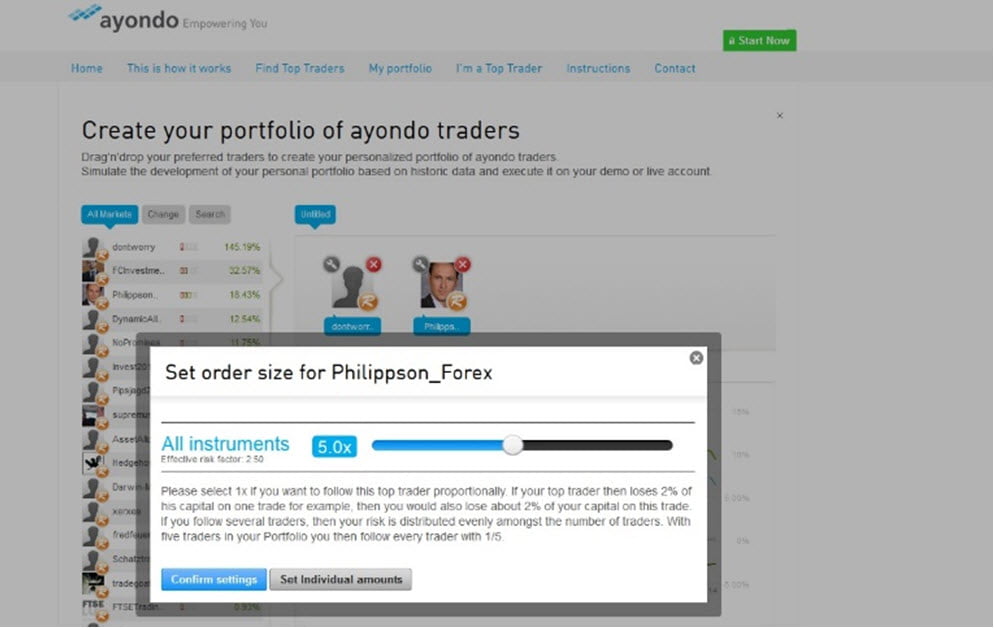

Ayondo provides a portfolio cconfiguration page where you get to add or remove traders from your portfolio. You are able to follow up to five traders. Adding traders is a simple matter of drag-and-drop. You will find it very simple to use. Expect to get a warning every time you try to add a ‘street trader’ to your portfolio. At the time of this review though, the top performer was at a street trader level with a massive 38.54% maximum draw down. From this page, you are able to control the factor by which trades from each trader is copied proportionally to your account using a simple sliding ruler.

The interface also comes with a very usable search capability. You can easily filter the results to show just the traders that meet your preferred criteria. When it comes to finding the ‘top traders’ in Ayondo, the interface is really very well designed.

So, now that you have selected your ‘top trader,’ what next? You can go to his profile and see detailed report of his performance. The trader’s performance information is displayed in six categories. The first thing you will notice is that at the very top is a summary of his performance (percentage since registration, maximum draw down, volatility of returns, number of trades, percentage of wining trades and percentage of past winning months).

There is a graph to show how the trader’s equity has fluctuated since they registered. We were happy to note that you could view all the transaction history of a trader even though it is not possible to download this data offline. For some investors, the ability to analyze the data offsite is important; they will find this disappointing.

‘Top traders’ can send signals from demo or live accounts. It is easy to find traders that are using ‘real money,’ they have huge noticeable ‘R’ badge on their profiles. There is comfort in getting your signals from a trader who has their own money at stake as compared to one trading with virtual money. Making it easy for us to find the ‘real money traders’ is certainly welcome.

In Ayondo, there are five levels that a ‘top trader’ (signals provider) can fall starting from a ‘street trader’ level and all the way to the ‘institutional’ level. Anyone can become a ‘top trader’, however there are criterias that must be fulfilled to join even the lowest level as a street trader. Here is a breakdown of the requirements that must be fulfilled for each level.

- Street trader level requires the trader to have completed a minimum of 15 trades in 30 days and their maximum draw down must be below 25.0% and finally thereafter 30 days, it must be over 1.0%.

- Advanced level requires a minimum of 15 completed trades in 60 days with a minimum of one trade each month and a maximum draw down of less than 25.0%. On top of this, the performance must be at least 2.0% since the start of their career

- Professional level requires a minimum of 25 completed trades in 90 days with at least one trade every 30 days and a maximum draw down not bigger than 20.0%. On top of this, with a performance of at least 4.0% since the start of their career.

- Risk-adjusted level requires a minimum of 50 completed trades in 180 days with at least one trade each month and a maximum draw down of less than 15.0%. On top of this, with a performance of 6.0% or more since the start of their career.

- Institutional level requires a trader to complete at least 150 trades a year with at least one trade each month. Their maximum draw down cannot be larger than 15.0% and their yearly performance must be a minimum 8.0%. Key data for institutional level trader is continuously monitored.

The ‘top traders’ compensation is based on the level they are in. Institutional traders get the highest compensation while street traders get the least among the levels. Because attaining a higher level, depends on the risk a trader takes on and not just his profits. The system is designed in such a way that a trader is motivated to take less risks and trade professionally in order to get higher compensation per trade.

Live accounts

Opening a live account with Ayondo is a straightforward process. It costs only 100 Euros to join. To fund your account, Ayondo accepts bank transfers, credit card funding and skrill payments. You will need to send certified copies of your identification documents together with the standard signed documents. In most countries, a notary public will suffice to certify your documents as ‘true copies of the original’.

Live accounts come with a live feed from Reuters, which in demo accounts; is delayed for 15 minutes (in trading terms 15 minutes is like a decade).

The trade execution is smooth. At the time of testing, we noticed no slippage, which is desirable for copy trading. The spread was about 1.5 pips on the EURUSD. Obviously, this cannot be compared to ECN spreads but it is one of the best available for social trading. In addition, the fact that your trades and those of your signals provider are executed by the same broker reduces lag time, which saves you precious pips.

One of the most impressive things about Ayondo is the interface. It has a clean, no-cluttered design. You will notice that it is very intuitive from the moment you log in. As we had mentioned, it has a useful drag-and-drop functionality for adding traders to your portfolio, which we are sure that you will enjoy using.

Trades from the ‘top traders’ are copied to your account proportionally with your account size. A nice feature is that you can adjust the risk setting for each trader individually. If you notice that one trader is making more losses on a particular instrument, you are able to tweak the order factor of that individual instrument for that specific trader. This enables you to optimize your returns and reduce your exposure to specific non-performing trades. We must say that it is a very impressive feature for risk management.

Another risk management option available for live accounts is the loss protection option. It works like an account stop loss. It allows you to predetermine the amount of loss you would let yourself suffer before you stop trading.

You will be able withdraw a minimum of £10. To withdraw your money from Ayondo, you can use your debit or credit card with no processing fee though it will take a minimum of 5 working days. You can also opt for a bank transfer which is free for UK banks and up to £15 for transfers outside the UK. Processing time will be between 3 to 5 working days. You can also use the CHAPS transfer for a charge of between £16 and £26. This option is only available in the UK.

Community and support

An immersive social trading platform ought to support social features that allow interaction among traders and followers. Unfortunately in this area, Ayondo does poorly. There is no way to interact with ‘top traders’. Some top traders do not even have uploaded profile pictures. In fact, apart from the impersonal charts, graphs and statistics provided, you will know very little about the person you are following. There is also no way for investors to interact with each other.

We also did not find any educational or training material on trading; which is disappointing for novice traders. There is a blog though, with a few trading articles. It does not seem to be regularly updated and we doubt if anyone will find it actually useful.

Support

Customer support is only available on the weekends during business hours. Trying to get support email was surprisingly frustrating. For instance, it took ten hours to get a reply from email support about opening an account. The confirmation email for the opening of a demo account also took ten hours. If you need to get emergency support from Ayondo at odd hours, you will be very disappointed.

Ayondo Tips and Tricks

In order to be great in social trading at Ayondo, it is important that you decide from the first moment you start participating that you will aim to be the best at it. Having this goal allows you to operate at a certain level of excellence that is above what other followers will ever get. The wonderful thing about social trading is that as an investor; the skill set required for you to succeed is easy to attain.

However, this demands a very high level of discipline and critical thinking. In this guide, we will look at the tips and tricks that successful social traders use in order to get the results that they want. By following these guidelines, you will set yourself apart from other followers and you will increase your probability of success several times over and you will be able to make better decisions in your social trading investments.

Set your own goals

Here at Social Trading Secrets, we will tell you as plainly as possible what works and what does not. Therefore, we hope that you will choose to practice what works. Here is one practice that works for all investors in all fields. Start with your goals in mind!

There is a reason why we put so much emphasis on this simple step. Most people who get into social trading, overlook it or assume that it is impossible to have specific goals for social trading and to realize them. It is not.

Not having social trading goals is a very poor strategy for making money in this field. You should at least know what you are doing, why and what you want to achieve in the long run. By simply knowing this three things, you will be in a better position to know when your methods are working and when they are not. You will have an objective standard to gauge your own performance as an investor.

Here are some questions you ought to answer when setting up your goals.

ü What is the return on investment that I want to make quarterly?

ü Which traders can help me get this sort of returns?

ü How much risk am I willing to take on?

ü Which traders will fit into my risk profile?

ü What amount of time will I set aside to monitor and follow up on my social trading activities?

ü How will I monitor my traders?

ü How will I find and screen traders who can help me meet my goals?

ü How will I know when a trader can no longer help me meet my goals?

ü How much initial investment will I make with Ayondo?

When you answer these questions, you are ready to come up with proper goals. Take time and consider each question and note down your answers.

Rely on your own analysis

We already know that social trading is a great way to invest for those who cannot do the actual trading for themselves. However, as a successful investor in the social trading realm; you need to be keen and diligent with how you allocate your money. The secret of social trading is taking responsibility for your own success.

There are too many people who choose not to do their own analysis and rely on the analysis of others. This is probably the worst strategy for engaging yourself in social trading. Unlike some other areas in life, money does not follow the majority. Money is not democratic; simply because a trader has many followers, does not automatically mean that they will be the most successful. This is the first lesson in social trading. Do not follow a trader simply because they have a huge number of followers. Follow him if he fully meets your criteria of an ideal top trader.

Here is a checklist of the things that will enable you to be more confident in following your own analysis and sticking to it.

ü Ensure that you are actually competent to analyze traders and allocate capital to them in a smart way. To do this, first check out the point below on ‘becoming a competent investor’. Also read and faithfully apply the tips in the ‘Ayondo Social Trader’s Tips’. Those tips deal specifically on the best practices when selecting traders on Ayondo.

ü Practice patience. If you cannot be patient and trust in your own analysis, you may get into a lot of problems with selecting traders. After you have made your own analysis and are determined who are the best traders to follow, trust in your decision making and give it time for it to work out. Do not switch traders unnecessarily. A good method to avoid constantly switching between traders is to decide ahead of time under which circumstances you would change a trader. For instance, you can decide that you will only change a trader if they exceed their historical maximum drawdown.

ü Keep reminding yourself that most of the followers who follow popular traders have not actually done any analysis research on them. They simply assume that everyone else who is following the popular trader must have done the research for them. Most of the time, this is not the case and even when it is, it is unlikely that the investment objectives are completely compatible with the ‘herd’.

Become a competent investor

Smart investors in all markets understand that the surest way to get mediocre returns or even to run into losses with an investment is to enter into an arrangement that you do not understand. Social trading is no different. We cannot get into social trading without any understanding of how to get the returns you want and expect to get lucky and gain profit.

As an investor, you should equip yourself with the knowledge and all the aspects of social trading in Ayondo before you ever commit to live trading. Learn about social trading, learn about Ayondo, learn about the best practices in Ayondo and test out your new learned skills in a demo account first. Here is a check list of the bare minimums of getting yourself competent enough to invest in Ayondo.

ü Learn how Ayondo actually works. It is important that you understand the Ayondo Social Trading Platform. You should be able to use all the social trading functions of the platform with ease.

ü Check out the comprehensive Ayondo review in order to get an overview of the Ayondo platform and after that, go through the ‘Ayondo trading guide’ page to get an easy guide on how to open and set up your account.

ü Finally, open an account with Ayondo and practice what you have learnt.

Learn from other investors

In Ayondo, you can check out the performances of other investors and examine their portfolio configurations. This means that you can save yourself a lot of the hustle that would come with a trial and error approach.

Also in Ayondo, you can copy the portfolio configurations of a copier that you like. This basically means that you can save yourself all the work of copying every customization that they may have made. This is quite a useful tool; however we advise that you use it sparingly. Why? Rule of thumb of social trading:- Rely on your own analysis. As we will see below, every investor has different investment objective, so it is quite difficult to determine exactly if the copier you are following has the same objectives as you. Or if they are as diligent in selecting traders as you are.

The point here is to learn from others but nonetheless, you must take complete responsibility for your trading. If you want to copy a follower’s configuration and then optimize it for your own needs, then that’s fine. We think that if you have your own trading plan and criteria for trader selection, it is unlikely that you will find a follower who has a configuration that fits your exact needs.

We have seen that Investing with Ayondo can be a very fruitful venture for social traders. In order to ensure your success, it is important that you come up with you own goals for investing with Ayondo. These goals will guide you to making all the important decisions when trading. And when your goals are set, you must ensure that you are competent to actually make your own analysis to screen traders. Because of this step of taking time to ensure your own competence, you can become confident in following your own analysis and sticking to it. Finally, in order to ensure success; learn from other followers but not blindly.

Summary

Ayondo is definitely a contender for one of the best social trading service providers. If you ignore the fact that it is not really ‘social’ then it is definitely a good choice. Ayondo is trade and performance oriented. The fact that signal providers are rewarded for taking on responsible risk, sets it apart from other platforms.

Pros

- Ayondo is a very transparent model of operation

- If you are from Europe then Ayondo is well regulated

- Signal providers’ remuneration is tied to the risk they take on

- Low cost to open a live account (only 100 Euros)

- It has an easy to use interface

- Demo account available

- It has impressive risk management features

Cons

- Their email customer support could definitely improve

- For a social trading platform, it lacks any real social features that allow interaction between investors.