Why Should You Open FOREX Trading Account With EToro?

Excellent question! If you’re like me, you may have read about FOREX and be curious about how trading is done and wondering if the advertisements you see on webpages is at all accurate. Can you make money trading forex in Kenya? Is it easy? Well, the making money on Forex requires one thing, a great brokerage service.

Before I decided to partner with eToro, I did my homework. I wanted to know the specifics of each of the online brokerages. The kind of training and support that was offered was very important for me because I didn’t know anything about the language of the market or exactly how it worked.

The other factor for me was the amount of money I was going to need to invest to start trading. I had studied enough of the successful Forex masters to know that I couldn’t invest any more than I was willing to lose. So, I wasn’t going to dump my life savings in a brokerage that I had tested with smaller amounts of money first.

eToro had several winning attributes for me that gave me the foundation I needed to start my real trading making money. Part of their training include an ePlatform guide and a Forex trading guide. A glossary is included in the guide that is really easy to navigate so I was able to find new terms very easily.

I am one of those people that likes to be sure that I understand something before I actually spend money on it. This is where the demo trading platform comes in. It is an exact replica of the real-money platform, but you are using virtual money. The cool think about this trading platform is that you are getting real-time information so, even though you aren’t spending real money, you are developing confidence, learning how to navigate through each of the nuances of the market, and participating in the trading challenge.

eToro Review

eToro was founded in 2007. Today it boasts as the world’s largest social investment network with over 2.75 million users across the world.

eToro aims to provide users with a simple, transparent and enjoyable way to trade in the global markets. It promises to be able to provide anyone; regardless of his or her investment style, with the right tools to further improve their trading. Among eToro’s goals is to gain your trust through transparency in their conduct.

Over time, eToro has become a major participant in developing the social trading environment.

We decided to check out how well it is doing to meet its objectives and how usable it is to an average investor.

Regulation

Initially when we began to investigate the company’s cooperate structure, we were amazed at the complexity of its cooperate network. It is not immediately apparent how the company is organized and in its website, it does not make it apparent. We realized that demonstrating the actual organization of eToro would be challenging to get across, so here we will list the names and details of different organizations associated with the eToro group.

- eToro (Europe) Ltd: This is a company incorporated under the laws of the Republic of Cyprus and is regulated in Cyprus by the Cypriote Securities and Exchange Committee (CYSEC). It has its address in Limassol, Cyprus. This is the companies you enter into a contract with, once you fund your account. Formally, it was known as RetailFx Ltd.

- eToro Group Limited: This is an unregulated company resident in the British Virgin Islands. It is also an approved principle of eTORO USA LLC. If your account is not funded and your contract is with this company; you would not enjoy any protection enjoyed by consumers under CYSEC regulations.

- eTORO USA LLC: This is a Limited Liability Company registered in the US and a National Features Association (NFA) member. At the time of this review dated May 2014, ETORO USA LLC is registered only as an introducing broker (IB). Its business address is in Tel Aviv Israel and according to NFA records, it was formally known as TRADONOMI LLC. Earlier this year, its status as a “forex firm pending” was withdrawn. Consequently as we had noted, it is registered as an introducing broker (IB) only in the US.

- eToro (UK) Ltd: This is a company with its principle address in London (UK), that is authorized to carry operations within the UK.

In our very intensive search on the major regulators databases, we could not find any disciplinary financial or regulatory cases involving any of these companies. So eToro gets a clean bill of health from us.

eToro acts as a broker itself, therefore there is no need to sign up with any other brokers. It also does not provide signals for use with other brokers. We were happy to see that eToro provides its traders with a comprehensive list of investment instruments to choose from; including currencies, commodities, indices, stocks and even Bitcoin. All transaction executed in eToro are in the form of Contract for difference (CFDs).

Demo accounts On eToro

It is important to test out the services offered by a company before depositing your money with them. As many other service providers, eToro also provides prospective customers with a free, fully functional demo account.

From the demo account, you can gauge how much your performance would be under different settings. It also allows you to be acquainted with the eToro’s trading platform and user interface.

Opening a demo account is a straightforward process. You can opt to open your account using Facebook to provide your personal details. You will need to provide your phone number to verify your account.

Live accounts

At any point, you can open a live account with eToro by simply funding your Demo account or choosing to register for a new one. Apart from the information required for opening a demo account, you will need to provide details of your payment methods. You will be happy to note that there are many funding options available to investors including Credit Card, PayPal, Neteller/1-Pay, Skrill (MoneyBookers), WebMoney, GiroPay (available in Germany only) and Wire Transfer.

One of the primary consideration for choosing a funding option, (apart from its availability), is the deposit limitation on each method.

Apart from a wire transfer, which has a minimum deposit of $500, every other option can be funded with at least $50. There is no upper limit on the funding amount that is allowed through wire transfer. On the other hand, the maximum amount allowed for Credit Cards and Skrill funding is $5,000, while for all other methods it is $50,000.

The next question to consider is how do you withdraw money from eToro?

eToro has several methods available for withdrawing funds. These are PayPal, Skrill, Credit Cards as well as Bank Transfers that take between 4-7 days to process. We noted that for the Credit Card funding option, you will only be able to use a card that has been used in the system, when you deposited money under your name initially. On top of this, you will only be able to withdraw up to the amount you deposited. This essentially means that if you make a profit you will need to use other means to withdraw your profits.

eToro makes it very clear that it does not process withdrawals through MoneyGram or Western Union. The minimum amount that can be processed for any withdrawal is $20. There are certain fees that you will be charged, for each withdrawal ranging from $5-$25. It is important to note that there are severe restrictions imposed on withdrawing money or credits earned through its promotion. Basically, eToro classifies these credits from its promotions as “Non-Withdrawable Amounts” (NWA) and the only way to convert NWA to “Withdrawable amounts” (WA) is by earning portions of the amounts by incurring cost of spreads. A small percentage of this spreads (about 20%) is used to reduce your NWA.

eToro also has an android and iPhone/iPad app called “eToro Mobile Trader” readily available. From the app, you can follow the progress of your account and trade ‘on the go’. Using this app, you are able to view charts, access price quotes and trade with the available instruments. You can also fully manage your portfolio from the apps. You will also find an “eToro OpenBook social trading app” available for android and iPhone/iPad. This app caters to the social trading aspects of the network on the mobile platform which allows you to follow and copy from your favorite investors. You can also get news about your favorite markets from your mobile device.

Professional Investors on Etoro

eToro has a large number of signal providers that were formally called ‘gurus’, but that name was dropped and they are now called ‘Professional Investors’. It does not vet its professional investors and basically anyone with an account can become a professional trader. For a trader to be called a professional trader, eToro requires that their real names be used and a verified photo be displayed in their profile.

There is an admirable sense of openness in eToro. Meaning that followers can follow other followers and copy their accounts configuration. This makes it easy to develop a functioning portfolio rapidly based on the social intelligence of the network and the people you follow. Of course, this is not advisable but you can basically have a nice portfolio without actually viewing the professional traders you actually are following.

The quality of the signal providers vary wildly. There are some with consistent profits and small maximum draw down and as with any other network; some of the providers have quite scary results. It is therefore important to carefully choose your signal providers wisely. eToro has several helpful features in OpenBook that helps you find your ‘perfect’ trader. We choose to start with ‘people rankings’ list to test how easy it was to use. From this list, you can find traders based on the number of followers they have. You can filter your results using many criterias so that you end up with a manageable number of traders to scrutinize.

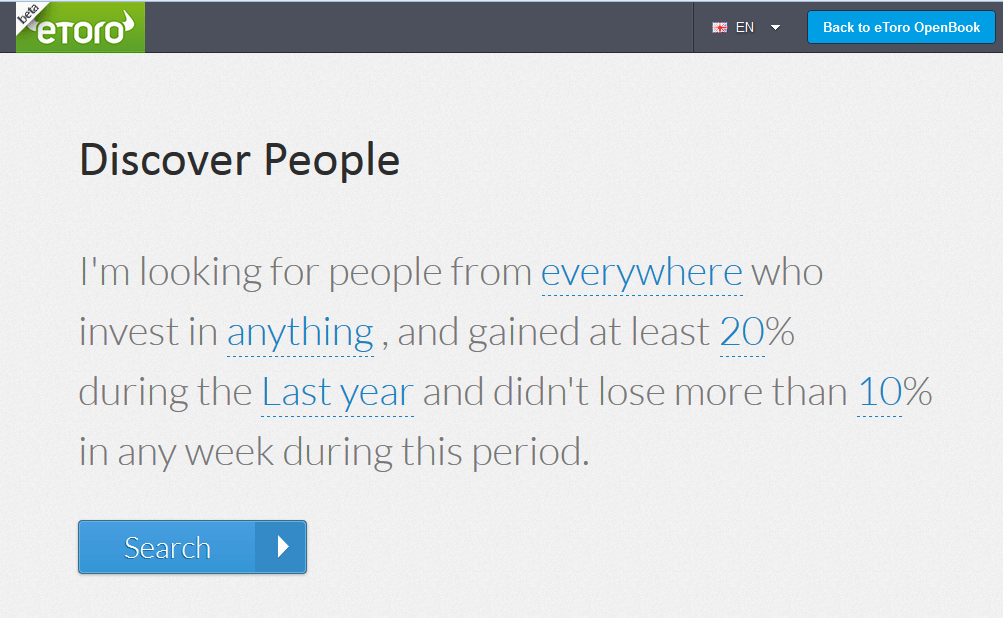

eToro has an intuitive Discover people feature and even though it seems to still be in beta; we could not find any serious faults with it. Searching and finding traders is definitely much easier using this tool and it is very easy to get used to it. The interface is very intelligently designed in such a way; that doesn’t require you to keep going back and forth. You will usually get what you want by simply doing what feels right the first time. You would have to check it out for yourself to fully understand what we mean.

Another lovely feature of the discover tool is that it is easy to customize the data that is shown. From the top row of each column of data, you can choose which data is relevant to you and simply change it. We like the fact that the designers do not presume to know the data set that is important to us and allows us the freedom to choose. Perhaps the only feature that most people will find unsatisfactory is the number of columns that are displayed. At the time of our review; there were only four columns of data available. An increase from that number would be great.

eToro aims to provide a simple to use platform for everyone. So the information displayed about each professional trader is kept simple–to-understand and useful. eToro does not bury you with endless statistics, it simply gives you the bottom line. This arrangement did not satisfy some of our meticulous, detail-oriented members of our review team, but we agree that the information available is enough for an average prudent follower to make a wise decision. The information about returns on investment (ROI) is presented as a percentage within a given time period. This makes it easy to compare the performances of different traders with each other. You will be disappointed as we were, to note that you can neither access the full trading history of a trader nor download it.

Following signal providers

To follow a trader, you simply need to click on the ‘follow’ button on their profile. A popup will ask you to indicate the amount of money you want to allocate to the trader. If the trader is using a virtual account, you will also find out from this pop up. If you wish, you can choose to open all the current open trades that of the trader; though we do not recommend doing this.

Trades in the traders account will be copied proportionally to your account depending on the risk management feature you have put in place. You can only assign a maximum of 20% of your equity to a single trader and you can copy up to a maximum of 20 traders at a time.

Your level of risk per trader primarily depends on how much of your capital you have allocated to each trader and the risk profile of that individual trader. If a trader takes small percentage risks on his account, the equity you have allocated to them will also be exposed to the same risk.

So assuming you are following just two professional traders and allocated to trader A 15% of your equity and to trader B the maximum 20% of your equity. Then trader A takes several trades that expose his account to 30% risk and trader B takes trades exposing his account to 10% risk. If at the time, your account has no other trades open, your total risk exposure will be:

[ (15/100) x (20/100) ] + [ (20/100) x (10/100)]

=0.065 or 6.5% risk exposure

We love the straightforward nature of equity allocation and risk management on eToro. The risk management features within eToro are easy to understand and manage. We especially love the fact that you allocate equity to each trader in terms of actual units, which makes it even easier to understand exactly how much you are putting under his or her control and how much you are risking.

Costs

The costs that you will incur when trading with eToro are mainly in terms of spreads. When we checked the spreads for currencies, it was up to 9pips for the EUR/CAD pair (this was the highest). The EUR/USD had a spread of 3pips and the least was 2pips of USD/JPY. Other instruments also had their own fixed above average spreads (they hurt your earnings more). At the time of our testing, we did not notice any slippage in execution, which somewhat makes up for the high spreads.

You will be charged a fee if you leave your trades open over the weekend but none for overnight traders on the weekdays. Other fees that you will incur with eToro as we had mentioned earlier are the withdrawal charges. They are from $5 for withdrawal amounts from $20 to $200, $10 for withdrawal amounts between $200-$500 and $25 for amounts above $500.

We found eToro to be a very social and lively environment; traders are capable of interacting with their followers and vice versa; almost to the same degree as they would on Facebook. On the site, some traders are quite active socially and provide regular updates on their trades. We find this to be very refreshing compared to other networks. Followers can leave comments on a trader’s wall and other traders can comment on it or like it.

The capability to interact with your traders at this level may provide some level of understanding of who the trader actually is and may potentially help followers decide whether they want to follow the trader.

Education/training resources

eToro has a trading academy where novice traders can learn about trading. There may not be much information to learn for advanced traders but certainly, the information there is valuable for the person just starting out on trading. The learning academy has a section for teaching social trading which we found to be quite immersive. Apart from the academy, eToro also maintains a blog that is active with regular updates and periodic live webinars.

Support

eToro has both email and telephone support. We find the email support to be very responsive and helpful. Email response took about 3 hours on trading time.

There is a section in the website dedicated to frequently asked questions which we found quite useful. For those who are unfamiliar with eToro, this will be a useful page to browse at.

ETORO Tips and Tricks

Consciously, making the decision to become the best investor you possibly can, will be your highest goal. It will help you make better decisions. Taking time to go through the guides we have provided for you at social trading secrets is a good step in this direction. On this page, we have prepared some of the tips and tricks that will help you to become a better investor on eToro. Take your time to read them and develop your investment plan accordingly.

Set your own goals

The most important part of any task is to know what you are doing and why. It is no different with social trading. You should be able to describe what you want to get out of social trading with clarity. You want to define your investment goals clearly from the moment you start, so that you can easily determine the following :-

- Who can help you meet them (traders and followers)

- When your investment goals are being met

- When they are not being met

- How to review and optimize your eToro activity in order to meet your goals

When defining your goals, you can have as many or as few criterias for measuring your performances as you want. Remember, it is your capital on the line and you have the final say. Here are some of the criterias you can use to define and measure your investment goals.

- Return on investment. The return on investment is the profit you gain over a given period expressed as a percentage of the initial amount at the beginning of that period. You can choose to define your investment goals in terms of how much return on investment you want to gain.Keep in mind that eToro gain is not equivalent to return on investment. The formula they use employs a weighted return and does not give you the actual return on investment. This can be misleading, so it is important to do your own calculations. For more information on the method used on eToro, please see the section on estimation of returns on the ‘eToro trader selection’ page.

- Risk tolerance. This is simply the amount of risk you are willing to take on. You should determine in your goals how much risk you are going to expose yourself to before you begin trading. The risk tolerance will determine the amount of money you deposit initially and the way you allocate that money among the traders you follow. Your risk tolerance will also tell you which traders you want to follow based on their historical risk profile.

- Traders to follow. The traders you follow will ultimately be the single most important factor in determining your success or failure. Take time to determine the types of traders you want to follow. For an in-depth guide on how to select traders, check out the eToro ‘selecting social traders’ page.

- Account monitoring. It is important that you set goals on how you will monitor your account. These goals can be in terms of a plan and a schedule of the time you will allocate for social trading. See the sections below for details on how you can monitor your account.

Spend more time learning

One of the biggest mistakes that new investors make when they are starting out is assuming that they already know how to trade. Smart investors take the time to learn how to do their job. You will find it very beneficial to take some time to study the best methods to use on eToro. Here are some of the steps you can take.

- Familiarize yourself with open book. You will be using the eToro’s open book platform to follow your account’s progress so get yourself familiar with how it works before you start live trading. Trade with virtual money and see how well you are able to use the platform. Make sure you can perform all the basic trading functions within the platform.

- Check out the social trading videos in order to familiarize yourself with the basics of social trading on eToro.

- Check out the trading interactive courses available on eToro. There is a wealth of information available both for traders and for investors. If you are a new investor, take time to see what skills you can learn from the resources available.

- Make a point to check regularly for new webinars. Every now and then, you will find a webinar that catches your attention and that you want to attend. Being a regular attendee of these webinars will undoubtedly increase your knowledge and this will enable you to make better investment decisions on eToro.

- Take time to go through the articles on this site which is related to eToro and social trading in general. You will notice that doing this regularly will enable you to gain knowledge and quickly learn the best trading practice. Also, please make sure you see the ‘eToro review’ page for an in-depth analysis of eToro and an overview of what to expect from the platform.

Demo trading

***eToro allows you to practice trading with virtual money. We recommend that you take some time to use virtual money to gauge how well you could perform on eToro. Of course, theoretical returns do not indicate future performance on live trading but it will enable you to get better at using the platform.

It is a good idea to use a realistic amount or that which is close to the money you will be depositing in order to get the best estimates for what you are actually capable of. It will also help you determine beforehand how to allocate your capital and control risk.

Use the Discover People Tool

We have found that searching for traders to follow, to be dramatically easy when using this tool. You want to check it out when locating your traders and we have no doubt that it will be more useful compared to the other search and ranking tool.

With the ‘discover people tool’ on eToro, you can define your own search parameters that you want to see in the columns and arrange them according to your level of importance. There is an in depth description of this tool on the comprehensive ‘eToro review’ page on this site.

Following up and monitoring your account

When will you check and evaluate the progress of your account? It is important that you set aside a specific time in your schedule to do the required follow up. We cannot possibly over emphasize this point! You need to monitor your account. As an investor, you ought to take full responsibility for your own success in social trading. Setting aside time to manage capital allocation is an important part as well as success in this area.

Ask yourself these questions

- How much time will I spend on eToro per day?

- How much time will I spend following up on my account per week?

- How do I want to review the progress of my account?

- What performance indicators will I look at?

- How will I monitor new traders to add to my people’s portfolio?

Answering these questions will help you come up with a plan for achieving your goals and crucially spend the required time on eToro efficiently. Make sure you take time to answer them.

Consistency

For you to attain consistent results, it is important that you look for consistency in the traders you copy. Check to see if the trader has been having consistent returns over the last six months to a year. Can you tell whether the trader is following their trading strategy always? If the trader has provided a description of their trading strategy, they should follow it strictly. If they have not described it, whatever strategy they are using ought to have a relatively consistent performance in terms of outcome.

Another thing to check for in a trader is how they deal with losing trades and how much risk they take on. We have dealt with this issues in great details in the eToro ‘selecting social traders age’ page. Do take time to go through the information provided there.

It is equally important that you let your plan work out. After you have done your due diligence and selected the traders that you feel are the best to copy, give them time to perform as you had projected. Some investors are too quick to switch traders the first time they see a loss in their account. Remember, losses are as much a part of the business as profits. To be a smart investor, it is important to have a longer-term perspective on trading. We would recommend to only switch a trader when you are confident that the trader can no longer help you attain your investment goals or if there is another one that you are confident can do better. There is no other reason to switch traders. Losing money in the short term is not a good enough reason unless it demonstrates incompetence.

Just like in any other business, to attain success in social trading requires you to use the best practices of the trade. It is important to make yourself a better investor according to your own defined goals. In the long run this approach will ensure that you attain a level of excellence that most investors cannot achieve.

Summary

When it comes to social trading, eToro is definitely one of the giants. It offers a truly social experience for investors and to top if off; it provides an open environment where ideas can be shared with like minded people.

The large number of trade providers available is definitely to eToro’s credit. It can be taken as a vote of confidence in their platform. Their relatively high spreads can be excused when we consider that there is virtually no slippage.

eToro will provide you with a large pool of investment instruments and you can easily diversify your portfolio. It also means that there will be a large number of trading set up available for you to trade on. All in all, eToro ought to be given serious consideration by anyone looking to venture into social trading and investments.

Pros

- It is easy to sign up with eToro

- There is no need to sign up with another broker

- There is minimal slippage when executing trades

- Availability of demo account

- Very active community

- eToro has an open sense of community and useful interaction

- eToro has a very usable discovery tool that helps you find traders to follow

- It has two mobile apps that support android and apple mobile devices

- eToro has a simple and straightforward way to manage risk

Cons

- Relatively higher spreads could cut into profits

- Finding the right trader to follow will take some effort

- The OpenBook platform can be too simplistic for any serious manual trading