Today we’re diving deep into the world of forex trading with a comprehensive review of Exness, one of the leading forex brokers in Kenya. Now, you might be thinking, “Another forex broker review? Really?” But trust me, this is not just any review. This is a thorough, unbiased Exness review, and it’s going to be a game-changer!

Exness has been making waves in Kenya with its unique offerings and robust trading platform. But is it all just hype, or does Exness truly deliver? That’s exactly what we’re going to find out.

We’ll explore its features, delve into its strengths and weaknesses, and see how it stacks up against the competition. Whether you’re a professional forex trader or just starting your forex journey, this review is designed to provide you with all the information you need to make an informed decision.

So, are you ready to embark on this journey with me? Let’s dive right into our Exness review and uncover the truth behind the buzz. Stay tuned, because this is going to be a thrilling ride!

9 Best Forex Brokers in Kenya With Mpesa

Exness Review: Is Exness A Good Forex Broker in Kenya?

Alright, let’s break down why Exness is turning heads as one of the top forex brokers for Kenyan traders:

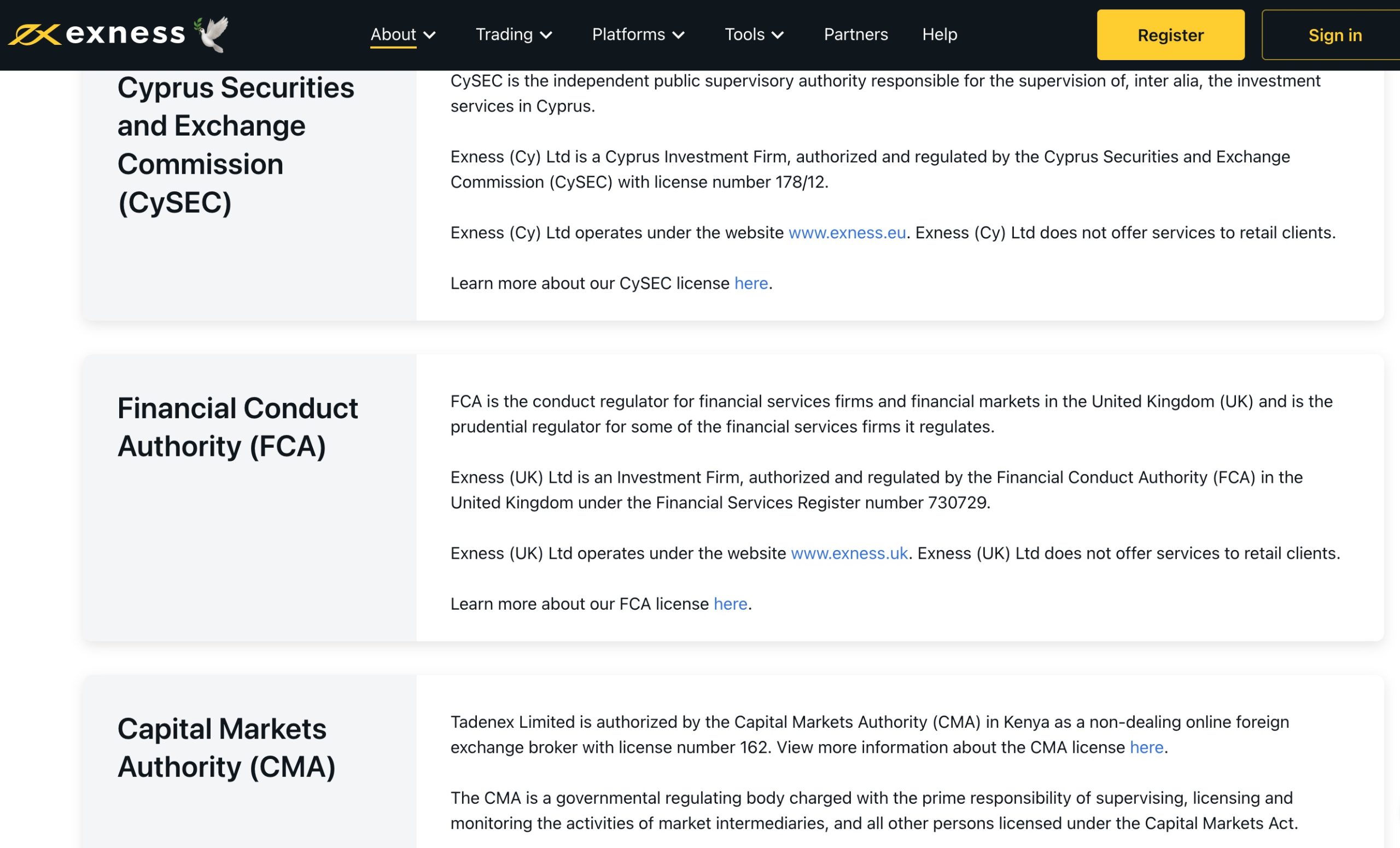

- Regulation and Safety: Exness is like a fortress when it comes to regulation. It’s supervised by a whole bunch of authorities, including the Financial Services Authority in Seychelles, the Central Bank of Curaçao and Sint Maarten, the British Virgin Islands Financial Services Commission, and the Cyprus Securities and Exchange Commission, among others. This global regulatory umbrella ensures your funds are in safe hands.

- Trading Platforms and Assets: They’ve got the full arsenal – MetaTrader 4, MetaTrader 5, their own Exness Terminal, and the Exness Trader app. You’re not just limited to forex; they’ve got metals, crypto, energies, indices, and stocks in their lineup. It’s like a financial buffet, you get to pick what suits your trading palate.

- Account Types for Everyone: Whether you’re just dipping your toes into forex trading or you’re a seasoned pro, Exness has got an account type for you. From Standard to Pro accounts, they cater to all levels of experience and trading styles. Their account types include Standard, Standard Cent, Raw Spread, Zero, and Pro, each with its own unique set of features and benefits.

- Mobile Trading on Steroids: With their Exness Trader app, trading on the go is a breeze. It’s packed with features like real-time quotes, charts, and the ability to manage trades and monitor account performance. Plus, it’s available for both Android and iOS devices, making it super convenient for trading anytime, anywhere.

- Deposit and Withdrawal Ease: For Kenyan traders, Exness rolls out the red carpet with Mpesa integration, making deposits and withdrawals smooth and hassle-free. It’s like having a financial concierge in your pocket.

- Account Opening and Verification: They’ve streamlined their account opening and verification process, making it as painless as possible. While you’ll need to provide standard documentation, they’ve got a knack for making it less of a headache compared to some other brokers.

- Competitive Spreads and Fees: Exness is known for its low trading fees and competitive spreads. They understand that every pip counts, so they ensure you’re not getting nickel-and-dimed on trades.

Exness Main Features

| 💰 Minimum Deposit | $10 |

| 📱 Mpesa Available | Yes |

| ⚖️ Regulations | CMA, CySEC, FCA |

| 🔥 Maximum Leverage | 2000:1 |

| 💵 Trading Cost | USD 7 per lot |

| 🖥️ Trading Platforms | MT4, MT5 |

Exness Safety & Regulation in Kenya (2024)

When it comes to online forex trading in Kenya, safety and regulation are paramount concerns for traders. Exness has taken significant steps to ensure that its operations in Kenya are secure and regulated, providing traders with peace of mind.

Exness is licensed by the Capital Markets Authority (CMA) in Kenya, under license number 162. This pivotal step, as part of Exness’s strategic expansion in Africa, not only enhances its credibility but also aligns with Kenya’s strengthened regulatory regime in the financial services sector, particularly in forex brokerage.

By regulating Exness, the CMA ensures the broker adheres to strict standards related to:

- Segregation of client funds

- Transparent order execution

- Regular financial reporting

- Strict anti-money laundering procedures

Exness is also regulated by other major bodies such as the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Authority (FSA) in Seychelles, and the Financial Sector Conduct Authority (FSCA) in South Africa. These regulatory bodies are responsible for ensuring that Exness operates under strict guidelines, safeguarding the interests of its traders.

Client Fund Protection

One of the key aspects of Exness’s commitment to safety is the segregation of client funds. This means that traders’ funds are kept separate from the broker’s operational funds, ensuring that the clients’ money is protected even in the event of financial issues within the company 3. This segregation is a standard practice among reputable brokers and is a strong indicator of Exness’s reliability in Kenya.

Exness Complaints and Legal Issues

Exness has operated in Kenya for several years with relatively few official complaints. The broker has maintained its CMA license and legal standing throughout this time.

If traders face any issues, they can file complaints directly with the CMA or take legal action in Kenyan courts. So far, there is no evidence of Exness violating traders’ rights or mishandling complaints.

There are many reasons why trading with a regulated forex broker is important. One of the most important reasons is because it protects traders from fraud and scams.

When you trade with a regulated forex broker, you know that they are accountable to certain rules and regulations, which means that they must operate in a fair and honest manner. This also helps to ensure that your money is safe and that you will receive the best possible service.

Another important reason to trade with a regulated forex broker is because they are typically much more reliable. They have been vetted and approved by the regulating body, which means that you can trust them to operate ethically and by the law. This also gives you peace of mind knowing that your money is in safe hands.

Finally, regulated forex brokers typically offer a wider range of services and features than unregulated brokers. This includes things like 24/7 customer support, educational materials, and trading tools. So if you are looking for a comprehensive trading experience, then it is important to trade with a regulated broker like Exness.

Exness ranks #4 in our list of the best trading apps in Kenya. Saying it, is however, not enough by itself. And that’s why we have done this detailed Exness review. After all, if you’re going to be trading with this forex broker, it is better when you know what to expect.

Exness Trading Instruments Review

A good forex broker should offer a wide range of trading assets. This includes not only a variety of currency pairs but also other assets like commodities, indices, shares, and even cryptocurrencies. This variety allows you to diversify your trading portfolio, which can help manage risk and potentially increase your chances of making a profit.

Exness provides a variety of trading instruments, including stocks, indices, commodities, forex, and cryptocurrencies.

- Currency Pairs: Forex trading is a major focus at Exness. The platform offers a variety of currency pairs, including majors and minors

- Cryptocurrency Trading: Exness provides Kenyan traders access to trade CFDs on over 35 top cryptocurrencies. The platform allows you to trade cryptocurrencies 24/7, except during server maintenance. This means you can take advantage of the volatile crypto market round the clock. Isn’t that exciting?

- CFDs on Stocks: Exness also offers Contract for Difference (CFD) trading on stocks. This means you can speculate on the price movements of popular stocks without owning the underlying asset. It’s a great way to get involved in the stock market without the need for a significant initial investment.

- Commodities Trading: For those interested in diversifying their portfolio, Exness offers commodity trading. You can trade popular commodities like gold and oil with low and stable spreads.

- Indices: Indices trading is a popular choice among the most successful forex traders in Kenya, and Exness offers access to popular global indices like the Dow, Nasdaq, FTSE100, and NIKKEI Stock Average. This means you can speculate on the performance of entire sectors or economies without having to buy individual stocks.

Exness Kenya Account Types Review

Choosing the right trading account is crucial for Kenyan forex traders looking to maximize profits while minimizing costs.

Exness Standard Accounts

Exness offers two flavors of Standard Accounts – the ‘Standard’ and the ‘Standard Cent’. Both accounts offer something special for Kenyan traders. Local bank transfers, M-Pesa compatibility (yes, you read that right), and customer support that speaks your language, literally and figuratively.

- Standard Account: The Standard Account offers a wide range of trading instruments and a user-friendly interface, making it ideal for those who are just starting or those who prefer fixed spreads. However, it does have some limitations, such as no access to ECN liquidity, and limited advanced trading tools.

- Standard Cent Account: Perfect for the cautious beginner. This account is ideal for practicing trading or testing strategies due to its lower financial risk. The Exness Cent Account offers smaller lot sizes and lower minimum deposits compared to the Standard Account. However, it may not provide access to all the advanced trading tools and options available in the Standard Account

Both Exness standard accounts provide competitive trading conditions but the Standard Account edges out when it comes to flexibility. It allows trading across forex, metals, cryptocurrencies, energies, stocks, and indices on both the MT4 and MT5 platforms with spreads from 0.2 pips.

The Standard Cent Account exclusively supports forex and metals trading on MT4 with spreads starting from 0.3 pips. So while costs are still low, your range of tradable assets and platforms is narrower.

A major plus of the Exness Standard Accounts is that neither account charges any commissions, incorporating costs within the spreads instead. This transparency and simplicity around fees is bound to resonate with Kenyan traders focused squarely on profitability.

Both accounts feature accessible $10 minimum deposits, irrespective of the payment method chosen. So traders can open either account affordably and scale up capital over time rather than facing unviable upfront deposit requirements.

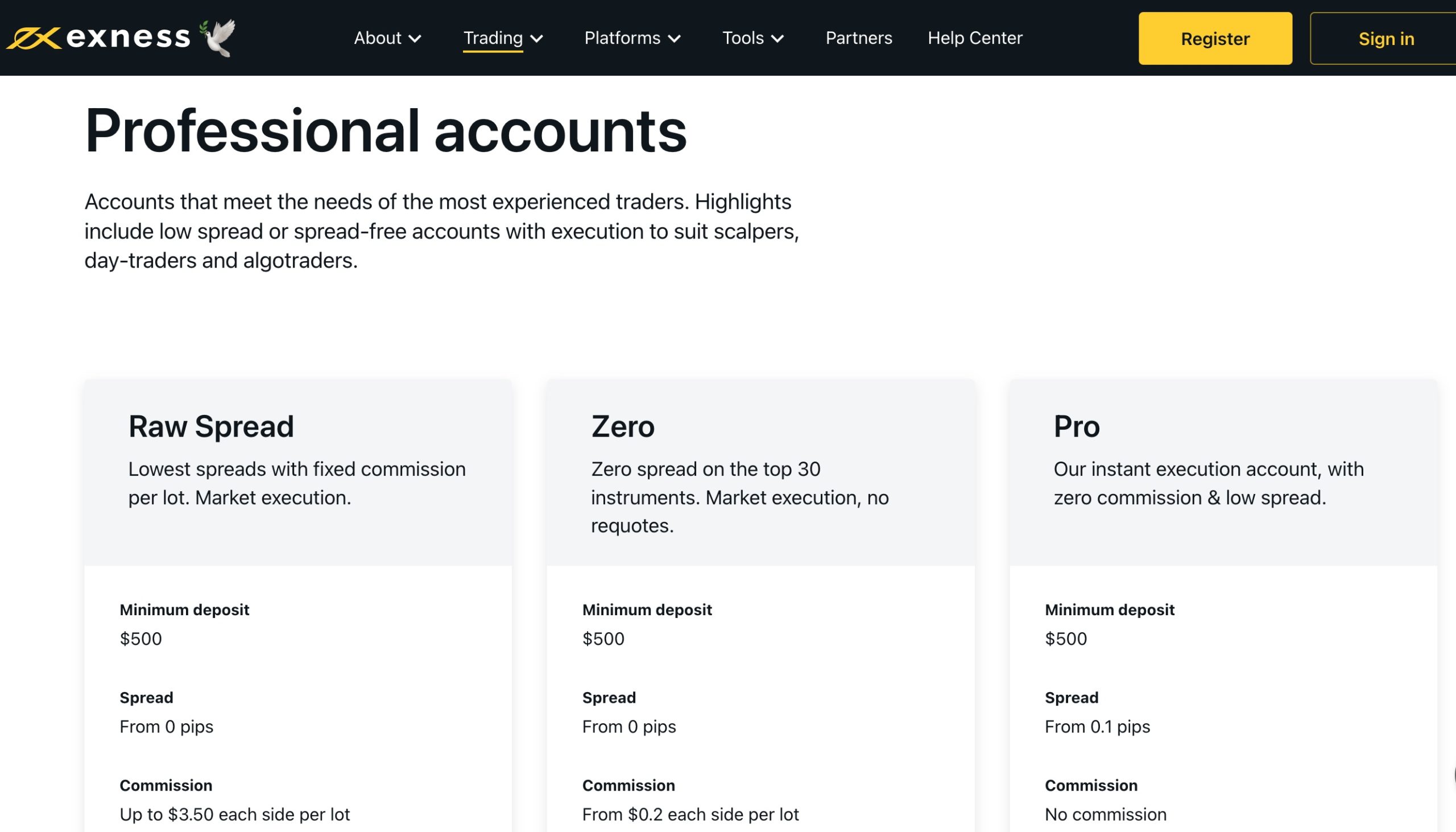

Exness Professional Accounts

Exness offers three types of professional accounts: Raw Spread, Zero, and Pro. Each of these accounts has unique features and trading conditions that cater to different types of traders.

All three accounts offer a maximum leverage of 1:400 and allow trading in forex, metals, energies, stocks, and indices. The key differences lie in the spreads and commissions. The Raw Spread account offers spreads from 0.0 pips with a commission of up to $3.50 on each side per lot. The Zero account also offers spreads from 0.0 pips but with a lower commission of $0.2 on each side per lot. The Pro account, on the other hand, offers spreads from 0.1 pips and charges no commission.

- The Raw Spread account is designed for experienced traders who require tighter spreads. This account offers raw spreads starting from 0.0 pips, with a commission charge of $3.5 per lot traded. The minimum deposit requirement for this account is $500, making it more suitable for traders with a larger budget.

- Zero Account: The Zero account is a specialized market execution account type that offers zero spread on the top 30 trading instruments for 95% of the day. It also offers zero spread on the remaining instruments for 50% of the trading period, depending on market volatility. This account is a popular choice for traders seeking the tightest spreads and competitive trading conditions.

- Pro Account: The Pro account is designed for experienced traders who require low spreads and fast execution. It offers competitive trading conditions and a range of features that cater to the needs of different traders. The Pro account offers spreads from 0.1 pips and does not charge any commission.

The minimum deposit is $500 across all Exness Professional accounts, with a maximum leverage of 1:400 offered. Hedged positions are allowed with no margin requirements too.

Overall, whilst the Standard account is a great option for beginner traders thanks to its simplicity and transparent cost structure based on wider spreads, the Professional accounts offer more advanced traders significantly lower trading costs in return for a small commission or ultra-tight variable spreads.

Exness Kenya Deposit & Withdrawal Methods Review

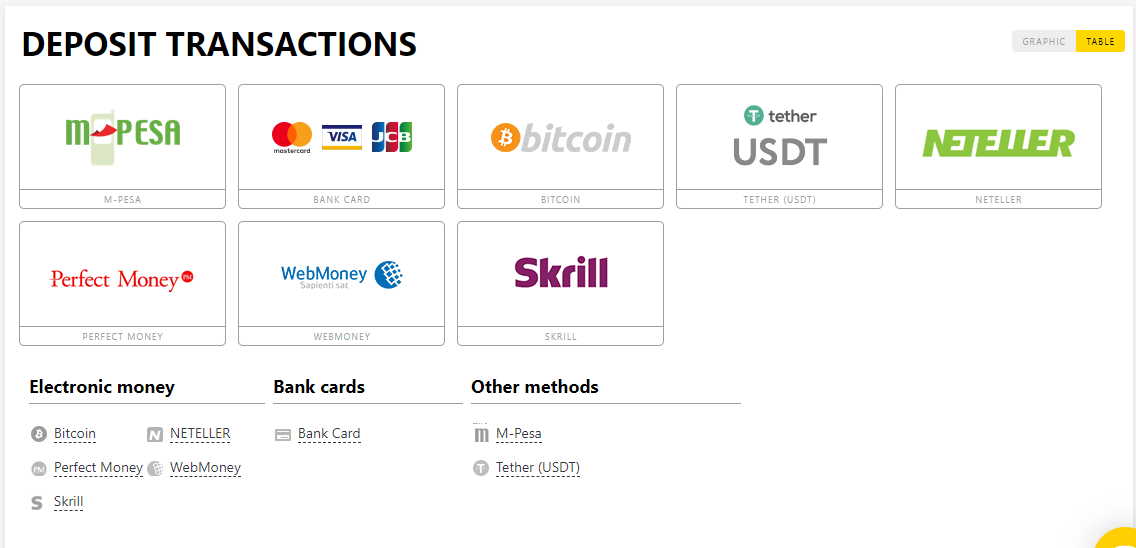

For Kenyan traders specifically, Exness offers an excellent selection of deposit and withdrawal options to choose from. Let’s take a closer look at what’s available:

- M-Pesa: Exness supports M-Pesa, a popular mobile money payment system in Kenya and Tanzania. The minimum deposit and withdrawal amount is USD 10, and the process is instant.

- Bank Wire Transfers: Bank transfers are a classic and reliable method of depositing and withdrawing funds. Exness supports this method, allowing you to directly transfer funds from your bank account to your Exness trading account and vice versa. Direct bank transfers take 1-3 days to reflect in your account. No fees applied. Minimum $50 deposit.

- Debit/Credit Cards: Exness also supports transactions via credit and debit cards. This method is convenient and widely used due to its speed. Once you’ve linked your card to your Exness account, you can easily deposit or withdraw funds. Visa and Mastercard deposits are instant with no fees. The minimum deposit is only $10.

- E-Wallets: Exness supports leading e-wallets like Neteller, Skrill, and Perfect Money. Deposits are instant with no fees. $10 minimum deposit.

A Closer Look at Exness M-Pesa Deposits and Withdrawals

I want to highlight M-Pesa in more detail as it’s ubiquitous in Kenya and such a convenient way to transfer money. Over 90% of Kenyan adults use M-Pesa regularly for all sorts of daily payments and transfers, so it makes complete sense to integrate it with forex trading accounts. Here’s an easy step-by-step guide to depositing with M-Pesa on Exness:

- Get Exness’s M-Pesa Paybill number from their website

- On your M-Pesa menu, select ‘Lipa Na M-Pesa’ Enter the Exness paybill number and deposit amount

- Enter your M-Pesa PIN to confirm It’s that quick! The funds will instantly reflect in your Exness account.

To withdraw from Exness using Mpesa, simply:

- In your Exness account, select Withdrawal > M-Pesa

- Enter your M-Pesa number and the amount

- Confirm your withdrawal request

- The money will land directly in your M-Pesa account within minutes. Easy!

Here are the key benefits of using M-Pesa with Exness specifically:

- Low Fees – No deposit or withdrawal charges when using M-Pesa with Exness. Only standard M-Pesa rates apply.

- High Speed – Deposits and withdrawals are processed almost instantly.

- Easy Access – Seamlessly transfer money between M-Pesa and Exness via mobile phone.

- High Limits – Deposit and withdraw up to Ksh 70,000 at once with M-Pesa.

- Local Currency – Move money in Kenyan Shillings rather than paying conversion fees.

Most deposit and withdrawal methods are processed instantly, but bank transfers may take up to 3 business days. Exness does not charge fees on deposits or withdrawals, but your bank or payment system may apply a transaction fee or commission.

Choosing the right deposit and withdrawal method depends on your personal preferences, the urgency of the transaction, and the potential fees involved. It’s always a good idea to contact Exness’s customer support to explore the different options available to you.

Exness Trading Platforms Review

- MetaTrader 4 (MT4): First up is the ever-popular MetaTrader 4 (MT4). This platform is a favorite among traders worldwide, and for good reason. It’s user-friendly, which means you’ll find it easy to navigate even if you’re new to trading. MT4 is packed with advanced charting tools, and automated trading capabilities, making it a versatile choice for trading forex, commodities, cryptocurrencies, stocks, and indices.

- MetaTrader 5 (MT5): Next, we have MetaTrader 5 (MT5), which is like the big sibling to MT4. It offers more advanced features and is designed for traders who want to trade multiple assets on one platform. With MT5, you get access to additional timeframes, more indicators, and analytical tools. It’s suitable for trading a wide range of instruments, including over 200 CFDs on forex currency pairs, metals, cryptocurrencies, stocks, indices, and energies.

- Exness Terminal: For those who prefer a web-based solution, the Exness Terminal is a fantastic choice. It’s a web platform that requires no downloads or installations, making it accessible from any device with an internet connection.

- Exness Trade App: Lastly, the Exness Trader mobile app lets Kenyans manage their entire trading account, execute trades, and analyze charts on Android and iOS devices. 8 It’s trading on the go, with full functionality, stable spreads, and the ability to trade over 200 instruments.

So, which platform should you choose? That depends on your trading needs and experience level. MT4 is a great choice if you’re looking for a user-friendly platform with advanced tools and automated trading capabilities. MT5, on the other hand, is ideal if you need more advanced features and want to trade multiple assets on one platform. And if you’re an active trader looking for a convenient, web-based platform, the Exness Terminal is the way to go.

Mobile Trading on Exness

Exness offers a mobile trading platform that gives you the ability to trade Forex and CFDs while on the go. With the mobile app, you can access your account and trade using your smartphone or tablet. The app is available for both Android and iOS devices.

The mobile app provides a wide range of features that allow you to trade effectively. These include:

- Real-time quotes and charts

- Trade Forex and CFDs

- Access your account and positions

- Place orders quickly and easily

- Monitor your account status and performance

The Exness Smartphone app is easy to use, and you can trade anywhere and anytime you want. Download the Exness app today and start trading on the go!

The Exness Trader app has several outstanding features. For starters it lets you visualize the balance in your account, your open positions as well as which currency pairs are being traded the most at that particular moment.

Additionally, you can easily initiate deposits and withdraw your profits from Exness using the app.

The other app that makes mobile trading at Exness a bliss is the Exness MT4 app. With this app, you can open charts and do your analysis right from your smartphone, open and close trades.

At Kenya Forex Firm, We particularly like using the Exness MT4 app when we are on the go, and don’t have the time to manage open trades from our computers.

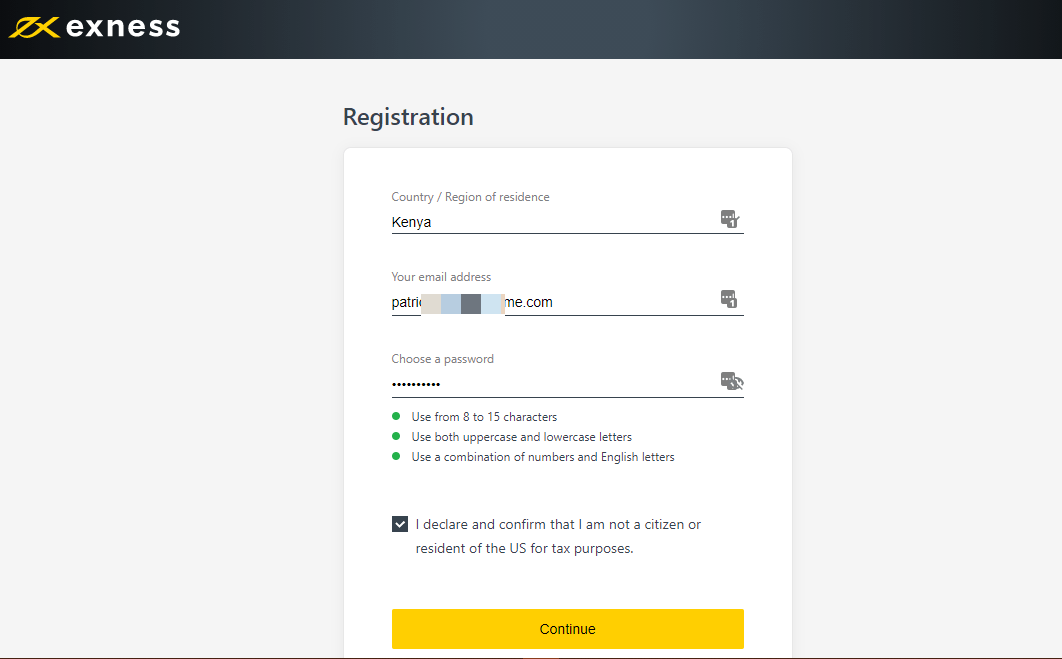

Exness Kenya Review – Ease of Account Opening and Verification

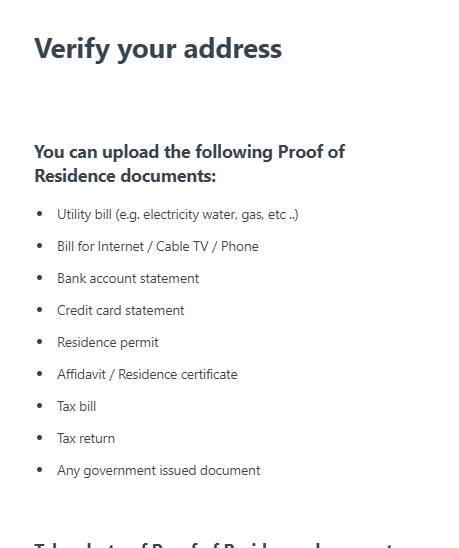

Every forex broker out there takes their customers through a process called Know Your Customer (KYC, in short). During this process, you’ll be required to provide the broker with a proof of identity (National ID or Passport) and a proof of residence document (bank statement/utility bills).

While it is easy to provide the proof of identity document, many customers usually have a hard time trying to come up with a proof of residence document, especially seeing that in Kenya we normally use Post Office Boxes as our addresses. And unfortunately, most forex brokers, Exness included, do not accept a P.O Box as enough proof of residence. This leaves a lot of would-be clients at crossroads.

With Exness, you’ll need either a water bill or Kenya Power bill to prove your address. Any other document that bears your physical address will also suffice as proof of residence when you’re opening your account. We were personally able to verify our accounts using a slightly edited copy of Safaricom ebill.

However, if you do not have such a document, contact us to help you verify your trading account. Otherwise you won’t be able to start trading (can’t deposit) until you verify your identity and residence.

There are a few brokers who have an easier account opening process. LiteForex and XM Forex are some of the brokers that are not overly strict with the format of documents you use to open your account.

Exness Review – Deposit and Withdrawal Methods

Exness supports various deposit and withdrawal methods that are convenient for forex traders in Kenya. Top in the list of the most favorite deposit methods is Mpesa. With just a few simple steps, you’ll have money into your Exness account, ready to start trading.

1. Exness Mpesa Paybill Number

For Kenyan traders, Exness offers easy deposits via Mpesa. However, we do not recommend you rely entirely on Mpesa for deposits and withdrawals. Sometimes, the option to withdraw via Mpesa disappears from the trading platform, leaving traders stranded.

However, depositing money into your Exness using Mpesa is quite easy. Here’s the short process to fund your Exness trading account using Mpesa

- Log into your Exness account at my.exness.com

- Once logged in, click on “Deposit” and choose Mpesa

- Choose the trading account you want to fund, enter amount (at least 400/=), and click on “Next“

- On the next screen, click on Confirm Payment.

- Enter your Mpesa phone number on the next screen and click on Pay. Make sure you have your phone with you, and preferably unlocked as you’ll receive a prompt on the phone asking you to input your Mpesa PIN number

- Complete the Mpesa payment process using your phone

As you can see, the Mpesa deposit process is quite easy using Exness. You do not even need to know the Exness Mpesa Paybill Number as the whole process is automated when you are logged into your account at My.Exness.Com.

2. Exness Deposit and Withdrawals Using Debit Card

Our favorite alternative deposit/withdrawal method at Exness is the NCBA Loop debit card. Admittedly, we haven’t tried other debit cards out there, but our guess is that they should all work fine. We love the NCBA Loop card because you can easily top it up using Mpesa and also withdraw money from it into your Mpesa at no cost at all.

Depositing and withdrawing money from your Exness trading account using the debit card is also free of charge and only takes a matter of seconds for the money to reflect into your account. To be precise, deposits and withdrawals at Exness using the NCBA Loop card take approximately 1 minute to reflect.

The other deposit and withdrawal methods at Exness include:

- Skrill and Neteller e-wallets

- Cryptocurrencies including Bitcoin and Tether

- AstroPay Card

- Perfect Money, and

- WebMoney

Exness Review on Cost of Trading and Spreads

Exness offers varying spreads depending on the account type you choose. There are 3 main account types offered at Exness:

- Standard Cent Account ( $1 minimum deposit)

- Standard Account ($1 minimum deposit)

- Exness Pro Account ($100 minimum deposit

These 3 account types have varying spreads with the cent account being costlier than the other two. This is because traders on the cent account tend to deposit less money, and tend to trade lower lot values. Brokers do not get a lot of profit from this kind of trading, so they naturally raise the spread on cent accounts.

The floats offered on Exness are mostly floating/dynamic spreads, meaning that they constantly change depending on the market volatility. The spread might be lower or wide, but we’ve found that on the major currency pairs including EUR/USD the spreads rarely go beyond 1.5 pips.

If you’re worried about wider spreads, we recommend that you trade during the best forex trading sessions as shown here.

Frequently Asked Questions About Exness

How Reliable is Exness?

Founded in 2008, Exness is one of the most reliable forex trading companies in Kenya. The broker is regulated by Financial Services Authority (FSA) in Seychelles and the FSCA of South Africa.

Does Exness Allow Scalping?

While some forex brokers do not allow scalping, Exness is quite open to all trading strategies and does not place any restrictions on scalping. You can open and close positions with whichever frequency you desire. Only dealing desk market makers put do not allow scalping. Exness, being an STP forex broker allows scalping.

Does Exness Have Nasdaq?

The Nasdaq-100 represents a capitalization-weighted index of the 100 largest non-financial companies listed on the NASDAQ and is available for trading on Exness. The index is available on Exness by the name of USTEC.

What is the Minimum Deposit on Exness?

The minimum deposit for Exness is $10.00. This applies to the Standard and Cent accounts. Other accounts (Pro, Zero, and Raw Spread) have a minimum deposit of $100. Additionally, the minimum deposit for Exness is also dependent on the deposit method that you choose. For instance, deposits using Mpesa and debit card are capped at a minimum of $3 while Neteller and Skrill deposits start at $10.

What is the actual process of withdrawing money from an Exness account?