If you’re new to binary options trading, you’re probably looking for the most accurate binary options strategy that will help you make the most of your trades.

Well, you’re in the right place. In this guide, we’ll explore some of the best binary trading strategies for beginners, along with some tips on risk management and technical indicators. Let’s dive in!

Best Binary Trading Strategies in 2024

Show Summary

Here are some of the most accurate binary trading strategies you can use in 2024:

Join the Copy Trading Revolution

Copy the trades of successful Forex traders and profit from their strategies.

*Forex and CFDs Trading involves high risk. T&Cs apply.

- Follow the Trend Strategy: This strategy involves making trades based on the overall direction of the market or a specific asset.

- News Trading Strategy: News trading involves making trades based on news events that are expected to impact the price of an asset.

- Straddle Strategy: The straddle strategy involves making two trades on the same asset: one trade predicting that the price will go up and another predicting that the price will go down. The goal is to profit from volatility, regardless of the direction in which the price moves

- Pinocchio Strategy: This strategy involves making trades based on the assumption that a drastic price movement in one direction will be followed by a price movement in the opposite direction

- Candlestick Formation Patterns Strategy: This strategy involves identifying specific patterns in candlestick charts and making trades based on those patterns. Candlestick patterns can provide insights into potential future price movements

- Even-Odd Trading Binary Options Strategy: Traders predict whether the last digit of an asset’s price will be an even or odd number within a specific time frame.

- Hedging Strategy

Most Accurate Binary Trading Strategies

Developed in-house by our team of experts, the Extreme Digit Over/Under Strategy is one of the most accurate binary options trading strategies ever developed.

The Extreme Digit Strategy revolves around the Over/Under trading option offered by Deriv, a leading binary options platform. In this type of trade, you predict whether the last digit of the last tick of a contract will be higher or lower than a specific number.

However, this binary options trading strategy isn’t just about making random predictions; it’s about making educated predictions. It’s a strategy that’s grounded in the understanding of statistical probabilities, specifically targeting the rarity of extreme digits in financial sequences.

The Extreme Digit Over/Under Strategy is based on empirical evidence from a study published in the Journal of Statistical Theory and Practice. It leverages the market’s tendency to avoid repeating extreme digits, giving you a unique advantage that’s both logical and powerful.

One of the most beautiful aspects of the Extreme Digit Over/Under Strategy is its simplicity. With trades based on just 3 ticks, you can make quick decisions without getting bogged down by complex analysis. This means you can capitalize on short-term volatility and make your moves before the market changes its mind.

The strategy works so well that the broker doesn’t actually want you to know about it. But we’ve prepared a comprehensive PDF guide that dives deep into the mechanics of this strategy, and it’s available exclusively for our readers.

To get your hands on this valuable over/under strategy, simply sign up and download the PDF. Trust me, you don’t want to miss out on this opportunity to enhance your trading toolkit.

| 💰 Minimum Deposit | $10 |

| 📱 Mpesa Available | Yes |

| ⚖️ Regulations | CMA, CySEC, FCA |

| 🔥 Maximum Leverage | 2000:1 |

| 💵 Trading Cost | USD 7 per lot |

| 🖥️ Trading Platforms | MT4, MT5 |

You might have heard that most of the assets you can trade with binary options follow trends. This simply means that their prices tend to move in a certain direction over a period of time. This could be upwards (which we call an uptrend or a “bullish” market) or downwards (a downtrend or a “bearish” market).

Think of it like a roller coaster ride. Sometimes, the roller coaster goes up, which is like an uptrend in the market. Other times, it goes down, which is like a downtrend. And just like a roller coaster ride, these ups and downs can be short and quick, or they can last a long time.Now, here’s the interesting part.

Many financial experts believe that these ups and downs happen in cycles. This means that after a period of going up, the market will likely go down, and vice versa. So, if you can figure out what part of the cycle the market is in, you can make a good guess about what it will do next. And that’s what the trend following binary options strategy is all about!

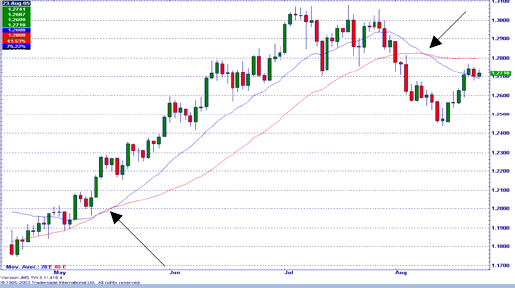

Trend lines are drawn using the price extremes.

A support line, drawn using the lower price extremes, often indicates an uptrend where the asset price is likely to bounce back and continue its upward pattern.

As a savvy binary options trader, you might consider buying a High binary option around the support line level, given the higher probability of a rebound at this level.

On the other hand, a resistance line, drawn using the upper price extremes, often indicates a downtrend where the asset price is likely to pull back and continue its downward pattern.

In this case, buying a Low binary option around the resistance line level could be a smart move, as the probability of a pullback is much higher at this level.

The strength and reliability of a trend line can be gauged by its length and the number of times the price has tested the support and resistance lines without breaking them.

The longer the trend line, the stronger it is, and the more likely the asset price will bounce or pull back on this trend.

Advantages of the Trend Following

- Simplicity: Trend following is a straightforward strategy that involves identifying an ongoing trend and trading in the direction of that trend. This simplicity makes it accessible to both beginners and experienced traders

- High Success Rate: The trend following strategy has a relatively high success rate. This is because once a trend has been established, there is a great chance that the trend will continue, allowing you to make a profit

- Risk Management: Trend following allows for effective risk management. Since binary options traders do not care by how much the market moves in their direction, trend following is a safer bet

Disadvantages of Trend Following

- False Breakouts: Trend following can lead to a lot of false breakouts. This means that sometimes, what appears to be a new trend may actually just be a temporary price fluctuation, leading to incorrect trading decisions.

- Not Suitable for All Market Conditions: Trend following strategies are most effective in strongly trending markets. However, they may not perform as well in ranging or choppy markets, where price movements are less predictable

| 💰 Minimum Deposit | $10 |

| 📱 Mpesa Available | Yes |

| ⚖️ Regulations | CMA, CySEC, FCA |

| 🔥 Maximum Leverage | 2000:1 |

| 💵 Trading Cost | USD 7 per lot |

| 🖥️ Trading Platforms | MT4, MT5 |

News events play a significant role in influencing financial markets, and many traders focus on financial news to make their trading decisions.

A well-rounded binary options broker will provide you with an advanced financial news feed to help you develop and adjust your trading strategies based on the news content.

Events and indicators can cause asset prices to move rapidly in a specific direction.

Most macro news events, such as GDP reports, Non-Farm Payrolls, and Manufacturing indexes, are scheduled, and it’s essential to learn their release dates before implementing any macro strategy. These indicators can significantly impact forex pair levels.

There are various types of news that affect the markets. Macro news, like the ones mentioned above, can impact financial markets as a whole.

For example, a strong GDP report from the United States may push the US dollar and US equity indices higher.

Micro news releases are associated with individual assets, such as oil inventory reports that mainly impact commodity prices or major company earnings that primarily affect the related company’s stock price.

Trading the news with binary options involves predicting how asset prices will react to significant events or announcements.

Prices typically become volatile before and after the news release. Around 60 to 90 minutes prior to these events, the price will likely start following a trend.

If most market participants believe that the actual news will be more positive than what is estimated, the price will follow an uptrend.

Conversely, if the majority of participants believe that the actual release will be more negative than what is estimated, the price will follow a downtrend.

If the price is in an uptrend and the news surprises negatively, or matches the expectations, the asset price will drop in seconds and likely resume a downtrend.

When trading the news, it’s crucial to focus on both the news itself and the expectations prior to the news release.

If you believe that the asset price has outperformed the likely benefits of positive news, it’s time to buy a Put (also known as a Low binary option).

If you believe that the asset price has underperformed the likely benefits of positive news, it’s time to buy a Call (also known as a High binary option).

Binary options are particularly useful for trading the news. They are short-term and leveraged financial instruments that can enable you to realize substantial profits in a short amount of time if the asset evolves in the desired direction after the release of the news. This is one of the most significant advantages of binary options.

Advantages of the News Trading Strategy

- Real-time Market Reaction: This strategy allows traders to make investment decisions based on real-time events and announcements, such as interest rate changes or product releases.

- Opportunity for Short-term Profits: News events often trigger short-term market volatility, providing opportunities for traders to make substantial profits within a short period.

Disadvantages of News Trading Strategy

- Unscheduled News: It is not always easy to account for unscheduled news that other traders haven’t considered. This unpredictability can lead to unexpected market movements that may not align with your trading strategy

- Difficulty in Assessing Market Sentiment: It can be challenging to assess how the market will react to news events. This is not just about predicting what the news will be, but also about reading market sentiment, which can sometimes take traders by surprise

The outcome of the even-odd binary options trading strategy is essentially a 50/50 proposition, similar to flipping a coin, which means that the potential for loss is as great as the potential for gain.

The Even-Odd strategy doesn’t take into account market trends, economic indicators, or other factors that can influence the price of an asset. This lack of analysis can make it a risky strategy for inexperienced traders or those without a solid understanding of market dynamics.

On the other hand, the simplicity of the Even-Odd strategy can be appealing to some traders, particularly those who prefer short-term trading.

It doesn’t require complex analysis or understanding of market trends, making it accessible to beginners.

However, it’s crucial to manage risk effectively when using this strategy, for instance, by setting a limit on the amount to be invested in each trade.

Some traders have reported success with the Even-Odd strategy, claiming significant profits. However, these claims should be taken with caution, as they often come from anecdotal evidence and may not reflect the typical experience of most traders.

Are you tired of jumping from one binary options trading strategy to another, only to end up with mediocre results? The strategy we’re about to share has been tried, tested, and vetted by many successful binary options traders. It’s hands down the most accurate binary options strategy of this year!

But first things first. The digital world of trading is brimming with potential, and you’re just a step away from tapping into that wealth. But let’s get one thing straight – the success of your trades doesn’t just rely on the strategy alone. It begins with being on the best trading platform.

Just as you wouldn’t build a house on unstable ground, venturing into binary options trading without the support of a robust platform is setting yourself up for potential pitfalls. The best binary options trading platforms provide you with:

-

- Real-time data: Updated market trends and news to help you make informed decisions.

-

- Advanced tools: Charting tools, indicators, and automated trading options to refine your strategy.

-

- Reliable support: Quick customer service and community support for your trading queries.

Why Is This Binary Strategy Worth Your Time?

Binary options trading can seem daunting. With a plethora of strategies available online, finding the one that resonates with your trading style can be overwhelming. But what if we told you that the strategy we’re about to share has been tried, tested, and acclaimed by many successful binary options traders?

Here’s a sneak peek into the most accurate binary options strategy that’s been turning heads and filling wallets:

Unveiling the Most Accurate Binary Options Strategy

Here’s a list of the most accurate binary options strategies

-

- Even-Odd Trading Strategy

-

- Over-Under Binary Trading Strategy

-

- Rise and Fall Binary Options Strategy

-

- Price action binary strategy

-

- Trendlines binary options trading strategy

-

- Trend is Your Friend: Always start by identifying the prevailing trend. Is the asset moving upwards, downwards, or is it ranging? By aligning your trades with the trend, you significantly increase your chances of a favorable outcome.

-

- Use Reliable Indicators: Pair your analysis with indicators like Moving Averages, RSI, and MACD. These indicators can provide you with insights about potential reversals or continuations.

-

- Key Support and Resistance Levels: Before placing any trade, identify key support and resistance levels. These are the points where price typically bounces back or breaks through, giving you clues on potential trade outcomes.

-

- Risk Management is Key: No strategy is foolproof. Hence, always determine your risk before entering a trade. Decide on a fixed percentage of your portfolio for each trade and stick to it.

-

- Keep Emotions at Bay: You need to stay objective. If a trade goes against you, it’s essential not to chase losses. Stick to your strategy, and remember: discipline is the bedrock of successful trading.

Treat these strategies as golden rules as they can make your trading more profitable.

Look for some easy-to-follow advice. There are plenty of tips and strategies out there and excellent brokers who are experienced and will be able to place the best odds that will win you enough to make it a good thing. You should be able to read up on and research on strategies so you can approve or disapprove of decisions made on behalf of you for the account. Also look at having instrument diversification in your trading habits and practices. Geographical diversification and chronological diversification is just as important if you want to maximize the profits you earn.

Technical Analysis Strategies

Although there exist many approaches used by traders and asset managers to forecast individual asset prices in financial markets, fundamental analysis and technical analysis are two disciplines among the most commonly used.

Technical analysis is best defined as the use of charts and historical prices in order to study market price activity and evolution. The ultimate objective is to use this information in order to attempt to forecast future price trends.

In order to fully understand and dig into technical analysis, you need to acknowledge 3 main principles that lay the groundwork for this practice:

-

- Market prices move in trends

-

- Market action reflects all known information that is available

-

- The past predictive value of price patterns that reflect the bullish or bearish psychology of the marketplace are assumed to apply in the future.

Simply put, technical analysis consists of a set of graphical and mathematical tools that can be visualized in real time on graphics that traders use to help them improve their investment decisions.

Advantages of technical analysis for binary options trading

Technical analysis presents many advantages for retail traders, it requires a lot less data, knowledge and experience than fundamental analysis. You just need an historical graph of an asset price and volume to run the most basic technical analysis. We want to highlight below the main advantages of technical analysis:

-

- Technical analysis can be applied to all asset classes (stocks (equity), forex, indices, commodities…)

-

- Applicable to any time horizon (short, medium and long-term) and mostly used for short-term trading decision that is the most relevant for binary option traders

-

- Established framework allows diverse markets to be followed at once, the most advanced trading platform provided by binary option brokers allow you to build advanced technical indicators in one click.

-

- Permits the focus on trending markets, as opposed to markets that are not “moving”.

Nevertheless, you should always remember that technical analysis is a subjective science, some say its mort an art than a science and that no technical indicator will be right 100% of time. Technical analysis is here to help you formulate hypothesis about the market direction but is in no way an absolute truth.

As a reminder, the regulated binary options broker that proposes the most complete offer in terms of technical indicators and chart analysis is OptionTime. Don’t hesitate to have a look at our detailed review of OptionTime for further details.

1. Chart Analysis

There exist different types of charts that convey more or less information about the evolution of the asset price over a chosen period. Please find below a brief description of different chart types used by professional traders.

[su_divider top=”no”]

Line Chart

It consists of merely plotting the closing prices of an instrument over a chosen time period.

Implications: While this most basic chart is easy to construct, the open, high and low data is not plotted for consideration.

[su_divider top=”no”]

Bar Chart

Vertically plotting the open, high, low and closing price of an instrument for a chosen time period will produce the bar chart.

Implications: It overcomes the weaknesses of the line chart by including open, high, low and close data for scrutiny.

[su_divider top=”no”]

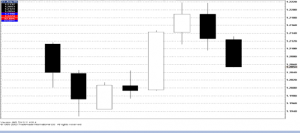

Candlestick Chart

It consists of plotting the open, high, low, and closing values for an instrument. However, the difference between the opening and closing values forms the candle and is termed the “real body”. The wicks that protrude above and below the real body are termed “upper shadows” and “lower shadows” respectively. Hollow real bodies are usually used to represent days with a positive net change in price, while solid real bodies usually represent days with a negative net change in price.

Implications: This is the most commonly used graphical representation by technicians as the up and/or down days are more easily discernible.

[su_divider top=”no”]

Point and Figure Chart

It records price changes that are defined by box size criteria. While “X’s” and “O’s” denote upmoves and downmoves respectively, prices must reverse by the amount of the box size in order to be plotted. The example in displays a point and figure chart for USD/CAD using a box size of 10×3. Therefore, each “X” or “O” represents a price move of 10 points, and prices must reverse by a minimum of 30 points (10×3 is termed the reversal amount) in order to be plotted.

Implications: A multidimensional chart format that eliminate the “time dimension” and concentrates on pure price movement. This type of chart is used by experienced trader and for the analysis of longer term trends, it is then less relevant for binary option traders and is almost never proposed by binary option brokers.

[su_divider top=”no”]

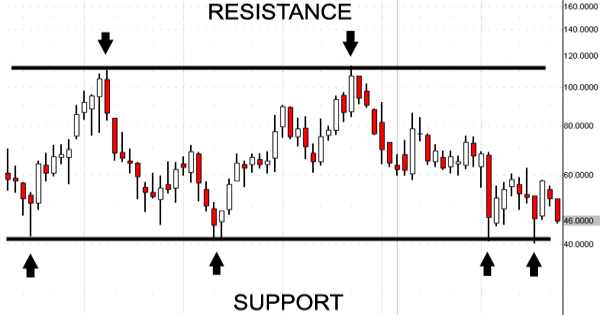

2. Support and Resistance

The principal purpose of technical analysis is to identify trends, supports and resistances that can either be tested or broken. These levels can then serve as entry points for binary option traders.

Asset price trends and binary option trading strategies

A trend can be defined as the general direction of an asset price. These trends can be uptrends, downtrends or sideways and may vary in length.

An uptrend consists of a series of ascending peaks and troughs that rise successively. A downtrend consists of a series of descending peaks and troughs that fall successively. Markets that are in a sideways trend are often called “range trading” and feature a series of roughly level peaks and troughs. Markets actually spend up to 33% of time in this state.

Technical analysts draw trends on candlestick charts by linking the successive highs or the successive lows of an asset price. These trends represent the general direction of the asset price and can be used to identify pivotal points. Indeed, when a trend is broken, the asset price is likely to move strongly in the opposite direction of the preceding trend. When successive highs and lows of an asset price chart draw two parallel lines, it forms what technical analyst call a channel. A break of a channel bound would imply a strong move of the asset price in the direction of the break.

Supports and resistances: Buying and Selling opportunities for binary option traders

Supports and resistances are graphically formed by horizontal lines on which an asset price has bounced at least more than two times. These levels represent the virtual fight between buyers and sellers of the asset. Asset prices are likely to pull-back on a resistance level and to bounce on a support level. Nevertheless, if one of these levels break, the trend of the asset is likely to accelerate in the direction of the break. An asset price that breaks a resistance will accelerate its uptrend move while an asset price that breaks a support will accelerate its downtrend move.

How to use supports and resistances for binary option trading?

Binary option traders will wait for an asset to bounce on a support before buying a bullish binary option on this asset. They will also wait for an asset price to pull-back from a resistance to buy a bearish binary option on this asset.

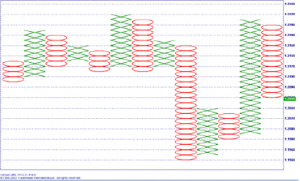

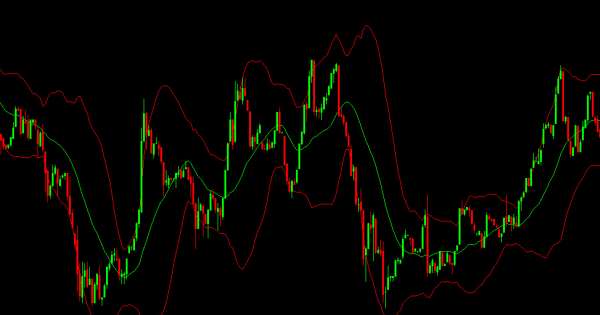

3. Moving Averages

Moving averages are one of the most popular technical indicators in the retail trader’s community. One of the main reasons of their success is that they are really easy to read and interpret on a technical chart in order to take an investment decision.

What is a moving average?

A moving average is the arithmetic average of a number of data points over a chosen time period. The most commonly used data points are closing prices.

The 20 day moving average will thus be the arithmetic average of the last 20 closing prices for a specific asset. The data is then smoothed daily and is used to identify the beginning or termination of a trend.

How to use moving averages for binary option trading?

The most commonly used moving averages by professional traders are the 20 day, 50 day, 100 day and 200 day moving averages, they use this moving averages on candlestick charts most of the time. The shorter the investment horizon, the more traders will use a short-term moving averages to identify potential technical supports and resistances. Moving averages can be used to identify trading trends (long term bullish trend when moving averages all in uptrend and vice-versa) but also to determine support and resistance levels on which the asset is likely to bounce or breakout.

Using moving average crossovers to identify BUY/SELL signal

A buy signal is generated in the context of a single moving average crossover when the closing price of an instrument moves above the selected moving average; it is called a bullish crossover. Conversely, a sell signal is generated when the closing price moves below the moving average; it is called a bearish crossover.

Implications: A bullish crossover can be used to implement long positions, while a bearish crossover can be used to reverse positions and to initiate a short position.

A buy signal is generated as part of the double crossover method when the shorter moving average closes above the longer moving average. This is often referred to as “the golden cross”. Conversely, a sell signal is generated when the shorter moving average closes below the longer moving average. This is often referred to as “the death cross”.

Implications: The “golden cross” can be used to implement long positions, while a “death cross” can be used as a take profit and to initiate a short position.

Most of the binary option brokers presented on the website propose platforms that will enable you to display live charts and moving averages to help you take quick investment decisions.

[su_divider top=”no”]

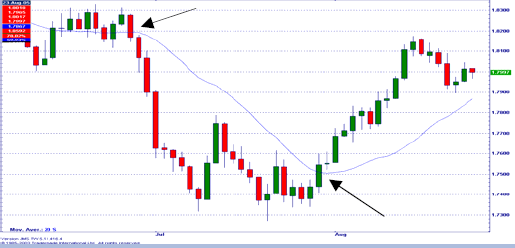

4. Trend line strategy for binary option trading

As you may know, most financial assets available with binary options are following trends (uptrend or downtrend) that may vary in magnitude and time horizon. A long-term uptrend is often called a bullish market on Wall Street and long-term downtrend market is often referred as bear market. This is why most financial analyst and economists defend the idea that financial markets and assets are evolving in cycles.

Using trends for binary option trading

Even though binary options are really simple to understand and to use, it would be foolish to assume that you can earn an income without having a disciplined trading strategy. Binary options are relatively straightforward instruments, as the retail investor is only required to predict whether the price of an asset will go up or down. Analysing, identifying and predicting trend lines can thus represent a huge advantage to implement successful binary option strategies.

As a reminder, a support line can be drawn by the lower price extremes. Most support lines are uptrend support lines where the asset price tends to bounce and resume its uptrend pattern. An experienced binary option trader will thus buy a High binary option around the support line level, as the probability of a rebound is much higher around this level.

A resistance line can be drawn by the upper price extremes. Most resistance lines are downtrend resistance lines where the asset price is likely to pull back and resume its downtrend pattern. An experienced binary option trader will thus buy a Low binary option around the support line level, as the probability of a pull back is much higher around this level as volatility increases.

Trend line characteristics

The longer a trend line the stronger and more likely is the asset price to bounce or pullback on this trend. Another indicator of the trend’s reliability is the number of times that the price has tested support and resistance lines (that is trying to break them), but it did not stand their power and came back.

Fundamental Analysis for Binary Options Trading

Fundamental and technical indicators will enable you to identify trends and opportunities to accurately time your entry and exit points on a specific asset.

When it comes to analysing the market and asset prices movements, there exist two main tools: fundamental analysis and technical analysis. Technical analysis is best defined as the use of charts and historical prices in order to study market price activity and evolution. The ultimate objective is to use this information in order to attempt to forecast future price trends. Fundamental analysis is best defined as the study of macro and micro economic data in order to attempt to forecast their impact on future asset price movements. It is extremely useful to gain at least a basic understanding of both these tools if you want to get the most from your trading and increase your chances of making money.

The analysis of macroeconomic indicators

Fundamental analysis is the study of fundamental and economic data. There exist a large range of data and indicators that may vary according to the asset class you are trying to study. Major indicators include interest rates, employment figures, GDP growth and inflation figures. For the forex market, more specific data include the variation of Central Banks’s forex reserves, monetary policy stimulus, consumer price indices evolution… For the equity stocks and index market, more specific data include earnings, dividend policy, merger announcements and Purchasing Manager Indices (PMIs). Eventually, for the commodity market (oil binary options for instance), more specific data will include weather conditions, producers’ reserves and importing countries’ expected consumption.

Fundamental analysis for binary option trading

From the binary option traders’ perspective, fundamental analysis is useful in building up a bigger picture of key themes and trends. Most economic data are scheduled in advance on the economic agenda and economists are freely providing estimates of these incoming data. It is thus not so much the data in itself that matters but the deviation of the released data from the consensus estimates and its evolution compared to the previous periods. This allows binary option traders to schedule their strategy around these events, when the volatility is expected to pick up.

Fundamental indicators are the drivers of wider and longer market trends. This is why most binary option traders prefer to base their strategies and entries timing on technical indicators that are more short-term focused.

Nice approach