How to Become a Professional Forex Trader

What makes a trader a professional Forex trader? Why are they consistently profitable and you’re not? What do you need to do, or need to change in order to become a professional Forex trader?

Understand how experienced Forex traders think

Professional Forex traders don’t have God like abilities, they’re just the same as you, but they do have a firm control over their trading emotions. You won’t find very many successful emotional pro FX traders. We tend to suppress our emotions, particularly about money so that we don’t fear losing money.

You need to get a control of your emotions if you’re going to trade like a pro Forex trader. You’re going to have to accept that there are going to be winning and losing trades, and that nobody, absolutely nobody can win all the time.

Our success as forex traders, very often comes down to how we deal with losing trades.

Lots of amateur forex traders will jump straight back into the market and try to make back every pip they just lost. Amateur forex traders hunt for trades all over the place, whereas an experienced Forex trader simply waits for the high probability trading opportunities to present themselves.

FX pro trading style will always include a trading plan which they follow to the core as the wait for the market to present the trades, they do not chase trades.

Discipline is also an essential point for professional Forex traders. A trader without discipline is doomed to failure, as they will constantly break their trading rules, not follow their trading plan, and more than likely risk more money per trade than they should.

As a professional Forex trader, discipline is everything; executing your trading strategy only when the trading opportunity is present, not just because you feel like it.

If you’re struggling with your trading, its more than likely that your forex trading discipline or emotions toward money are at fault.

There’s no easy way to put this but losing money is painful, it hurts, and it triggers emotions that are so strong they can override your discipline.

The way to combat emotional trading is to reduce your trade size to an acceptable level of loss, and to restrict yourself to only the best trading opportunities.

You may say that sounds easier than it is, so restrict yourself to no more than 3-5 trades per week. If for example you trade 10 currency pairs, this will limit the amount of trades you take.

Experienced traders don’t spray and pray, they stalk trades like a sniper stalks his targets. They have far fewer positions than most amateur traders do.

Learn Price Action Trading to Become a Professional Forex trader

Amateur traders normally have several different indicators on their charts, a MACD here, an RSI there, and 4 or 5 different moving averages for luck.

More often than not all these different indicators are lagging, and, if anything, are there to help amateurs find trades where there are none. They also obscure the most important part of the chart – the price action.

Professional Forex traders understand that price action patterns are the most important information on the chart, and make everything else a secondary concern.

You may still find a moving average or a stochastic on their chart, but it’s there for a reason, because it’s part of their trading strategy.

Look at the important stuff – Reward:Risk, Drawdown and Trade Sizing

Professional Forex traders look at their average Reward:Risk ratio compared to their average success rate to determine how they might perform in the future.

Let us assume that a trader has an average Reward:Risk ratio of 2:1, whereby they typically return 2% for every 1% that they risk. We’re also going to say that they have a 50% success rate. Are they going to make money trading forex? Yes, it’s highly unlikely they’re going to suffer over 100 losing trades in a row, but let’s take a look at what could happen.

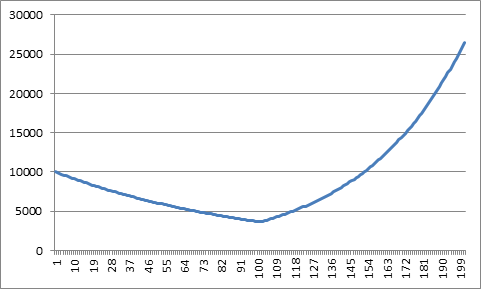

Taking a 10,000 start balance and allowing for trade sizing and compounding. We’re using a sample of 200 trades with the above metrics, a 2:1 Reward:Risk ratio, and 50% success rate.

In this first example we’ve assumed all losing trades took place first. You may think that the account should be empty, after all, 100 losing trades in a row, at 1% risk wipes the account right? Wrong, a pro Forex trader would realize that compounding is his friend, both on the way down, and on the way up.

Taking a sample of 200 trades, losing the first 100, and winning the second 100.

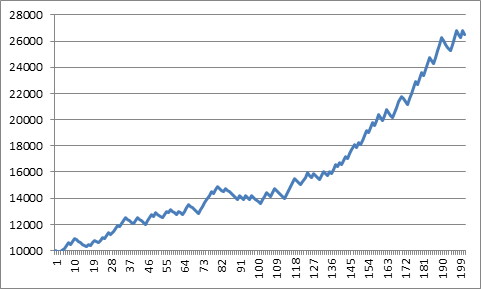

Or more likely, they would be more staggered like this:

We never know what is going to happen next, but it’s statistically very unlikely that the first event would happen. The second is far more likely to occur, and shows a pretty good equity curve of the account. The interesting part is that so long as trade sizing is used, and the trading approach remains constant, no matter how the winners and losers occur the accounts end positively.

Once you know your average Reward:Risk ratio and success rate, you can take 2 standard deviations either side of your data, and predict what is likely to happen going forwards.

Selection, Timing and Management

Each trade has 3 steps – selection, timing and management. A pro Forex trader uses this process either consciously or subconsciously on each and every trade.

Selection is identifying the price action setup, such as a pin bar. Timing is waiting that price action setup at a level where price is likely to react, waiting for that price bar to close, and placing the order. Management is what you do after you’ve placed the order. If the trade doesn’t trigger by the end of the next bar, you do cancel the order. Do you set a take profit, or manage your stop loss?

You should know each of these steps before you even begin the selection stage. The reason for this is that selection, timing and management form a part of your trading plan, which rather nicely leads us on to…

Create a trading plan – and stick to it

If you haven’t already got a trading plan, then it’s about time you put some time aside and created one. Nearly all pro Forex traders have a trading plan, they may not be written down any more, but at some point, they put pen to paper, or fingers to keyboard.

There are no hard and fast rules of exactly what should be included in a trading plan, but most pro Forex traders include selection, timing and management, plus which trading strategies they use, when they trade, what markets they trade etc. Think of it as a business plan for your trading business.

Pick one or two trading strategies and master them

One part that should feature in your trading plan if you want to be a professional Forex trader is the trading strategies that you use, or intend to use. I’d recommend that you start out with one or 2 strategies maximum to begin with; and actually suggest if you’re new to trading that you stick to 1 strategy and master it. As a pro trader you need to be a master of one trading strategy rather than a jack of many.

10 Things Professional Traders Do To Make Money

For an amateur forex trader to progress it is important to study what the professional Forex traders are doing. In the article I outline the main 10 reasons why pro Forex traders make money consistently in the markets. Trade the market like a professional Forex trader, learn what they do and why they do it and see for yourself how you can achieve their level of success.

Below are my 10 Reasons Why Pro Forex Traders Make Money Trading Forex And How You Can Do It To.

1. Pro Forex Traders See The Chart For What It Is, Not What They Want It To Be

Amateur traders get over-involved in forecasting what will happen next on the charts. Predicting long term market movements is not only an unrealistic method of trading but also the incorrect focus. Many things in the markets are out of your control and therefore the focus must be on what is currently happening on the chart and not what you think will happen next or what you want to happen next.

Professional Forex traders focus on the present information on the chart. The easiest way to do this is to forget any open trades that you have running, remove the emotion and look only at market direction and potential new set ups. Use rules or approaches such as looking at price cyclicity and price action. Follow you rules, and only when your rules give you signals can you trade.

2. Professional Traders Keep It Simple And Follow Price Action First

Pro Forex traders believe in quality over quantity. They do not overwhelm themselves and their charts with contradicting signals. Their focus is only on the best and the highest probability setups. The greatest trades should jump off the chart and slap you across the face, professional traders understand that too many indicators hide those trades and make things more complex. Their decision making process is primarily based off price action, cyclicity and support and resistance. It might not be fancy but it’s proven to work.

3. Expert Traders Don’t Spend All Day Analyzing The Markets

Advanced traders understand less is more. Many amateur traders make the mistake in thinking the more time spent the more money can be made. This is risky as you’re overwhelming your mind and charts with so much information it all begins to conflict itself.

Secondly, it prevents you from trading only the highest probability setups as the more time spent the more trades you will want to place. Step one, is to clear your charts and chose maximum 10 currency pairs. You can and should comfortably analyze the markets and place trades in less than 20-30 minutes a day.

Your brain can only focus at a high level for that long, and after that time, your mind simply isn’t as focused as it should be; which isn’t the best way to manage your money. Expert traders understand the greatest trades shout out at you from the charts. Try limiting yourself to 30 minutes a day, and see how you’re trading develops.

4. Pro Traders Are Practical

Professional Forex traders focus on what they are prepared to lose not what they stand to gain. They have reasonable targets for account growth as they are disciplined and always risk manage. Pro traders understand that drawdown periods must be considered and they aim for low drawdowns in order to stay in the game, they allow their profits to grow and compound over time. Expert traders know that yes, trading can be highly rewarding but it is not a get rich quick scheme.

Compare the above mindset to your amateur trader who is looking to make as much money as possible as fast as possible, and you can see that a pro trader has a much more level-headed approach, whereas an amateur has a ‘get rich quick’ mentality. Trading sensibly ensure you only take the best opportunities, you risk manage and you have patience to allow time and compounding to grow an account. That amateur approach leads to over-trading, losing money and a very disgruntle person. The professional approach leads to consistent profits.

Be reasonable and set practical goals. You’re not going to start living off your Forex trading next month if you’re trading a $2,000 account. Focus on growing your capital to a sensible level where you can draw money each month, and still allow your account to grow.

5. Professionals Use Their Minds, Not The ‘Sexy’ ‘Guaranteed’ Expert Advisers Or Robots.

As the old saying goes ‘if it seems too good to be true, it probably is’. Professional traders do not fall victim to the over-promised and under delivered expert advisers or robots. Professional traders are not looking for the ‘holy grail’ or ‘next big thing’. Experienced traders know that these promises are very unlikely to work long-term, if they even work in the first place, and hold no value in them.

Pro traders grow their account by using their mind, their skills and their abilities. For the foreseeable future, no computer program for $27 will be able to beat a professional trader mindset.

The big banks may be able to get automated systems to work for them for periods of time, but they have a lot of experienced people watching these robots all day long, with PhD’s in complex subjects the rest of us didn’t even know existed. They have the money, manpower and the infrastructure to deal directly with the major banks, funds and liquidity providers on a level you can only dream of. As you can guess, it costs much more than $27.

6. Professional Forex Traders Don’t Listen To Others

Nobody cares more about your money then you do. Pro Traders follow their trading strategies rules and not the opinion of others. They don’t risk their money based on what an expert ‘analyst’ has just told millions of people. Most analysts aren’t even traders; they have opinions but don’t put their own money on the line for it. If their opinion is incorrect they won’t lose money, but you can. You’ll find no shortage of opposing ‘expert’ opinions, which can make things overly complicated. First step, learn trading strategies with proven results and write your own trading plan and place your trades based on rules not opinions.

7. Professional Traders Concentrate On Technical Analysis First, News Events Last.

Expert traders use technical analysis as their most important method of market analysis. Technical analysis will give you areas on the chart where you can buy and sell with confidence. This is due to repeating patterns and support and resistance levels in the markets. Unlike news events which are difficult to trade profitably because of larger transaction costs and volatile whipsaws because of large volumes of banks and funds entering the market in a very short space of time. A professional trader should know what setups they are looking for without fundamental factors. The price action usually has the news release priced into it in advance.

8. Experts Traders Do Not Over Trade. They Can Walk Away From The Screen.

Amateur traders often struggle to tear themselves away from the charts. Whereas, pro traders understand they can only control their own behavior not the markets. Watching the price move up and down all day and night long is a dangerous and tiresome way to trade. Pro traders do their business and walk away; they trust their strategies and rules.

A great way to train yourself to walk away is by setting an alarm 30 minutes from when you sit down to trade. Ensure the alarm is put in another room so you must get up to turn it off. Get up and walk away from the charts. The best perk of trading is it can be done in 30 minutes a day so that you can go and do the things you love so take advantage of this benefit and enjoy some hobbies.

9. Pro Forex Traders Have A Discretionary Trading Sense.

Humans have the capability to be greater traders than computers because humans have the capability to use ‘discretion’. Through education, time and experience with trading the market you can develop your own trading discretion. Price action trading is rules based, yet open for discretion. Pro traders use high probability trade setups with multiple confirmations that add further substance to the price action setup. Signals will make it ‘look’ right and your discretion will make it ‘feel’ right. Through education, time and experience your discretion will advance and you will be able to use this to know which trades to take and which ones you allow to go by.

10. Experienced Forex Traders Use Straightforward Trading Systems.

The most difficult thing to get my new students to initially accept is that trading is not complex. Learning how to trade does not require an advanced specially made indicator, vastly complex mathematical equations or fancy charts. Amateur traders are often surprised to learn most professional traders simply use only a few trading strategies on some currency pairs on higher timeframes or as I like to say it: K.I.S.S a keep it stupidly simple trading approach.

Thanks for sharing this very important information .. I’d like to learn more please.