If you’re reading this forex trading guide for beginners, I presume that you’re a beginner forex trader. I also presume that you’ve heard about online forex trading, but you somehow haven’t started trading yet. In this guide, I will take you through the steps that you need to follow in order to start forex trading in Kenya.

I’ll also be answering some of the most frequently asked questions along the way.

Steps to Start Forex Trading in Kenya

- Learn the basics of online forex trading

- Raise adequate capital to start trading

- Choose a reliable forex broker

- Open a demo account with your chosen broker

- Open a real money trading account

- Refine your forex trading strategy

- Keep a trading journal

- Keep learning and implementing what you learn

Step 1: Learn the Basics of Forex Trading

Attempting to get into the forex market without some level of learning is akin to throwing your money into a flaring pit of fire.

Many beginner traders have learned this the hard way.

Don’t be one of them.

And do not make the mistake of thinking that forex trading is like gambling. It is not a game of chance. Beginners who get into the industry with this mentality quickly get wiped and are left with a tainted image of the forex industry.

Commit yourself to learning everything there is to learn about forex trading.

There are several different paths you can choose to learn how to trade.

- You can decide to teach yourself by reading online tutorials on websites such as babypips.com, watching YouTube videos or reading a book

- You can enroll for a purely online course from guys such as Adam Khoo

- You can choose to learn in some of the best forex trading schools in Kenya for one-on-one training with experienced traders

Among all these, I’d recommend that you enroll in one of the best forex trade training schools in the country. Their fees range from 20,000/= to around 50,000/=. As you can clearly see, forex education does not come cheap, but it is better than getting into trading untrained and losing all your money in a few days time.

See: How to Join Forex Trading in Kenya

Can I teach myself to trade forex?

Yes, you can teach yourself how to trade forex. However, it is going to take you a very long time before you can become proficient in it. You’ll make a lot of costly mistakes along the way.

Teaching yourself how to trade forex is not something that I’d recommend you do. Instead, enroll into our forex training course for the best results.

Step 2: Raise Enough Capital to Start Trading

This is the other part where a lot of beginner forex traders in Kenya make mistakes. Most of them do not raise sufficient capital to allow them to trade successfully.

I have seen traders who deposit $10-50 dollars into their trading accounts and expect to start earning handsomely. Unfortunately, this little money ends up in the bank accounts of their chosen forex brokers.

Although a lot of legit forex brokers in Kenya have low initial deposit (as low as $1), it is not recommended that you start trading with such a low amount.

Yes, you may start trading forex with $5, but honestly, such an amount is not going to give you any tangible profits. Also, raising $5 into something that you can survive is far from reality.

With only a small amount of capital, traders tend to use high leverage and take riskier trades trying to grow the amount. Additionally, you’ll find yourself being emotional with every up or down move of the market price. This will force you to open and close positions haphazardly.

To avoid this, make sure that your account is adequately funded before you start trading. I’d recommend that you have an initial trading capital of at least $250 before you start trading.

If you can’t raise sufficient trading capital, stick to trading on a demo account. A demo trading account will build your skills so that when you feel ready, you can start with enough trading capital.

Step 3: Choose a Reliable Forex Broker

You have your skills and capital ready, now is the time to get into the thick and thin of it. To start trading, you’ll need a forex broker. There are hundreds, if not thousands, of online forex brokers in the world.

Ideally, you want to stick to a well-known broker, one that a lot of people are using, and one that is well regulated and licensed. If in doubt about a broker, head over ForexPeaceArmy.com and read reviews by other people who have used the broker.

It is also important to consider the ease with which you can sign up, deposit, start trading, and withdraw your profits. In general, CMA licensed forex brokers like FxPesa and Scope Markets are the easiest to use for forex beginners in Kenya.

Step 4: Open a Demo Account

Regardless of how well you think you’ve mastered the art/science of forex trading, it is important that you start off with a demo account at your chosen broker. This will give you a feel of their trading platform. Does their trading app freeze in times of high market volatility? Are their servers fast enough to execute trade orders in just a few milliseconds?

A demo account is also good in helping you develop the trading strategy that you learned in school. With a demo account, you can test any trading strategy without risking your hard earned money.

Is demo trading really useful?

Yes, demo accounts are extremely useful to beginner as well as experienced forex traders. The demo accounts allows you to have a feel of the platform you’ll be using to trade. Demo accounts are also useful for test driving different trading systems before you take them to your live account.

Step 5: Open and Fund Your Trading Account

In order to start trading online forex in Kenya, you’ll need to sign up with a trustworthy and reputable forex broker. It will be an added advantage to you if the forex broker accepts Mpesa as a means of funding and withdrawing money from your account.

I have a done a review article of the best forex brokers that accept Mpesa. Click here to read it (opens on a new tab). The list includes such reputable brokers like LiteForex, XM, and HotForex. LiteForex are my current favorite in the list. Opening a live trading account with the brokers is super easy and fast.

What is Online Forex Trading in Kenya?

Forex trading in Kenya seems to be enjoying a great deal of popularity nowadays. All types of media from news dailies to glossy publications are extolling the benefits of investing in foreign exchange.

Forex trading goes under a few different names. Some call it forex, others foreign exchange but for many it is simply FX.

The forex market is the largest and most liquid in the world. About $7 trillion is exchanged every day in this gigantic market which never sleeps, except on Sundays. This 24 hour trading cycle provides its own advantages, most notable of which is the elimination of overnight “price gaps” so commonplace on stock exchanges.

The forex trading market is also unique in that it is not conducted through a central exchange but on the “interbank market”. This essentially means short term borrowing and lending directly between banks on electronic networks all over the globe, rather than through a third party such as a stock exchange.

The main banking centres are Sydney, Tokyo, London, Frankfurt and New York. Since these centres are located around the globe, there is always an overlap where at least two banks are open at the same time. This is what creates the 24 trading cycle.

Different currencies are exchanged as part of the supply and demand for money used to purchase or sell local products. For example, the Australian resource boom in 2007 created a demand for Australian Dollars (AUD) because foreign countries had to pay for these natural resources in that currency. This caused a strengthening of the AUD exchange rate against other major currencies, including the US Dollar.

As one currency is exchanged simultaneously for another, it creates what is called a “cross” rate. This rate is expressed in terms of the value of one currency against the other. For example, if the AUD/USD cross rate is 0.8542 this means that for every one Australian dollar you can only buy 85.42 US cents. The most commonly traded and consequently most liquid currencies are called the “majors”. These are USD/EUR, USD/JPY, USD/CHF and GBP/USD.

The best forex trading market to focus on is called the “Spot Market” because there trades are settled immediately or “on the spot”. Other less liquid forex markets include futures and options markets.

[su_button url=”https://kenyaforexfirm.co.ke/what-is-forex/” target=”blank” style=”soft” background=”#ffffff” color=”#000000″ size=”7″ center=”yes” radius=”round” icon=”icon: long-arrow-right” icon_color=”#000000″]What is Forex Trading and How Does it Work?[/su_button]

[su_spacer size=”40″]

Here’s a brief summary that explains how to start forex trading in Kenya:

- Open a demo trading account with a reputable online forex broker

- Learn and practice how to trade on your forex demo account. The learning process can take from a few weeks to years depending on your determination.

- Deposit money (trading capital) into your trading account and start trading. Most brokers will let you deposit as low as $1 into your trading account, but I recommend you have at least $100 if you want to trade seriously.

Opening a Forex Trading Account in Kenya

In order to start trading online forex in Kenya, you’ll need to sign up with a trustworthy and reputable forex broker. It will be an added advantage to you if the forex broker accepts Mpesa as a means of funding and withdrawing money from your account.

I have a done a review article of the best forex brokers that accept Mpesa. Click here to read it (opens on a new tab). The list includes such reputable brokers like LiteForex, XM, and FXTM. LiteForex are my current favorite in the list. Opening an account with the brokers is super easy and, if you’re a beginner, you can start trading after an initial deposit of just $10. Click here to open an account now.

Why you should Learn Online Forex Trading in Kenya

So you’ve opened your Forex Trading Account, but you don’t have a clue where to start? Sound familiar? Firstly you need to learn how to trade the Forex market.

You already know that you can profit from exchanging one currency to another at the right time…but when is the right time to trade forex? That’s the reason why you need to learn how to trade the market before you actually step into it.

[su_quote]‘An investment in education always pays the highest return’ -Benjamin Franklin.[/su_quote]

Seek out a trading educator that can show you how to trade the Forex markets. Look for one that has Trading Results and a company that actually trades, not just educates.

We produce weekly articles on how to trade the Forex market with motivational articles, price action trading articles, and articles on how to trade. These are free articles available in our Trader Talk Blog.

First steps in Learning How to Trade Online Forex

Your first steps in learning how to trade Forex are to open a demo trading account, and get some high quality trading education. You then need to put what you learn into practice on a demo trading account. You can open a demo trading account HERE. Learn how to trade and use your demo trading platform to practice in the beginning. As you feel more comfortable in your ability, open a Live Trading Account. You can open a Live Trading Account HERE.

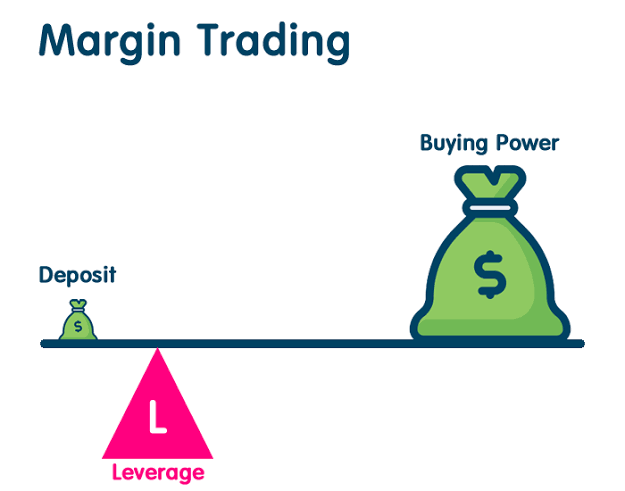

Trading Forex on Margin

If you trade on margin, it means that your capital outlay is only a small percentage of the total value of the assets traded and that someone else finances the balance.

The smaller the margin deposit, the greater the remainder that is financed. So if your margin is only 1 percent it means that your dealer or broker is financing the other 99 percent of the trade value. The advantage to you is leverage, but this can also work against you.

At 1% margin you can use 1,000 units of your capital to purchase 100,000 units of currency. Your leverage is 100:1 in this case and your returns or losses correspond to the price fluctuation of 100,000 units of currency.

This is why you should not maximize your leverage (reduce your margin) too much. Whilst your profits may be spectacular, your losses could easily be more than your original capital and wipe you out. The percentage of your capital outlayed on any one trade should be a major part of your money management system.

In summary then, these are the major advantages of forex trading over other financial instruments:-

1. 24 hour trading cycle – no price gaps

2. Better liquidity – up to $3trillion exchanged daily

3. No commissions – dealers make their money on the spread

4. Margin and leverage – provided it is used wisely

5. Profit in falling markets – you have the choice how you pair the currencies – e.g. EUR/USD or USD/EUR

Finally, there are a couple of terms to be familiar with. The first is the “spread”. This is the difference between the buying and selling price of one currency, usually called the “Bid” and the “Ask”. The second concept is about “pips”. The “pip” is the smallest unit by which a cross price quote changes. In the case of a major like the US Dollar for example, one pip equals 0.0001 dollar, since the bid and ask prices run out to the 4th decimal place.

Forex brokers and dealers compete by offering tight spreads. You’ll hear offers like “only a 3 pip spread on the majors”.

You can become familiar with the above concepts by opening a free demo account with LiteForex. They provide a “virtual trading” account where you get an imaginary $25,000 and can use it to trade live prices using their state of the art charting program.

Let’s look a little closer at forex trading basics and look beyond the high praises. This introduction to forex basics will explain the risks involved as well as the realistic profit potential and how to make money through forex trading in Kenya.

What is Forex Trading?

Basically, forex trading is making money through the exchange of foreign currencies. Given the volatile nature of the forex market, savvy forex traders in Kenya stand to earn good profits should they manage to buy currencies right before a jump in prices then selling as it peaks. Because of this nature, it bears some similarities to stock market trading.

An expectation that the value of a certain currency would rise or fall predictably over a medium to long period of time could make it a good investment over the long haul.

However, traders generally prefer trading within a much narrower time span. Their methods tend to focus on trading forex in shorter times with relatively modest profits on individual trades.

Often traders will open and close a trade in a matter of minutes, buying currencies they think are about to jump or selling those that they think will drop. They do this on the basis of a perceived pattern or trend that they foresee, reacting to certain predictive indicators that they track.

The profit making potential of forex trading in Kenya has steadily become more accessible to individual, non-institutional investors. Since fast internet connections are now commonplace in most homes, brokers are quick to service this new and growing market of individuals that possess modest investment budgets. Thus, trading with just a few of hundred dollars to start is now possible with the advent of forex mini accounts.

A large number of systems now exist which the new investor can utilize to educate themselves with the skills necessary to succeed in forex. Aside from these, there are also forex robots (eg. FAP Turbo Robot Software) which are automated forex trading systems. They open and close trades without the need for human intervention.

The risks in online forex trading

The dream of making huge profits in a relatively short time is common among forex trading beginners. This often results in some degree of disappointment when their dreams are not realized as quickly as they had hoped.

Forex trading demands a number of skills and a high level of discipline and control from the individual. Those who don’t possess these traits can acquire them gradually by educating themselves and through trading experience.

Keep in mind though that global events can have significant repercussions on all markets including currencies. Events such as the World Trade Center disaster can arrive out of the blue with equally disastrous effects on markets.

To protect from being wiped out by such events, traders place automatic stops on their trades. These stops are intended to close your trades automatically should market events suddenly become unfavorable. Stop orders aside, losses are a reality that should be weighed versus the promise of profits.

So while one can make a good living trading forex in Kenya, it most certainly isn’t the safest and steadiest money making option for your investment dollars.

Sit down and weigh the pros and cons, and take stock of your personal capabilities to handle the demands of the market. If you do decide that forex trading is for you, take the time to prepare yourself by studying forex trading basics at the outset.

Avoid Common Forex Trading Mistakes

To be a part of the 95% of the traders who bear losses just has to make any one of the mistakes given below. Thus to achieve success in currency trading, one needs to avoid the following.

1. Depending on Others for Success:

The common thinking trend among most beginner forex traders in Kenya is that success can be bought with the help of someone else. But even though there are a lot of individuals around to help you , no one will be able to buy success for you except yourself. To gain confidence and to be able to follow any discipline one needs to understand the logic of the system he is buying completely.

2. Forex Day Trading Functioning:

Day trading is never the thing to do, each and every short term movements are being random. The ones who are new, try day trading more with respect to any other form and get duped by exaggerating advertisement and sales copies however.

3. Scientific theory to movement of Forex Markets:

Fibonacci. The best selling courses by Gann and Elliot wave have a grand business but never tend to work i.e. for the reason if the markets functions are based on scientific theories there will not be any markets at all as there would be answers predefined for everything. Still there are people who think that there are methods of beating the market by some scientific formulas.

4. Prediction to Win:

You will never be rewarded for your predictions but will only lose on your equity if you go on predictions, as guessing or hoping seldom helps. Rather one should study the momentum indicators and trade when they are sure that the price momentum has turned their way. In such a situation the chances will be on your side as you trade on reality on the forex charts.

5. Markets Move to Supply and Demand Fundamentals:

To some extent the markets do move to the supply and demand fundamentals but trading on them isn’t possible as communication is too fast and the important news in quickly discounted in the value. Thus one can’t catch up and win on it.

The best way is to follow the charts and allow the price action to guide you as we are inspired by emotions and thus the costs don’t always move the way one wants.

Thus one needs to remember the following equation:-

Supply & Demand Fundamentals + Investor Psychology = Market Movement

6. News sources on the internet are useful:

To keep emotions away from trading one needs to avoid listening to the news, as we have already seen that the fundamentals discount immediately. Again, the news is quite at times not false and basically people’s opinions which are quite convincing.

7. Leveraging is The Factor to Gaining Profits:

Excess of anything isn’t good. In the same way excessive leveraging is also not recommended. Don’t leverage too far, one doesn’t need a 400 : 1 ,10: 1 is sufficient for most of the traders. How leverage in forex works.

8. You don’t go Broke Taking a Profit:

Trying too hard to mislead a risk and giving yourself no scope of winning, a lot of traders actually create the risk. The losses will never be covered if one doesn’t run the profits.

The solution is to take calculated risks. Snatching or tightening stops too quickly wont help.

9. The More Money Put In The More You Will Earn:

Hard work doesn’t pay you in forex trading. To be rewarded one needs to be right about the trading signals.

10. Confidence & Discipline Are A Piece of Cake:

The reason why following someone else will not help you in making money is that it takes a through knowledge of the methods followed and your own emotions and discipline and self control come form this understanding. Never try to acquire them.

Am kindly and humbled requesting for your help sir

I have tried my best to teach myself for like two years but I haven’t understood it yet, I think Mr Mahinge you’re going to take me through this and be my mentor, I’ll appreciate so much

very encouraging insights thereof.

Hi,patrick…..Kindly guide how to do forex trading includes it’s merit and demerit especially in business form.

Thanks a lot for all this info, keep it up

You are welcome, Joseph. Kindly consider subscribing to my newsletter for more amazing information about forex trading in Kenya

Very educative.

Thanks

You are welcome, Anthony. Glad to always help and make forex trading education available to everyone in Kenya.

Would like to learn more about forex trading

Quite enlightening. I have taken time to build my knowledge on Forex and have started trading in a demo account.

Thanks, Patrick for sharing the tips of one to start trading with. I was much impressed with avoiding common mistakes. I share it out

Hi Patrick,

I do need mentorship in this. Kindly contact me with details of how to start on this path.

Hey Laura, there are several ways you can use to learn forex trading in Kenya. This article explains more. You can also reach me on WhatsApp 0739088050 for personalized help

Hi Patrick. How do I get in touch?

Hey Jacqueline, you can WhatsApp me on 0739088050

Interesting Stuff.. always wanted to learn about this.

You are welcome Jacqueline. There’s a lot to learn about online forex trading in Kenya. Don’t hesitate to get in touch in case you need personalized mentorship.

Patrick,, I want to join;but I need someone can help me how to trade and teach me more about it like you,,

Thanks for this insight.

It’s enlightening and leaving one hungry for more

Am interested in learning and trading in FX

Hey Mathew, I am glad you found this useful. There ‘s several ways you can use to learn forex.