What is FOREX trading and how does it work?

Forex, or foreign currency exchange, is the largest trading market in the world, averaging a turnover of US $5.9 trillion per day.

Trade Forex refers to the simultaneous buying and selling of currency pairs, traded against one another. For example, USD/GBP would be a pair consisting of US dollars against the Great British pound. Common currencies seen during forex trading include the euro (EUR), the yen (JPY), and the franc (CHF).

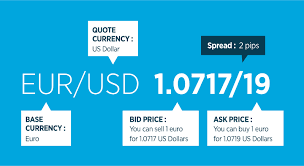

In an equation like USD/GBP above, the first currency (in this case the US dollar) is known as the base currency. The second currency (in this case the Great British pound) is called the quote or counter currency. All forex quotes are given in terms of the base currency and when asking for a currency quote, the asker will be given two prices – the bid price and the ask price.

- The bid price is the price the asker would get for selling the currency.

- The ask price is the price they would get for buying it.

Both prices are expressed in terms of the base currency, which is, in the example above, USD. If the exchange rate is currently 1.608, this means that one US dollar is equal to 1.608 British pounds.

If, for instance, you were to ask for a quote for EUR/USD, then you would be supplied with something that looks like this: 1.4550/55. The first price is the bid price; the second is the ask price – or 1.4550 and 1.4555. The spread is the difference between the two prices, while fluctuations within the rates are known as pips.

A person who trades in Forex is making a speculation that the currency rate between two country’s currencies is going to change, go up or down. The most commonly traded currency pairs are the US Dollar/Japanese Yen (USD/JPY); Euro/US Dollar (EUR/USD); US Dollar/Swiss franc (USD/CHF); British Pound/US Dollar (GBP/USD). The country on the left is the higher rate and there are many other pairs traded.

There are all kinds of events that affect a country’s currency rate. These events are occurring on a twenty-four hour basis, seven days a week. Therefore, the Forex market is open and trading all of the time. This is one of the big differences between Forex and the stock market. The other difference is that there are strict regulations with stocks that are not in place with Forex. There is not control by the SEC and Exchange commission and no oversight of brokers regarding fees, commissions, etc.

Understand Price Quotes in Forex Trading

In forex trading, currency is always quoted in pairs, with one pair creating one product. The formula is generally XXX/YYY, with XXX being the base currency and the YYY being the ‘quote’ or counter currency.

In currency bids and quotes, an international ISO 4217 three letter currency code is used; for example, the US dollar is shown as USD while the Japanese yen appears as JPY.

The base currency quoted in forex will always have a value equalling one (1) while the counter currency will reflect the units it would take to create one in base currency. For example, the numbers provided for EUR/GBP will represent one euro and the number of British pounds it takes to make one euro – i.e. the exchange rate.

While forex quotes can come in a single quote number, most of the time they are displayed in pairs according to bid price and ask price. When you trade forex, the bid price is the price at which you will sell the base currency, while the ask price is the price at which you will be buying. The difference between the two numbers is the spread.

A pip is the smallest value within a quote, which is the last decimal. For example, if the exchange rate for GBP/USD goes from 1.618 to 1.619, that change equals one pip. In the case of USD/JPY, the change from 120.75 to 120.80 would represent five pips. Pips are always determined by the last decimal place, no matter how long the quoted number.

[su_divider top=”no”]

Advantages of Trading Forex

Why trade forex when you could be trading futures, options, commodities, or stocks? Here are some of the advantages of trading forex:

1. Trade Forex 24/7

The forex market never rests. There is no need to wait for the market to open, because you can trade 24/7, responding to the latest news as soon as you hear it.

The forex market begins its trading week every Sunday at 5:00 New York time. Trade begins in Sydney, Australia and is then followed by Tokyo, Singapore, Hong Kong, London, and finally New York. But hey, just because the market is open 24/7 doesn’t mean you should trade all the time. Check the best forex trading time in Kenya.

2. Trade Forex From Anywhere

If you have a computer, an internet connection and an active forex account, then you can trade forex from anywhere.

3. Flexibility In Trading

You can trade forex in your spare time. This means you can start off small, working as a trader on a part-time basis, before building your way up to full-time.

4. High Leverage Margins

Margins typically offered by forex brokers are 50:1, 100:1, 150:1, or even 200:1. This means you can find yourself in control of large sums of money with very little actual cash outlay. For example, buying $150,000 worth of currency at a 150:1 margin means your outlay is only $1,000.

5. Ability To Profit

It does not matter whether the market is going up or going down, a forex trader is able to profit, depending upon whether he or she has undertaken a short or long position.

6. No Commission Charges

There are no commission charges payable when trading forex. Instead, you pay a spread, which is the difference between the bid price and the ask price.

Can You Get Rich from Forex Trading?

There is a huge potential for a person to make money with Forex if an individual learns how to read trends and is vigilant about events that are occurring in the countries they are trading in.

Earning a living through forex trading may feel like an unreachable goal, but there are plenty of examples out there of people who have successfully used the foreign exchange market as their primary source of income, providing comfortably for both themselves and their families. That being said, it is important to point out that the majority of forex traders do not earn enough to make a living, although some do make enough to attractively supplement their lifestyles.

Before you can consider trying to make a living trading forex, you will first need to educate yourself on the intricacies of the foreign exchange market. As with any other career, knowledge is a necessity. Making money takes time; it also takes a lot of patience and the willingness to learn.

To begin trading forex for a living you will need to turn to one of two places: proprietary trading firms or trading yourself. Proprietary firms are attracted to the currency markets because traders can generate a massive return on investments, using highly levered currency trades. It is important to note that entry to these proprietary firms costs as much as $25,000 and requires that you learn the firm’s specific trading techniques.

As a trader based at home, you will be a part of an ever-growing part of the foreign exchange market. Reaching the level of understanding necessary to create a standalone income will probably take years, but it can be done if you have the patience, the willingness, and the time.

Let’s say that you are trading in EUR/USD. Several countries in the EURO go bankrupt or lose credit ratings. Everyone finds this information out at the same time, but if you had come in early because you had a “feeling” that something was going to happen in some of the EURO countries, you would make a lot of money when it was announced in the newspapers.

If you want to get into Forex trading for maximum profit, you simply just have to learn the basics – familiarize yourself with the nuts and bolts of the business, and once you get the hang of it, you can start making profit.

Learn about Foreign Exchange as much as you can from its nature, to how it’s done, and so on. Learning the right forex trading strategy will make you rich from trading forex.

Tips for Success in Forex Trading

Consistency in forex trading is what will make you rich. Day in day out, you keep doing the same thing over and over. If it doesn’t work change it, but once you get it right and perfect, you must keep doing it so you can get the same result.

I’ve always strived for consistency in everything I do. If I say something I will do it. If I say I’m going to be somewhere, I’m there. If I say I’m going to gain 20 pounds of rock solid muscle in 6 months, I will do it (I have seriously done this, I used to be very skinny). If I say I’m going to trade my forex plan, I’m going to do it.

What you do consistently day in and day out will forge your future. There’s a plan to almost all common goals. If it’s been done before you can bet there is a plan to do it. All you have to do is have the discipline to follow the plan. If you’re consistent with following the plan to your goals you can expect to achieve positive results towards your goal and eventually reach it.

Consistency allows for measurement:

As a discretionary price action trader I have learnt that that being disciplined, patient, having a great trading plan, just isn’t enough, you need consistency to bind it all together.

If you’re not consistent with following your trading plan how can you expect to be profitable? Your equity curve will be very volatile with massive highs and massive lows.

Day in day out I day out I have a process that I use consistently because I know it works. And if I follow it I can expect to be profitable.

I never found this process by accident. It was all through trial and error. As I made mistakes and found solutions, I would embed those solutions into my trading daily routine.

For instance: When I was a beginner I used to always trade using the same contract size regardless of how big my stop loss or profit target was. This would lead to a very volatile equity curve. I would have massive wins and be a optimistic then have massive lows and be pessimistic. My solution was to trade using percentages rather than fixed contract sizes. So I would started to risk 1% per trade. Then my equity curve started to smooth out and so did my emotions. After I saw the results I started to do this on a consistent basis until it became a habit.

Now if you take the above example and times that by 100 examples, that leads to profitable trading. There are many other examples of what I do on a consistent basis, but that’s just one example. If I grab all my top 100 things I do on a consistent basis and keep doing them I know that it leads to profit.

Why Forex Traders Aren’t Consistent:

Forex traders struggle with consistency for many reasons but the main one is sacrificing consistency for speed. In other words they want to achieve their goals of being rich in the shortest amount of time.

You take short cuts to riches because you can’t handle not being in a trade. You can’t see any trades to take based on your trading method so you start to bend the rules to satisfy your goal of being rich quickly.

Problem is taking short cuts in trading just makes your trading goal further and further away. The way to reaching your trading goals is through consistency.

Doing something consistently is how habits are made:

Studies have shown that it takes 21, 30, or 40 days (depending on which study you read) to break a habit and create a new one in its place. Most the things I do on a consistent basis are today habits. At first trading 1% was hard for me. I really needed to force myself to do it but once I saw results it was a little easier. Then after a month I was doing it without even thinking.

I wake up at 4am every day. This was very hard but I knew it would lead me to living a more healthy productive life. Again it was hard at the start but after doing it for a month it became a habit. Now I get up at 4am naturally.

Today all trading methods, styles, process, are habits to me, I do them without even thinking. When I look at a chart it will take me less than 3 seconds to figure out the bias. If it’s obvious enough it will take me an extra 2 seconds to find an entry point. For less obvious entries it will take me around 20 seconds but if it takes that long I wouldn’t trade it anyway. I never become this way by accident. It was by rigorous training, practice and dedication to my craft.

Once you have fixed a solution in your trading you must do it day in and day out with consistency. Never ever derive from it unless you are sure it will make you a better trader. After you have fixed most of your mistakes as a trader and trade in line with those solutions consistently you will end up being a profitable trader.

1. Attitude

One of the most important aspects of forex trading is the attitude the trader brings to the table. Without a desire to learn new skills and then improve upon them the novice trader is likely to be disappointed by his or her forex currency trading experience. While making money is an important consideration for any trader, most successful traders are in the market for the long haul and make their profits over time, rather than looking for a “quick score.”

It is also advisable that those new to the world of forex trading not look on it as their primary source of income. Rather, it should start out as a secondary enterprise while the novice learns the finer points of forex and becomes proficient at trading. After the trader becomes confident with the systems they employ and consistently makes a profit, it will be time to consider trading on a full-time basis.

2. Focus on signals

Just because a trader has had some success and seen profits grow, it does not mean he or she should take bigger risks in the forex market. Traders should understand that past success does not guarantee a like outcome in future trades, and should concentrate purely on the forex signals for the trade at hand. Only by focusing on those signals can an informed decision be made about a specific trade.

3. No competition

Individuals new to forex currency trading should understand that they are not in competition with fellow traders; traders adopt different trading styles based on what works before for them in their individual circumstances. The key for the novice is that he or she discovers what the best forex currency trading system is for them instead of trying to match how much other traders are making.

4. Learn from your mistakes

While any trader enjoys success, overconfidence is never a virtue and can lead to costly mistakes. In short the message is: “Don’t assume your next trade will be successful just because the last few were.” By the same token no trader should lose confidence in their abilities just because of a few unsuccessful trades. Failures can and will happen, and the forex trader needs to learn from them and avoid making the same mistakes in future trades.

How Much Money Do I Need to Start Trading Forex?

You can start trading forex with as little as $10 or even $5. Some brokers will even allow you to start trading with an initial deposit of $0.00! This is called a No Deposit Bonus. The forex broker is basically giving you money to start trading.

However, just because you can start trading with $5 does not mean you should do it. But this starting capital will not be making you rich any time soon. Only uniformed beginners start trading with capital less than $100.

Managing Risk in Forex Trading

As is the case when trading in any market, there are risks associated with forex trading that traders need to understand and accept. One of the keys to being successful in the online currency market is knowing how to manage risk as well as how to avoid taking risks that are unnecessary.

Finding a good forex broker is one of the best ways to help manage risk. There are many FX brokerages to be found on the internet, and the trader needs to ensure that they choose one that can serve their individual needs.

For example, while a forex brokerage offering high leverage may appeal to some traders, the risks associated with high leverage trading may be greater than newer traders are comfortable with. Individuals who are new to the world of online forex trading may be better off finding a brokerage website which offers average leverage. The chances of making a huge profit on a single trade will be less, but there will also be less chance of incurring heavy losses.

Additionally, new traders may want to consider a brokerage that offers a stop-loss facility as this will automatically sell currency when it sinks below a certain level, hence minimizing potential losses.

Another way to minimize risk is to make proper use of all available information. In most cases it is worth investing in forex charts, as these will help the trader identify trends in the way the markets are moving. Forex news will also give an indication of various economic and political factors which can positively or negatively influence the value of specific currency pairs.

While it is inevitable that some losses will occur, effectively managing risk will help to minimize these losses and allow the trader to engage in more consistently profitable trading.

Technical vs Fundamental Analysis in Forex Trading

Trading decisions in the foreign exchange market are typically made based on an analysis of the market and the forces that govern them. Based on the kind of analysis that they use to make their decision, traders are divided into two types – fundamental and technical.

Fundamental analysis deals with how macroeconomic factors like international trade, interest rates and so on affect the market, thereby affecting the currency exchange rate.

On the other hand, technical analysis uses various indicators and charts their progress to forecast how market forces and thus the exchange rate will behave. It is essential to understand these very important aspects of Forex trading.

Although they are very different from each other, both are very useful tools for Forex traders. They share a common goal, predicting prices or movements in the market. Technicians analyze the effects, and fundamentalists look at the causes of market movements. By combining both, successful traders increase their chances for profitable trading.

The goal of Forex technical analysis is to help investors determine their views and predict their forecasts regarding exchange rates of currency pairs. If you really want to learn technical analysis, there are many resources available. However, this article is here to help you become familiar with the tools and terminology used by technical analysts.

Tools

Descriptions of technical analysis tools may seem redundant because there are so many ways to categorize the tools available. Here are the ones that we will be covering in this series of articles:

- Background, advantages, and disadvantages of technical analysis

- Terminology and techniques

- Diagrams and charts

- Price indicators

- Number theory

- Waves

- Gaps

- Trends

- Other tools

- Other technical indicator categories

Technical analysis

Technical analysis is simply a way of trying to predict price movements and future market trends by using charts to study past events.

Only the details of what is happened in the past markets is of interest in technical analysis. It is not concerned with, what should happen and takes many factors into account to adjust for this.Its primary tool is creating charts based on the data, such as price of instruments and the volume of trading.

Experienced analysts using technical analysis, gain a large advantage, because they are able to follow multiple market instruments and markets at the same time. There are three essential principles that form the basis of technical analysis.

Movements matter not the reasons!

What I mean by this is that the current price is merely a reflection of all factors known to the market of things that could affect it. These factors include inflation, interest rates, and other fundamentals, supply and demand, geopolitical factors, and overall market sentiment. However, the only true concern of a discipline technical analysts are the price movements, and not the reasons they occurred.

Trends

Identifying patterns of market behavior is a major part of technical analysis. There are certain patterns that have been identified as being significant, because either the probability is high that their results are predictable, or that a given pattern will consistently repeat itself.

Repetition

For over a hundred years, forex chart patterns have been identified and categorized. Due to the consistent manner in which these patterns repeat themselves, it has been concluded that the psychology of human has changed very little. And because these patterns have been predictable in the past, we assume that they will continue to be predictable in the future.

Disadvantages of Technical Analysis

So what are the disadvantages of technical analysis. Critics of technical analysis claim that the Dow approach (i.e. prices are not random) is weak, and today’s prices do not project future prices. Critics also claim that signals of a changing trend show up too late, usually after the change has already happened. Because of this Forex traders who rely heavily on technical analysis may react too late, and therefore lose about one third of the fluctuation.

There is also a concern that technical analysis in short intervals may be exposed to “market noise” which may cause a misreading of the market direction.& Another complaint is that because the patterns and trends of technical analysis have been so widely publicized over the last few years that many traders have become familiar with them and therefore act on them accordingly. This therefore is responsible for creating a “self-fulfilling prophecy”, and the buying and selling trends are artificially created in response to the bullish or bearish patterns.

Advantages of Technical Analysis

If you’re thinking, “the disadvantages of technical analysis seemed to make sense.” I’m hoping that you’re also asking yourself, “So what are the advantages of technical analysis. Well I’m glad you asked.

For starters, that start with supply and demand. Any asset priced under the supply and demand forces that are available for trade and capital markets, can be predicted with technical analysis. Because it is focused on what “is” happening, instead of relying on what “has” happened in the past. Therefore, technical analysis can be proved valid at any pricing level. The technical analysis approach concentrates its efforts on prices, neutralizing external factors. True technical analysis uses objective tools, such as tables and charts, and disregards other factors such as bad trading emotions.

Traders using technical analysis can better maintain their profit or subsequently minimize their losses by paying close attention to the signals. Signaling indicators will sometimes point to a conclusive end of a current trend before it is actually shown in the market.

Common Indicators Used in Technical Analysis

Predicting and following Forex indicators can be accomplished by many different techniques. The primary goal is predicting the major parts of the trend, including the direction, level, and the timing.

Following is a list of some of the best-known techniques.

Bollinger bands

Named after their inventor in the 1980s, John Bollinger, they define a range of price volatility. Their evolution grew out of the concept of trading bands. Bollinger bands are used in measuring relative heights and depths of price. Bollinger bands are able to adjust themselves to the market conditions by widening our contracting closer to the average of the standard deviation.

A band is placed 2 standard deviations (a measure of volatility) from a simple moving average. We have become of the most popular techniques of technical analysis. A market is “overbought” the closer prices move towards the upper band. Conversely, a market is “oversold” the closer prices move towards the lower back.

Support and resistance

Support is considered the lowest price that an instrument trades at over a given period of time. Support is said to be stronger at a given level, the longer the price stays there. You were to look at a chart, this is the price level. Under the market, where the buying interest is strong enough to overcome any selling pressure. It is believed, by some traders, that he price is less likely to break through that level in the future, the stronger support it has at a given level.

On the flip side, the resistance level is a price where a market can trade, but cannot exceed for a given period of time. This would be a price level on a chart over the market, where a price advance is turned around, because selling pressure has overcome buying pressure.

Support and resistance breakout is when a price is able to pass through and stay beyond the areas of support or resistance.

Commodity Channel Index (CCI) – developed by Donald Lambert, a commodity Channel Index is able to quantify the relationship between a given asset price, a moving average of that asset price, and the normal deviations from that average. Its main purpose is to help in determining when an investment instruments has been either overbought, or oversold. It has been growing in popularity among technical investors.

It is often used to indicate and determined cyclical trends in commodities, currencies, an equities. It is able to provide investors with good evidence can estimate changes in price direction of an asset, by identifying its potential peaks and valleys.

Hikkake Pattern

This method is used for identifying patterns of reversals and continuation. By determining trending behavior (market turning points, and continuations), this simple pattern can be viewed in market price data, using traditional bar, or candlesticks charts.

Moving averages (MA)

Moving averages are typically used for emphasizing directions of a trend and for smoothing out price and volume fluctuations(i.e. market noise) that often confuse interpretation. There are 7 types of moving averages:

• simple (arithmetic)

• exponential

• volume adjusted

• triangular

• weighed

• time series

• variable

The most significant difference between these various types is the amount of weight assigns to the most current data. A simple moving average, for example, can be calculated by adding closing price of the assets for a given number of time periods, then dividing the total by the number of time periods.

The most popular method, by far, of interpreting moving averages is by comparing the relationship between a MA of an assets closing price, and the actual closing price of the asset.

Sell signal

Triggered when an instruments price goes below is MA

Buy signal

Triggered when an instruments price rises above its MA

Double crossover

This technique uses short term and long term averages. The upward momentum is typically confirmed when a short-term average crosses above the long-term average. Conversely, downward momentum is confirmed when the short-term average goes below the long-term average.

MACD

Moving Average Convergence/Divergence was developed by Gerald Appel, detect price swings of financial instruments. This technical indicator is generated using 2 exponentially smoothed moving averages of the historical price. By comparing the Moving Average Convergence/Divergence to its own MA (referred to as the signal line), traders believe they can figure out when a security will rise or fall. The MACD is typically used with other technical indicators.

Momentum

An oscillator is purpose is to measure the rate of price change, not the actual price level. This value is the net difference between the current closing price and the oldest closing price from a predetermined period.

The formula is:

momentum (M )= current closing price (CCP) – old closing price (OCP)

Relative Strength Index (RSI)

The RSI, developed by Welles Wilder, is a technical indicator of momentum, and measures relative changes between the lower and higher closing prices. RSI attempts to determine the overbought or oversold conditions of an assets by comparing the difference between recent gains in recent losses.

The RSI formula is:

RSI = 100 – [100 / (1 + RS)]

RS – average of N days up closes, divided by average of N days down closes

N – predetermined number of days

The range of RSI is from zero to 100. To be considered overbought and asset must approach the 70 level. This probably means that it is getting overvalued and would be a good candidate pullback. Conversely, an RSI of 30, indicates an asset that may be oversold and likely become undervalued. The RSI is best used as a complement to, rather than as the primary, other tools, because false signals can be created by large churches and drops in the price of an asset.

Stochastic oscillator

Another technical momentum indicator, comparing an instruments closing price to its price range over a predetermined time period. By adjusting the time period, the oscillators sensitivity market movements can be reduced. It may also be reduced by taking a MA of the results.

This formula is:

%K = 100 * [(C – L14) / (H14 – L14)]

C= the most recent closing price;

L14= the low of the 14 previous trading sessions;

H14= the highest price traded during the same 14-day period.

Trend line

a sloping line of resistance or support

Up trend line

The upward straight-line drawn to the rights following successive reaction lows

Down trend line

The downward straight-line drawn to the rights following successive rally peeks

You need two points to draw a trend line with a third point to make it valid. There are many ways, that trend lines are used by traders. For example, when price returns to an existing trend line, that could be opportunity for a trader to open new positions in the trend direction, believing that the trend line will hold and continue.

Another way, that trend lines are used by traders is when price action breaks through the principal trend line of an existing trend, it may mean that the trend is going to fail. At that point, a trader may consider trading the opposite direction of the existing trend, or possibly exiting positions in the direction of the trend.

That brings us to the end of our second part of this series. If you would like to learn more, please see the other parts of the series.

Applying Fundamental Analysis to Forex Trading

Fundamental analysis is best used to determine long term trends. By studying the factors that affect a country’s economic growth or decline over the long term, fundamental analysis can help a trader predict which way a currency pair will move over time. Examples of fundamental analysis include:

Euro/US Dollar (EUR/USD)

It is common to see a rise in the euro value whenever the US dollar weakens. Conversely, when the dollar gets stronger, the euro tends to decline. This means that as the US faces rising unemployment rates and the currency is thus negatively affected, the euro strengthens against it, prompting a trader to buy (ask price) the euro based upon the idea that EUR will appreciate against USD. Alternatively, if there is a heightened demand for US bonds and the value of the USD rises, the opposite is true and the trader will act accordingly.

US Dollar/Japanese Yen (USD/JPY)

Another example would be if the government of Japan decided to boost export demand from the USA. To promote value, the government would seek to weaken the yen against the dollar. If/when that happened, the USD/JPY would rise in price and any forex trader hoping to benefit from that event would buy (ask) USD/JPY in anticipation of the strengthened dollar against the yen.

Australian Dollar/US Dollar (AUD/USD)

Mining is one of Australia’s biggest sources of export revenue, so any time there is an increase in commodities pricing, the Australian dollar will benefit. If you are to trade forex to benefit from this situation, you will buy AUD/USD.

Useful Tips for Fundamental Analysis in Forex Trading

When applying fundamental analysis to trading forex, it is advisable to look at several countries, because the strong political and/or economic connections maintained between two or more countries will be reflected in their currency value fluctuations.

Other useful tips when embarking upon fundamental analysis as you trade forex include:

- Economic calendar: pay attention to the where and when. Due to the fact that the value of a currency responds quickly to the release of certain economic information, it is imperative to keep a close watch on currency price trends whenever new information is publicised.

- Economic indicators: know what economic indicators are capturing the market’s attention. These indicators serve as catalysts for the largest price and volume movements. For example, when the British pound sterling is weakened, one of the most watched indicators becomes inflation.

- Market expectations: do not just watch the data; know what market expectations develop from it and then watch closely to see whether or not those expectations are met. This serves as a better indicator of trends than just watching the data itself. From time to time, there is a major gap between what is expected and what actually occurs; therefore you need to remain aware of the possibilities.

Fundamental analysis is highly effective in helping to predict overall market behaviour and determining a country’s economic health trends, but where fundamental analysis falls short is in the short-term. This type of analysis is simply not capable of accounting for short-term fluctuations. It is important to use other techniques in conjunction with fundamental analysis and so this is where the technical analysis comes in.

[su_divider top=”no”]

How to Start Forex Trading in Kenya

Forex is completely run on the global network and you need a broker to participate. Brokers charge from 3-20 pips on the spread. A pip is normally referred to as 1/100th of 1%. While it’s not a lot of money, it is always a good idea to check pips and other fees before committing to a broker.

Most Forex brokers offer training modules so that you can learn how to work within the market and get started with a solid knowledge of how currency moves and what the trends for currency are.

When you work with a reputable and reliable broker, they will also have several different avenues to keep you alerted to any changes in the market or new information that may be coming up. The broker will make sure that you know what is FOREX and what you need to know to get the most return on your investment.

Which forex broker is the best?

The Forex trading market is the busiest market in the world considering its capacity to generate as much as $4 trillion each day. Because of the great liquidity of the forex market, investors and businessmen continue to engage in the currency trading as they meet their objective of gaining good profit. Participating in the forex market requires the help of a forex broker. This is because the forex market has no central place that is why traders must acquire a reliable forex broker in order for investors to be in the right track.

Knowing how competitive the forex market is, finding a quality broker is essential. Below are tips on selecting the best broker.

1. Forex Broker must be reputable

When choosing a broker you have to check on his portfolio. It is important that the broker must be a member of reputable organizations such as the National Futures Association of NFA. Also check that the broker is registered with the U.S. Commodity Futures Trading Commission or CFTC as a Retail Foreign Exchange Dealer or Futures Commission Merchant.

If you want to know why a broker should be a member of these organizations, perhaps their functions will explain why.

The NFA is an organization that regulates the United States’ future industries. It is responsible in providing services, programs and rules in protecting the credibility and integrity of all investors and traders in the market. The organization sees to it that each member in the organization is able to practice his or her regulatory responsibilities.

The CFTC is an agency of the government which functions independently. Their task is to regulate options market and commodity futures in the United States. The CFTC is responsible in protecting the public and market users from any form of abusive practices, manipulation and fraud related to financial futures and options as well as commodity sales.

As a way of choosing a reliable broker, make sure that the broker is an NFA member and/or a regulated by the CFTC. Always check on the ‘about us’ page of the website that this information are stated otherwise brokers without NFS and CTFC evidence should not be accommodated.

More often than not, websites with flashy designs pretend to be prestigious and reputable. For as long as there’s no proof about their membership to NFA and CTFC, then these brokers should be avoided. It always pays to be cautious in choosing a reputable broker.

2. Currency Pairs Offered by Forex Broker

The forex market comprise of a number of currencies for trading, therefore you have to focus on only a few pairs which have the greatest liquidity. These major foreign exchange pairs are:

- The Euro / US Dollar (EUR / USD),

- The British pound /US dollar (GBP / USD),

- The US Dollar / Japanese Yen (USD / JPY),

- The US dollar / Swiss franc (USD / CHF)

Brokers are allowed to present other currencies to the trader however; it is still the trader who has the power to select which currencies he or she is interest at.

3. Forex Broker Customer Support Service

The forex market operates 24 hours a day, 5 days a week. On the side of the trader, customer service is a totally important service because there are times when queries need to be answered. In addition, customer service must also be available on the same time and days the Forex market is open. When it comes to communicating with a customer service representative, traders prefer to speak with a live agent rather than an auto attendant. This is because trading is a serious matter that involves investing money therefore; such issues must be resolved accurately. Since brokers need to earn the trust of traders, information about their company details, leverage, spreads as well as organizational memberships must be readily available.

The Foreign Exchange (FOREX) market is by far the largest market in the world. The $4 trillion average daily turnover dwarfs the daily turnover of the American stock and bond markets combined.

There are many reasons for the popularity of foreign exchange trading, but among the most important are:

- The available margin trading

- The 24-hour a day 5 days a week liquidity

- And low if any commissions.

Of course many commercial organizations are participating purely due to the currency exposures created by their financial institutions accounts on their import and export activities.

Investing in foreign exchange remains predominantly a domain of the big professional players in the market such as hedge funds, banks and brokers.

Nevertheless, any investor with the necessary knowledge is and complete understanding of this market can benefit from this exciting arena.

Forex Trading Hours

What are the best days of the week and the best times to trade on Forex exchange market?

The choice of when to make trades in the market is a key step to achieve significant results in the Forex market, so what is the best day and time?

The best times are when the market is more active and has the most of trading, then in the hours that overlap multiple sessions

London-New York from 14 to 17

Sydney – Tokyo from 8 to 23

London – Tokyo from 9 to 10 am

(European time)

Forex Trading Session in Sydney / Tokyo

The volume of trading during these two sessions according to a 2004 survey represent 21% of the total daily global. The main financial centers are Wellington (New Zealand), Sydney (Australia), Tokyo (Japan), Hong Kong and Singapore.

This means that the data and reports from these countries will probably be reflected in the market during this session.

Most of the exchanges during This session is focused on currency pairs that include such as the Yen USD / JPY, EUR / JPY

Forex Trading in European Session (London)

The volume of trading in this session is approximately 50% of the daily total.

The European session overlaps (14 to 17) at New York, it follows that in these times the liquidity reaches often its peak.

Attention to the couples exchanged during this section are the EUR / USD (39% of the total volume) GBP / USD (23%), USD / JPY (17%) USD / CHF (6%) and USD / CAD (5%)

Forex trading session in New York

In this session, the trading volume represents approximately 22% of the total, the most active time, with greater liquidity.

Common Forex Trading Strategies

There are three different methods of Forex trading that each require a different strategy to produce excellent Forex profits. These three different forex strategy are:

- Day Trading

- Position Trading

- Swing trading.

These systems are all good trading strategies, so that some forex traders use them all three in their forex strategies.

Day Trading in the Forex Market

Day Trading The Forex refers to the purchase and sale of currencies within the same trading day.Due to the different time zones around the world, trading sessions have different trading hours, so you can choose the time for you.

A day trader buys at the time the currencies of the Forex market and sells before it closes. Within the same trading day you can open positions with different strategies, practice of scalping strategies, lasting a few minutes to open up positions that can remain in the market for several hours.

Day Trading forex strategy is very demanding, requiring the use of many indicators, and a full-time monitoring of the market. Day trading is a system so that, if applied methodically, will produce small profits, consistently.

Many professional money managers shy away from day trading as they believe that the premium for such strategies is not commensurate with the risk to bear.

Position trading in the Forex

The second system of Forex trading is the trading position. With this strategy, Forex means the buying and selling of currency, with positions that can remain open for periods of weeks or even months. This strategy requires a lot of initial planning, as you should be able to anticipate the changes that occur in the market through your Forex strategy.

The position trading can generate a profit, but you must have a good grasp of fundamental in the first place, plus a good knowledge of technical analysis.

The trading location is relatively easier, thanks to steady supply of economic data from different countries, which allow you to understand and predict fluctuations in their currencies. You must be very patient, however, read the reports, as data on employment, GDP, reports, import / export and other reports relating to currency.

Swing Trading in Forex

Swing Trading in Forex trading is a strategy similar to the position, even if it has a duration ranging from a few days to a week. Longer rely on the weekly trends of currencies, rather than daily or monthly trends, and needs to be monitored constantly to react to any unexpected fluctuations. swing trading is a strategy that requires a high risk to get higher premiums.

To succeed, a swing trader must choose the appropriate currency pairs, usually those that are traded more actively. The best time to swing trading is the time when the market is not going anywhere – when prices rise for a couple of days and then decline during the following days, and the opposite pattern is repeated again and again. The challenge to the swing trader is to determine which currencies and markets are located between the extremes.

They must quickly understand the scheme in order to obtain profit by the inversion. To do this, they will need to obtain reference data and graphs daily or weekly, in order to analyze the direction of the currency and if there is a possibility that the values go up or fall in the short term.

What is Currency Trading

Currency trading is done, when a trade off is made against the strength and weakness of two or more opposing currencies. For example the currency trading of the Euro against the US dollar or that of the Japanese Yen.

In order for a Forex trader to be successful in currency trading, he needs to look at the market trends and try to analyse where and in what direction he might think that the market is going to go.

There are many factors which can (and do) contribute to the daily currency trades being made, and these can have almost immediate effects to the currency trader. In the world of online forex trading such factors could be:

- The outbreak of war

- Natural (sometimes called Acts of God, in insurance terminology) disasters such as hurricanes, earthquakes, typhoons

- Secessions and the breaking of trade blocs as recently witnessed with Britain’s exit from the Euro bloc (Brexit)

All these factors impact directly on the supply and demand of currencies and commodities. For example, war could interfere with the supply and delivery of crude oil. Terror acts also play a role in currency trading. Although, traders today, and after 9/11 tend to take such things more in their stride now, and the currency trading markets usually correct themselves pretty quickly today.

In internet forex trading, an exchange rate represents the value of one currency against that of another. An exchange rate fluctuates over time.

The US dollar is the most traded currency in the world and we can look at the value relative to a third currency, which may be obtained by dividing the US dollar rate for that of another.

For example, if there a 120 Japanese yen to the dollar and 1.2 euros to the dollar, then the number of yen per Euro is 120/1.2 = 100.

The magnitude of numbers is not, by themselves, indicative of the strengths or weaknesses of any particular currency. Meaning that the US dollar could be rebased tomorrow, so that one new dollar was worth one hundred old dollars.

All the numbers, in the table, would be multiplied by one hundred – this does not suggest, however, that all the world’s currencies just got weaker. One way or another, currency trading is almost as old as mankind itself.

What is Margin Trading?

Foreign exchange trading is normally undertaken on the basis of margin trading or gearing.

A relatively small deposit is required in order to control much larger positions in the market. This is possible because when you buy one currency you sell another.

Margin requirements are set by your broker and vary from as little as 1% to 10% margin.

This means that in order to trade 1,000,000 USD on 1 % margin, you need to place just 10,000 USD by way of security.

That same security of 10,000 USD, traded on a 10% margin could control up to 100,000 USD worth of one currency against another currency.