Are you considering an investment opportunity that offers potential returns and flexibility? If so, Forex trading might be the avenue you’re looking for. Let’s dive straight into understanding Forex trading and how to open a Forex trading account in Kenya.

Forex, short for foreign exchange, is the global market where currencies are traded. It’s about buying one currency while simultaneously selling another, aiming for profit through the fluctuations in exchange rates.

Here’s a simplified step-by-step guide on how to open a forex trading account in Kenya.

- Choose a Reputable Broker: Research thoroughly. Look for forex brokers that are regulated by recognized authorities like the Capital Markets Authority (CMA) in Kenya.

- Registration: This involves providing personal details, and typically, brokers will require proof of identity and residence, to ensure your security.

- Deposit Funds: Once your account is set up, deposit the amount you wish to start trading with. Many Kenyan-friendly platforms accept various payment methods, including bank transfers and mobile payments like M-Pesa. Here’s a list of the best forex brokers that accept Mpesa.

- Start Trading: Familiarize yourself with the trading platform, maybe even starting with a demo account. This way, you understand the dynamics before diving into live trading.

Requirements to Open A Forex Trading Account in Kenya

- Age Requirement:

- Eligibility: You must be 18 years of age or older to open a Forex trading account in Kenya. This age requirement is standard in many countries to ensure that individuals have the legal capacity to enter into contractual agreements.

- Identification Documents:

- National ID or Passport: Every reputable Forex broker will require you to submit a copy of your national ID card or an international passport. This helps in verifying your identity and ensuring that the person opening the account is genuine.

- Photographs: Some brokers might also ask for recent passport-sized photographs, although this is becoming less common due to digital verification methods.

- Proof of Residence:

- Utility Bills or Bank Statements: To further verify your identity and place of residence, you may be asked to provide a recent (typically no older than 3 months) utility bill (e.g., electricity, water, or telephone) or a bank statement that has your name and address on it.

- Tenancy Agreement: If you’re renting, some brokers might accept a tenancy agreement as proof of residence, given that it’s recent and has all the necessary details.

- Initial Deposit:

- Most Forex brokers require an initial deposit to start trading. The amount varies between brokers, with some offering accounts that can be opened with as little as $10, while others might require higher amounts. It’s essential to check the broker’s requirements and ensure it aligns with your investment strategy and budget.

- Knowledge and Experience Assessment:

- Some brokers have a procedure where they assess your knowledge of Forex trading and your trading experience. This is done to ensure that you understand the risks associated with forex trading. Depending on your answers, brokers might offer additional educational resources or even suggest starting with a demo account.

- Agreement to Terms and Conditions:

- Before your account is activated, you will need to agree to the broker’s terms and conditions. It’s crucial to read these thoroughly to understand your rights and responsibilities, the broker’s policies, and any associated fees or costs.

- Additional Requirements (Varies by Broker):

- Some brokers might have additional requirements, especially if they operate internationally or have specific account types. These could include additional financial documentation, employment details, or tax identification numbers.

Choosing a Reputable Forex Broker

When you decide to step into the world of forex trading, one of the most pivotal decisions you’ll make is selecting a broker. But with the multitude of options available, how do you choose the right one? Our guide will walk you through the essential considerations to keep in mind as you research potential brokers to open a forex trading account.

For more details, make sure you read our detailed guide about A Book vs B Book brokers.

1. Reputation and Credibility

- Regulatory Compliance: Before you open a forex trading account in Kenya, ensure the broker is regulated by recognized financial authorities. This can vary based on region – for instance, in the U.S., it would be the National Futures Association (NFA) or Commodity Futures Trading Commission (CFTC). In the UK, look for brokers regulated by the Financial Conduct Authority (FCA). It’d be an added advantage if the forex broker is also regulated by the Capital Markets Authority in Kenya.

- Online Reviews: Dive into forex forums, websites, and social media to gather insights from other traders. While every broker will have both good and bad reviews, consistent negative feedback can be a red flag.

2. Trading Platforms Offered

The trading platform is your gateway to the forex market. It should be user-friendly, stable, and packed with necessary tools and indicators.

Most traders are familiar with MetaTrader 4 & 5, but many forex brokers offer their proprietary platforms. Test the platform’s demo version before you open a Forex trading account to ensure you’re comfortable with its interface.

3. Spreads and Commissions

Spreads (the difference between the buy and sell price of a currency pair) can impact your profitability. Look for forex brokers offering competitive spreads. Some might offer zero or low spread but compensate by charging a commission on trades. Always calculate the total cost of trading with a broker before making a decision.

4. Deposit and Withdrawal Options and Fees

A reliable forex broker makes it easy for traders to deposit and withdraw funds. Before you open a forex trading account in Kenya, check the available payment methods, any associated fees, and the speed of transactions. Quick withdrawals without exorbitant fees are indicative of a trader-centric broker. If possible, choose a forex broker that accepts Mpesa.

5. Customer Service Quality

At some point, you might face issues or have questions. A broker with excellent customer support can be a boon. Look for 24/7 support, multiple channels of communication (e.g., live chat, phone, email), and the responsiveness and knowledgeability of the support team.

Taking the time to thoroughly research potential forex brokers is crucial for a successful and hassle-free trading journey. By focusing on the factors above and leveraging the power of online reviews and demos, you can confidently open a forex trading account with a broker that aligns with your needs.

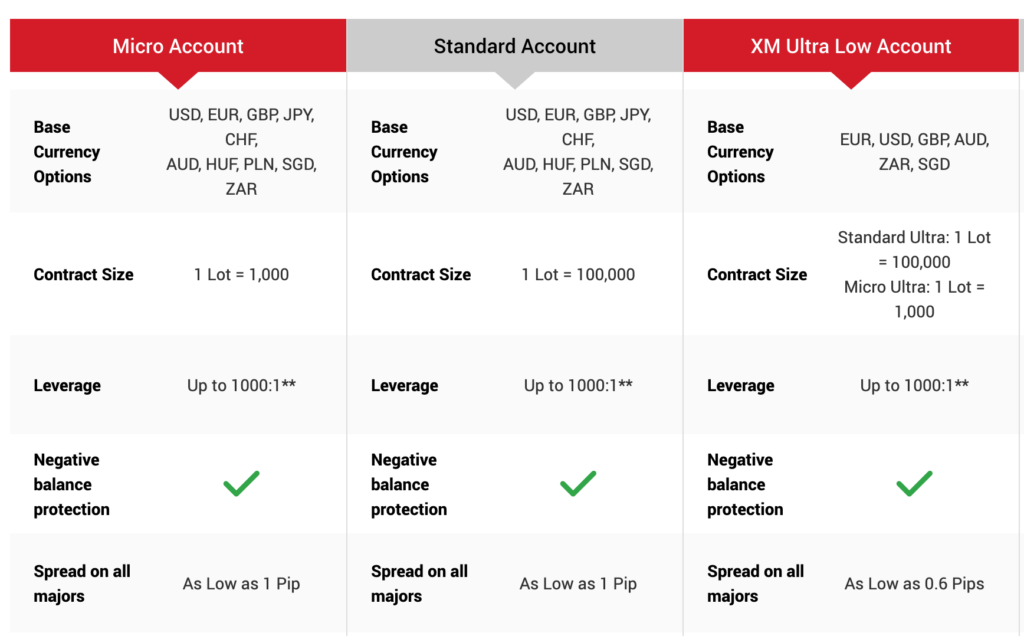

Choosing the Right Forex Trading Account Type

Once you’ve chosen a good forex broker, the next step is to open a trading account. Different forex brokers offer different account types. The account type you choose will impact your potential profits and the risks you face.

1. Standard Account

A standard account is the most common type traders opt for. When you open a forex trading account of this type, one standard lot traded means 100,000 units of the base currency.

For example: If you’re trading the EUR/USD pair, a one-lot trade would involve 100,000 Euros.

- Benefits:

- Higher potential profit due to the size of the trades.

- Often comes with added features like more in-depth analysis tools or access to expert market insights.

- Drawbacks:

- Higher initial deposit requirement.

- Greater risk exposure given the volume of the trade.

2. Mini and Micro Accounts

These accounts allow traders to participate in the market with a smaller initial deposit when they open a forex trading account. A mini account typically involves a 10,000-unit lot size, while a micro account deals with 1,000 units. Example: If trading the GBP/JPY pair in a micro account, a one-lot trade would be 1,000 British Pounds.

- Benefits:

- Suitable for beginners or those testing new strategies.

- Lower risk exposure and less capital needed.

- Drawbacks:

- Lower profit potential due to smaller trade sizes.

- Might not offer all the perks and tools of a standard account.

3. Copy Trading Accounts

Copy trading allows traders to replicate the trading activities of experienced and successful traders automatically. When you open a forex trading account with a copy trading feature, your trades mirror those of the trader you choose to follow.

- Benefits:

- Excellent for traders who wish to leverage the expertise of seasoned players in the market.

- Potential to garner profits from forex without the need for in-depth engagement or strategy formulation.

- Drawbacks:

- Typically involves fees, either as a commission based on success or a fixed charge.

- Relinquishing some control over trading decisions, as they’re based on another trader’s actions.

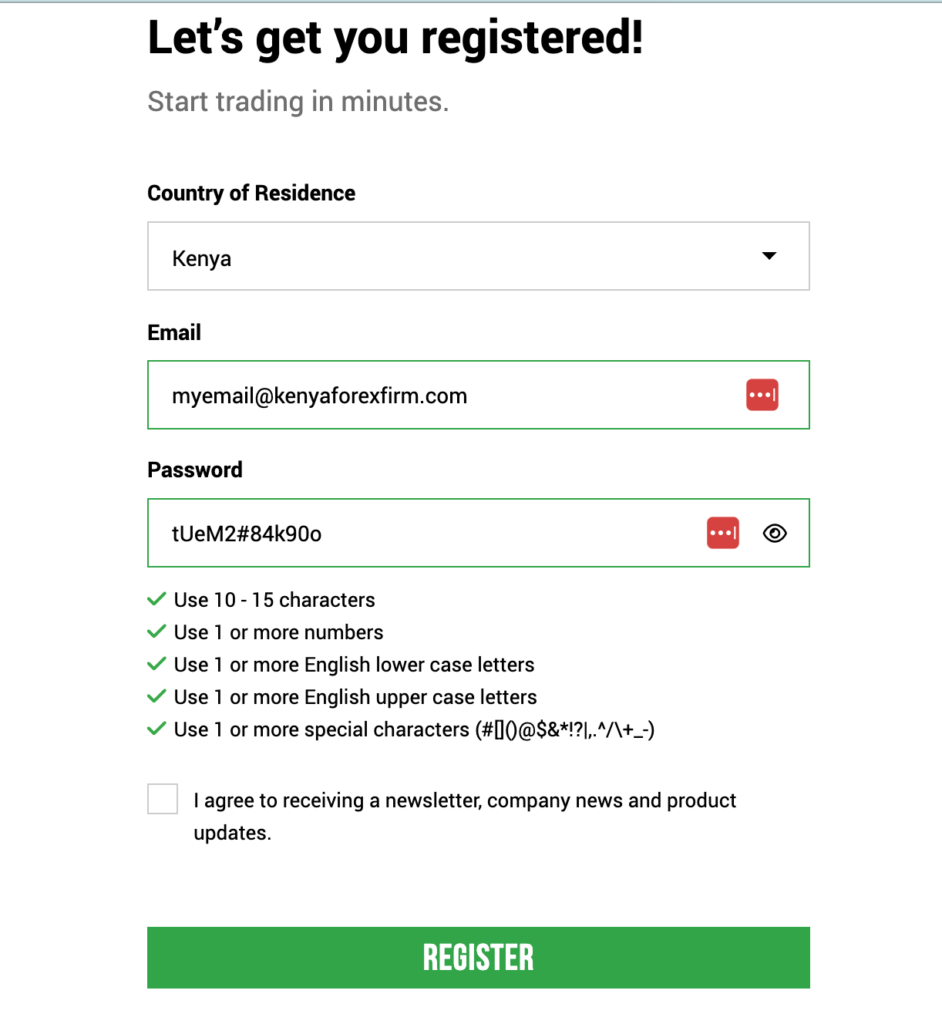

The Registration Process

1. Accessing the Registration Page:

Once you’ve selected a broker, visit their official website. Look for a button or link that says “Open an Account,” “Start Trading,” or something similar. This will lead you to the registration page.

2. Filling Out the Application Form: This is where you’ll provide the broker with your personal details. Typically, the form will require information like:

- Full Name: As displayed on your official identification.

- Date of Birth: To ensure you meet age requirements.

- Address: This must be your current residential address.

- Email & Phone: Vital communication lines between you and your broker.

Did you know? Forex brokers request this specific data to create a secure, personalized trading environment tailored to you.

3. Providing Financial Information: The broker will also want to know a bit about your financial situation and trading experience. This helps them assess whether Forex trading is appropriate for you. Expect questions such as:

- Employment status and profession

- Annual income and net worth

- Trading experience and objectives (Are you trading for capital appreciation? Hedging? Speculation?)

- Risk tolerance (High? Medium? Low?)

Insider Tip: Always be truthful here. Overselling your experience or financial strength can lead to unsuitable product recommendations.

4. Account Security: To ensure the safety of your funds and data, you’ll be asked to create a secure password. Make sure it’s a combination of uppercase and lowercase letters, numbers, and symbols. Some brokers might also offer or require two-factor authentication (2FA) for added security.

Why the emphasis on security? The Forex market, being digital, is susceptible to cyber threats. These measures protect your investments and personal data.

5. Submitting Identification Documents: Due to international regulations aimed at preventing money laundering and fraud, forex brokers need to verify your identity. This is known as the Know Your Customer (KYC) process. You will usually be asked to provide:

- A clear copy of a valid passport or national ID card. Ensure that your photo, name, signature, date of birth, and expiry date are visible.

- Proof of residence, which can be a recent utility bill, bank statement, or official government document showing your name and current address.

6. Application Review: Once you’ve submitted all required information and documents, the broker will review your application. This can take anywhere from a few hours to a few days, depending on the broker’s workload and the clarity of the documents you’ve provided.

7. Account Approval: Upon successful review, the broker will approve your account. You’ll receive a confirmation email with your account details, login credentials, and instructions on how to access the trading platform. Some brokers might also give you a call to welcome you and provide further assistance.

Tips for a Smooth Registration:

- Ensure all documents you provide are clear and legible.

- Use a secure internet connection when filling out forms to protect your personal information. Avoid using WiFi hotspots in cafes and other public places!

- If you face any challenges, reach out to the broker’s customer support. They’re there to help!

Making the Initial Deposit

Forex trading, like any other financial venture, requires some form of capital to start. After you register an account with your desired forex broker, the next step is to fund your account. Making your initial deposit might seem straightforward, but there are nuances and choices to consider. Let’s delve into the specifics so that you can make an informed decision.

This deposit will serve as your trading capital and margin, allowing you to open and maintain positions in the market. Think of it as your ticket to the world of forex trading. The amount you choose to start with can affect the kind of trades you can make and the risks you’re exposed to. However, always remember: only deposit what you can afford to lose.

If you’re not sure about how capital you need to start reading, here’s a guide for you.

Methods of Making the Initial Deposit

- Bank Transfers: Traditional and straightforward. Depending on your bank and broker, this method might take a few days. Be prepared for possible transfer fees, and always confirm with your bank about any additional charges.

- Credit/Debit Cards: Faster than bank transfers. Most brokers will process card deposits within a day, if not instantly. Ensure your card is enabled for international transactions if your broker isn’t based in Kenya.

- E-Wallets: These are becoming increasingly popular, especially among younger traders. Common e-wallets include PayPal, Skrill, and Neteller. They offer almost instantaneous transfers and are quite secure.

- Mpesa: Tailored for the Kenyan trader! Some forex brokers now accept Mpesa, a testament to its popularity and efficiency in Kenya. It’s fast and user-friendly, and you can deposit funds directly from your mobile phone.

- Cryptocurrencies: An emerging and increasingly accepted deposit method. Cryptocurrencies like Bitcoin, Ethereum, and Litecoin offer decentralized, fast, and sometimes cheaper transaction fees. Before using this method, ensure you are familiar with how cryptocurrency transactions work and are comfortable with the volatility associated with them.

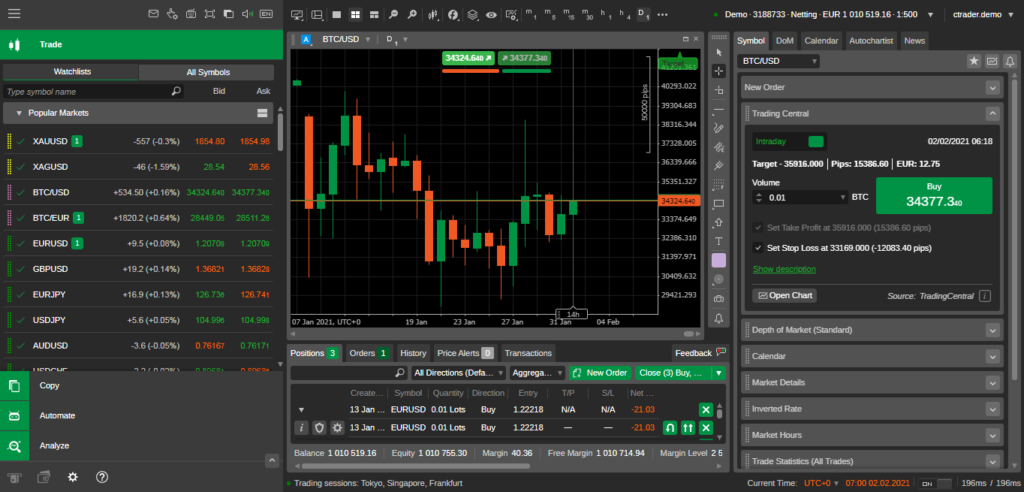

Familiarizing Yourself With the Trading Platform

When you first open a forex trading account, one of the most critical steps before diving into live trading is understanding your chosen trading platform. This tool will be your main interface for executing trades, analyzing markets, and managing your investment.

1. Logging In and Layout Understanding

- Start Simple: Once you’ve logged into the platform, take a moment to familiarize yourself with its layout. Identify where the main menu, charting tools, market quotes, and other essential features are located.

- Customization: Most platforms allow you to modify the layout to your preference. You can usually adjust the colors, position of windows, and which tools are readily accessible. Organize the platform in a way that feels most intuitive to you.

2. Accessing and Reading Forex Pairs

- Locate the Market Watch or Quote Window: Here, you’ll see a list of currency pairs like EUR/USD, GBP/JPY, and AUD/CAD. Each pair will typically display a bid and ask price.

- Currency Pair Information: By clicking on a specific pair, you can usually access more detailed information like the high, low, and volume for the day.

3. Charting Tools and Technical Analysis

- Opening a Chart: Select a currency pair and open its chart. For example, if you’re interested in the EUR/USD, you should see its historical price movements displayed graphically.

- Timeframes: Most platforms allow you to view price data in various timeframes, from one minute (M1) to monthly (M). If you’re day trading, you might focus on shorter timeframes like 5 minutes or 1 hour. For longer-term analysis, daily or weekly charts might be more appropriate.

- Indicators and Drawing Tools: Familiarize yourself with how to add technical indicators like Moving Averages, Bollinger Bands, or RSI. Learn how to draw trendlines, support, and resistance levels. For instance, if you believe the GBP/JPY is respecting an upward trendline, use the drawing tool to visually represent that on the chart.

4. Placing and Managing Trades

- Order Execution: Identify the order window, where you’ll specify details when entering a trade. For a currency pair like AUD/CAD, you can set the lot size (e.g., 0.10 lots or 10,000 units), decide whether you’re buying or selling, and place your order.

- Setting Stop Loss and Take Profit: Always have a risk management strategy. For every trade, determine where you’ll set your stop loss (the level at which you’ll close the trade if it goes against you) and take profit (the level at which you’ll close the trade with profits). For instance, if you buy EUR/USD at 1.2000, you might set a stop loss at 1.1970 and a take profit at 1.2100.

- Monitor Open Trades: Identify the section of the platform that displays your current open positions. It will show your entry price, the current market price, and your running profit or loss.

5. Demo Practice

- Risk-Free Learning: Most brokers offer a demo or practice account, which simulates live trading but with virtual money. Use this feature extensively. Try out different strategies, practice placing trades, and get comfortable with the platform’s various functionalities without risking real capital.

Remember, every platform might have its unique features or layout, but the underlying principles remain the same. The more time you spend navigating and practicing on your chosen platform, the more confident you’ll become when it’s time to trade with real money. Always refer to the platform’s user manual or help section if you’re unsure about any feature – taking the time to learn now can save you from costly mistakes in the future.

Begin Trading

Once you’ve familiarized yourself with the trading platform and have a solid understanding of the forex market’s dynamics, you’re ready to dip your toes into the vast ocean of currency trading. But before you dive in, let’s discuss some fundamental concepts you should know.

Basics of Placing Trades

- Currency Pairs: Forex trading involves buying one currency while simultaneously selling another. This is done in pairs, such as EUR/USD, GBP/JPY, or USD/JPY. When you believe the first currency in a pair (known as the ‘base currency’) will strengthen against the second currency (the ‘quote currency’), you’d buy the pair. Conversely, if you believe the base currency will weaken against the quote currency, you’d sell the pair.

- Order Types:

- Market Order: When you want to buy or sell a currency pair at the current market price, you place a market order. For example, if EUR/USD is trading at 1.2000 and you believe it will rise, placing a market order would buy the pair at approximately that price.

- Limit Order: This allows you to buy or sell a currency pair at a specific price or better. For instance, if you believe that EUR/USD will have strong support at 1.1950 and wish to buy when it reaches that price, you can set a limit order.

- Stop Order: This is essentially a trigger. If you have a position and you want to close it when the price hits a certain level to prevent further losses or lock in profits, you’d use a stop order.

Setting Stop Losses and Take Profits

- Stop Loss (SL): This is a predetermined level at which your trade will be closed if the market moves against you. It’s a safeguard against unexpected market movements. For example, if you buy EUR/USD at 1.2000, expecting it to rise, you might set a stop loss at 1.1980. This means if the price drops to this level, your trade will automatically close, limiting your loss.

- Take Profit (TP): This is a pre-established level where you want your trade to close once you’ve achieved a certain profit. If you buy EUR/USD at 1.2000 expecting it to rise, you might set a take profit at 1.2050. If the price reaches this level, your trade will close automatically, securing your profits.

Importance of a Trading Strategy

Venturing into the forex market without a strategy is akin to navigating a ship without a compass. Here’s why you need a trading strategy:

- Direction: A well-defined strategy provides a roadmap. It tells you when to enter a trade, when to exit, and how to manage risk.

- Discipline: It’s easy to get swayed by market noise and emotions. A strategy keeps you grounded, ensuring you stick to your plan regardless of market volatility.

- Consistency: With a robust strategy, you can replicate successful trades. This doesn’t mean every trade will be a winner, but it increases the likelihood of consistent results over time.

- Evaluation: A strategy provides a benchmark. You can review your trades, see what worked, what didn’t, and refine your approach accordingly.

In conclusion, as you embark on your forex trading journey, remember the importance of mastering the basics and adhering to a solid strategy. The market is vast and can be unpredictable, but with patience, discipline, and continuous learning, you can navigate its waves more confidently. Happy trading!