There are a gazillion forex brokers in Kenya, and finding one that is trustworthy can sometimes feel like you’re looking for a needle in a haystack.

- Is JustMarkets A Legit Forex Broker in Kenya?

- Advantages of Using JustMarkets in Kenya

- Review of the Main Features of JustMarkets in Kenya

- JustMarkets Account Features and Trading Conditions in Kenya

- JustMarkets Fees and Commissions Review

- JustMarkets Offers & Promotions

- JustMarkets Withdrawal Process Review

That’s why at Kenya Forex Firm, we’ve taken it upon ourselves to do thorough reviews of the most popular forex brokers in the country.

As a trader myself for over a decade, I know the pain of dealing with shady brokers who are only after making a quick buck off your deposits and trades. You want to work with someone who has your back, provides top-notch customer service, and offers favorable trading conditions, right?

Join the Copy Trading Revolution

Copy the trades of successful Forex traders and profit from their strategies.

*Forex and CFDs Trading involves high risk. T&Cs apply.

In today’s review, we are going to focus on JustMarkets, a forex broker that’s been gaining quite some momentum in the country.

We’re going to be answering all the questions that you might have about this forex broker start from the most benign ones to some that you might not have thought about:

- Is JustMarkets a legit forex broker in Kenya?

- Do they onboard Kenyan clients? What’s needed to start trading with them?

- Do they accept Mpesa?

- What’s the minimum deposit at JustMarkets?

- What are the trading costs?

Is JustMarkets A Legit Forex Broker in Kenya?

- Our extensive use and testing of JustMarkets have shown that it is a broker that takes its commitment to traders seriously.

When choosing a forex broker in Kenya, the legitimacy question is paramount. You want to ensure that your hard-earned money is in safe hands, and rightly so. With so many scam forex brokers out there, this is an important question to tackle first.

From our extensive background research on JustMarkets, we can say with confidence that yes, this broker is 100% legit and properly regulated. The forex broker, previously known as JustForex, was founded in 2012.

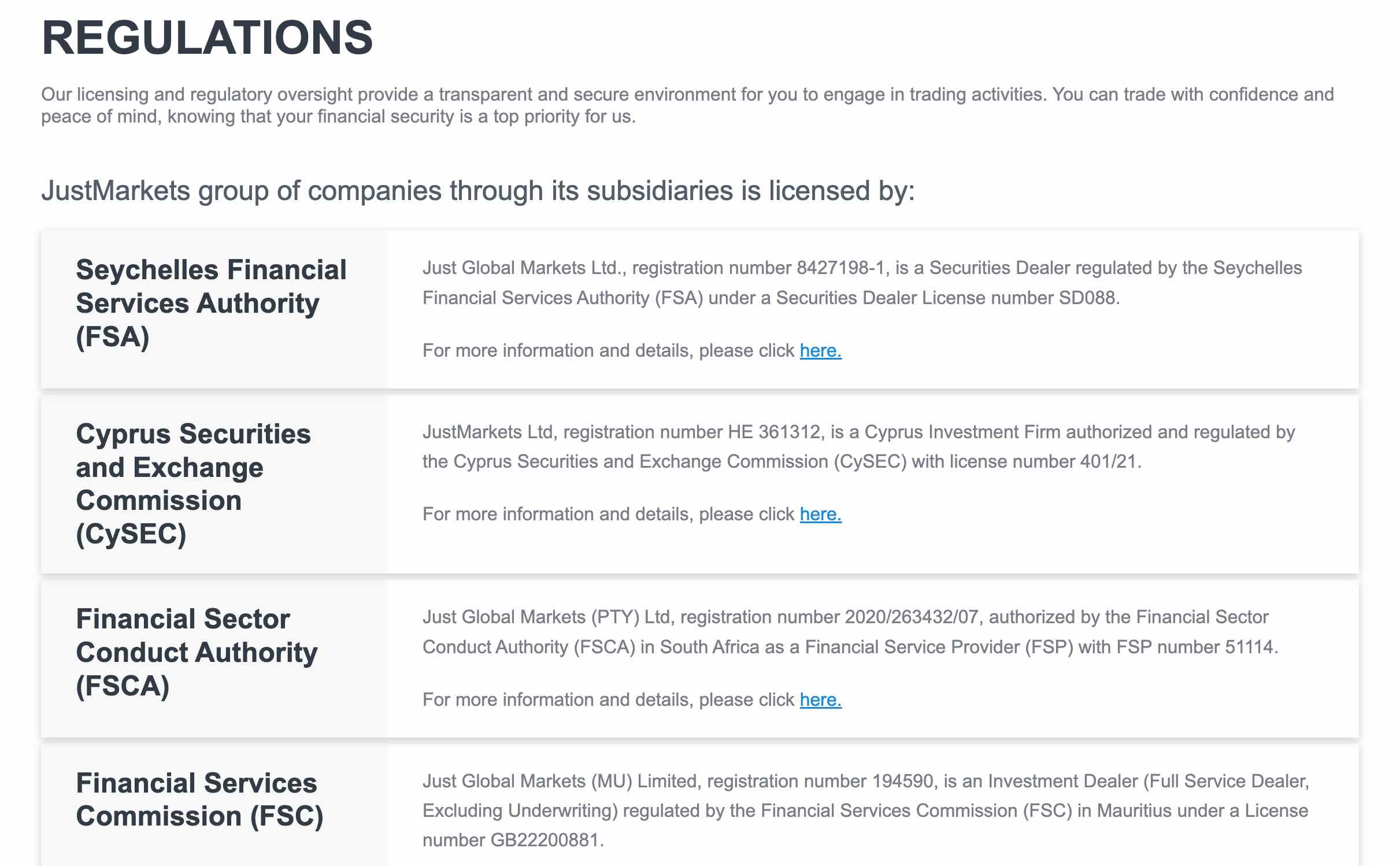

Having been in the Kenyan market for a long time, JustMarkets has earned itself a reputation as a trustworthy trading partner. It is regulated by several international agencies such as:

- The Cyprus Securities and Exchange Commission (CySEC)

- The Seychelles Financial Services Authority (FSA)

- The Financial Services Commission (FSC) in Mauritius

- The Financial Sector Conduct Authority (FSCA) in South Africa

But, as a Kenyan trader, you need to be aware that JustMarkets is not regulated by the Capital Markets Authority (CMA) of Kenya. The CMA is the local regulatory body responsible for overseeing the financial markets in Kenya, including forex trading. The absence of CMA regulation means that JustMarkets does not have a local regulatory license to operate within Kenya.

- While the lack of CMA regulation might raise questions for some Kenyan traders, it's important to remember that JustMarkets' adherence to international regulatory standards offers a significant level of protection and reliability.

-

Advantages of Using JustMarkets in Kenya

- Regulatory Compliance: JustMarkets operates under the regulatory oversight of several reputable international bodies

- Diverse Trading Conditions: Offering four account types plus a demo account, JustMarkets caters to a wide range of traders. From beginners to seasoned professionals, there’s an account type that fits various trading styles and preferences.

- Low Entry Barrier: With a minimum deposit as low as $10 on their Standard Account, JustMarkets makes it accessible for traders with different financial capabilities to enter the forex market.

- Comprehensive Educational Resources: JustMarkets provides an abundance of educational materials, making it easier for beginner traders to learn and start trading.

- Copytrading: JustMarkets’ copytrading platform allows you to replicate the trades of successful forex traders, making it an excellent tool for beginners to earn while they learn.

-

Review of the Main Features of JustMarkets in Kenya

At Kenya Forex Firm, we understand that diving into the world of forex trading can be overwhelming, especially when it comes to selecting the right broker. To that effect, we developed a meticulous approach to analyzing the main features of forex brokers, ensuring that you can make informed decisions with confidence.

Our analysis is rooted in both hard data and extensive first-hand experience, providing a comprehensive look at each broker’s offerings.

JustMarkets Account Features and Trading Conditions in Kenya

JustMarkets offers a variety of account types, including Standard Cent, Standard, Pro, and Raw Spread accounts, alongside a demo account for practice and strategy testing.

This range ensures that whether you’re a beginner forex trader starting with small volumes or an experienced trader looking for tight spreads and high leverage, there’s an account that fits your needs.

- JustMarkets Minimum Deposit: The minimum deposit for JustMarkets is $10 on their Standard Account.

- Account Currencies: Traders can operate their accounts in multiple currencies, including USD, EUR, GBP, and others. Unfortunately, they don't have an account that is denominated in Kenya shillings.

- Leverage: JustMarkets offers high leverage up to 1:3000 on all their account types, which can significantly increase profit potential but also comes with increased risk. Learn more about how leverage works in forex.

- Spreads: JustMarkets offers competitive spreads starting from 0 pips on certain account types, which can reduce trading costs, especially for high-volume traders.

- Trading Platforms: Access to both MetaTrader 4 and MetaTrader 5 platforms is provided

- Market Access: Traders have access to over 170 trading products, including forex pairs, indices, metals, and cryptocurrencies, allowing for diversified trading strategies.

- Copytrading: JustMarkets offers an automated copy trading service, enabling traders to replicate the trades of successful traders. This feature is particularly beneficial for forex beginners in Kenya looking to learn from more experienced market participants.

-

JustMarkets Fees and Commissions Review

- We evaluate trading fees and commissions by considering both the spread on various account types and any additional costs that might affect your trading profitability. We analyze the spreads on major currency pairs during peak and off-peak hours, as these are often indicative of the broker's overall pricing strategy. We also compare these fees with industry standards and other brokers to ensure you're getting a fair deal.

Our analysis compared JustMarkets’ fees with its competitors, and we found that the broker offers competitive spreads, especially on the Pro and Raw Spread accounts. The absence of withdrawal fees on most accounts is a plus for Kenyan traders, as it helps to minimize non-trading costs.

- Standard Account: Ideal for beginners, this account typically features no commissions with spreads starting from 0.3 pips. It's a great entry point for those new to Forex trading, offering a balance between affordable costs and access to a wide range of instruments.

- Pro Account: Targeted at more experienced traders, the Pro account offers tighter spreads starting from 0.1 pips. The overall cost can be more beneficial for those trading larger volumes or preferring scalping strategies.

- Raw Spread Account: For those seeking the tightest spreads and don't mind paying a commission for each trade, the Raw Spread account can provide spreads from 0.0 pips. This account is best suited for high-volume traders and those utilizing automated trading systems.

JustMarkets Offers & Promotions

$30 No-Deposit Welcome Bonus

JustMarkets offers a $30 No-Deposit Welcome Bonus to Kenyan traders who register a retail account.

This is a great way for you to start trading without having to commit any funds upfront.

The critical advantage here is the risk-free environment it creates for beginners to experience real-market conditions.

To make the most of this bonus, you need to trade at least 5 standard lots and have a profit/loss of at least 60 pips within 30 days from when the bonus is received. If you meet these conditions, JustMarkets will transfer any profits from the welcome account to your main trading account

When evaluating these bonuses, we consider several factors:

- The terms and conditions associated with the bonuses, such as trading volume requirements and time limits.

- The potential benefits versus the risks, including the impact on your trading strategy and money management.

- The broker’s regulatory compliance and the safety of your funds.

JustMarkets is regulated by multiple entities, including the Cyprus Securities and Exchange Commission and the Financial Services Authority of Seychelles, which adds a layer of trustworthiness to their operations.

Our extensive testing and review of JustMarkets have shown that their bonuses can be beneficial, especially for new traders looking to start with a lower risk profile.

The No-Deposit Welcome Bonus is particularly attractive as it allows you to experience real-market conditions without an initial investment. However, it’s crucial to read the fine print and understand the requirements to benefit from these offers fully.

The 120% Deposit Bonus can also be a valuable offer, providing you with additional trading capital. Still, it’s important to trade responsibly and not to overextend yourself just because there’s a bonus involved.

JustMarkets Withdrawal Process Review

The withdrawal section at JustMarkets was easy to navigate, and I was presented with a variety of options to receive my funds, including M-Pesa, bank wire, credit/debit card transactions, and e-wallets.

I was impressed with the speed of the withdrawal process.

After submitting my request, it was processed by JustMarkets within a couple of hours, which is in line with the experiences of many users who praise the broker for its efficiency.

Another positive aspect was the absence of withdrawal fees charged by JustMarkets. This transparency in costs is a significant advantage, allowing me to withdraw my full amount without worrying about any deductions.

However, while my experience with JustMarket’s withdrawal was mostly positive, I did encounter a slight delay during one of my withdrawal requests.

It was a minor hiccup that required additional verification, which, although somewhat inconvenient, was resolved promptly after providing the necessary documentation.

When I faced the delay, I reached out to JustMarkets’ customer support. The response was not immediate, but once I was in contact with a representative, they were helpful and provided clear instructions on how to expedite my withdrawal request.