| 💰 Min Deposit | 1 USD |

| ⚖️ Max Leverage | 3000:1 |

| 📗 Regulated By | ASIC, CySEC, FCSA, FCS |

| 💳 Spread | From 0.5 Pips |

| 💻 Platforms | MT4, MT5 |

| 💹 Instruments | Crypto, Energies, Stock CFDs, Forex, Indices, Metals |

| 📅 Year Founded | 2009 |

| 🇰🇪 Mpesa Accepted | ✅ |

| 👤 Copy Trading | ❌ |

If you’ve been searching for a trusted forex broker to kickstart or elevate your trading journey, you might have come across FBS. Let’s unpack what they offer and see if they’re the right fit for our Kenyan trading community!

Whether you are a seasoned trader or just starting out, this FBS broker review will help you get a better understanding of what this broker has to offer. Our aim is to provide you with the information you need to make an informed decision about whether FBS Forex Broker is the right fit for you.

In this comprehensive review, we will be examining the FBS’s trading platforms, financial instruments, account types, fees, and more to give you a clear insight into what you can expect when trading with FBS. Additionally, we will also touch on the regulatory compliance and safety measures in place to ensure that your funds are protected.

FBS Broker Pros and Cons

Is FBS Legit in Kenya?

Our Verdict: FBS is a legitimate and reliable forex broker in Kenya. The company holds all necessary licenses to conduct financial activities and complies with key requirements of regulators like the Cyprus Securities and Exchange Commission (CySEC). Although FBS is not regulated by the Capital Markets Authority (CMA) in Kenya, it is regulated by multiple international bodies, ensuring adherence to specific standards set by these regulators. The broker is known for its dedicated customer support, available 24/7, ensuring that traders can efficiently manage their funds and enhance their overall trading experience.

- High leverage up to 1:3000

- Regulated in multiple jurisdictions

- Wide range of educational tools and resources

- FBS offers various bonuses and promotions to Kenyan traders

- Wide Range of Tradable Assets: FBS offers a variety of tradable assets including forex, indices, metals, and futures contracts

- FBS provides round-the-clock customer support, ensuring that traders can get assistance whenever they need it

- Not regulated by the Capital Markets Authority

One question that’s been making rounds recently is: “Can FBS be trusted?” It’s a question that merits a comprehensive answer, especially as many Kenyans are keen on exploring the world of forex trading.

First and foremost, it’s important to note that FBS is not regulated by the Capital Markets Authority (CMA) in Kenya. This lack of local oversight might be a concern for some, but it doesn’t tell the whole story.

FBS is regulated by multiple other international bodies, which means they do adhere to specific standards set by these regulators.

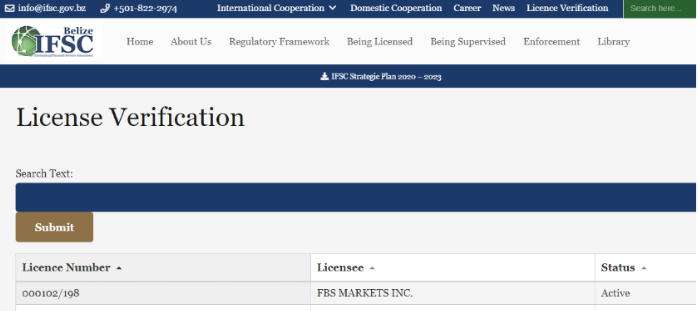

FBS has different branches around the world, and for traders in Kenya, the relevant entity is FBS Markets INC, regulated by the International Financial Services Commission (IFSC) in Belize. This distinction is essential because different regulators around the world have varying standards and requirements.

The IFSC, in comparison to some other global regulators, has less stringent regulatory requirements. This means while they do impose regulations to ensure broker credibility, they might not be as thorough or as strict as some of their counterparts in, say, Australia, the UK, or the US. For instance, the capital requirement (which is a measure to ensure brokers have enough funds to support their operations) set by IFSC is notably lower than what’s demanded by other well-known regulatory bodies.

Now, let’s delve into the IFSC’s approach to regulation. The IFSC’s role includes monitoring the activities of financial service providers to ensure that they operate within the laws and regulations of Belize. They also aim to protect consumers and promote Belize as a reputable international financial services center. The IFSC requires forex brokers to adhere to certain criteria, including maintaining sufficient capital, submitting regular financial reports, and implementing measures to prevent money laundering and fraud.

However, it’s crucial to understand that the IFSC’s regulation might not be as stringent as those in other major financial jurisdictions. While the IFSC does regulate, its main focus has been on promoting Belize as an international financial hub, which may lead to a different emphasis in regulatory oversight compared to other regulators.

So, what does this mean for forex traders in Kenya?

On one hand, FBS Markets INC’s regulation by the IFSC demonstrates some level of oversight and adherence to international standards. On the other hand, the absence of local regulation by the CMA means Kenyan traders might not have the same recourse in case of disputes as they would with a locally regulated broker.

In conclusion, whether or not to trust FBS comes down to individual risk tolerance, needs, and preferences. It’s advisable to thoroughly review FBS’s terms and conditions, understand the regulatory environment, and possibly consult with a financial expert to make an informed decision. While FBS has become a recognized name in the forex industry, it’s imperative to understand that trading always carries risks, and the regulatory landscape is a key aspect to consider.

FBS Deposit & Withdrawal Methods

FBS now accepts M-Pesa for deposits and withdrawals! ?? This is a game-changer for all of us in the Forex community here in Kenya.

Most of us use M-Pesa daily. It’s a platform we know and trust. With FBS accepting M-Pesa, the process of funding and withdrawing becomes seamless and hassle-free.

Transacting via M-Pesa also means lower fees compared to other international payment methods.

FBS’s integration with Mpesa truly reflects a thoughtful approach to Kenyan traders’ needs, making forex trading more accessible and hassle-free for all of us.

If you’ve been considering entering the trading arena, or you’re an experienced trader looking for a more convenient way to manage your funds, FBS with Mpesa might just be what you’ve been waiting for.

FBS Supported Trading Platforms

MetaTrader 4 (MT4): A classic favorite for many. MT4 is known for its intuitive interface, reliability, and a plethora of charting tools. Ideal for both novices and seasoned traders.

MetaTrader 5 (MT5): The next-gen platform with more timeframes, economic calendars integrated, and even a multi-threaded strategy tester. If you’re looking to level up your trading game, MT5 might be for you!

While many popular forex brokers offer MT4 and MT5 due to their global appeal, here’s where FBS shines:

- Customizability: FBS’s platforms come with added customization options, allowing you to tailor your trading environment.

- Educational Tools: FBS frequently integrates educational tools and resources directly within their platforms, making learning and trading a seamless experience.

- Competitive Spreads: While the platform is a crucial part of trading, FBS also ensures competitive spreads which can impact your trading outcomes.

Of course, the best platform always boils down to personal preference. Some traders might favor other platforms or specific broker-specific features.

We believe that an informed trader is a successful trader, and our aim is to provide you with all the information you need to make an informed decision.

Whether you’re looking to trade forex, commodities, or indices, this FBS broker review will give you a comprehensive understanding of what the broker has to offer. So, let’s dive in and take a closer look at FBS Forex Broker.

FBS offers a spectrum of trading assets, but the depth varies. While they might not be the ‘jack of all trades’, they certainly have niched down in areas like crypto. If you’re considering FBS or any other broker, always assess the assets offered in line with your trading goals and risk appetite.

? Forex: The heart and soul of the FBS platform. Here, you can trade major, minor, and exotic currency pairs. Depending on the pair, leverage can go as high as 1:3000. While higher leverage offers greater profit potential, it also multiplies the risk. Always remember, higher leverage can amplify both gains and losses!

? Metals: Trading metals like Gold and Silver is an option, but like all commodities, their markets can be volatile and influenced by global events.

? Stocks: FBS gives access to selected global company stocks. Leverage in stock trading may be lower compared to forex, reflecting the different risk profiles.

? Indices: If you’re looking at a broader market perspective, trading global indices is possible with FBS. However, understanding the underlying components and their performance is key.

? Commodities & Energies: Fancy trading oil or gas? FBS has got you covered. These are typically more volatile assets, influenced by global geopolitical events, and environmental, and economic factors.

? Cryptocurrencies: Here’s where FBS really stands out. Their extensive crypto offering is unmatched by many popular forex brokers. With the digital currency realm gaining traction, FBS seems keen to offer traders a piece of this future-forward market. While offering potential returns, the crypto market is known for its volatility. Tread carefully and be well-informed.

Special Conditions: Always check specific trading conditions for each asset. Some might have restricted trading hours or may incur charges if positions are held overnight.

| 💰 Min Deposit | 1 USD |

| ⚖️ Max Leverage | 3000:1 |

| 📗 Regulated By | ASIC, CySEC, FCSA, FCS |

| 💳 Spread | From 0.5 Pips |

| 💻 Platforms | MT4, MT5 |

| 💹 Instruments | Crypto, Energies, Stock CFDs, Forex, Indices, Metals |

| 📅 Year Founded | 2009 |

| 🇰🇪 Mpesa Accepted | ✅ |

| 👤 Copy Trading | ❌ |

How much is FBS Minimum Deposit?

The minimum deposit for FBS is as low as $1. Yes, you read that right! And for us Kenyans, the good news is that if you’re using M-Pesa for your transactions, you can make a deposit equivalent to that amount in Kshs. This incredibly low threshold makes it feasible for many to dip their toes into the world of forex trading without making a hefty initial investment.

However, as much as this low minimum deposit can be enticing, it’s vital to understand the implications.

While a $1 deposit lowers the barriers to entry, it also comes with certain constraints. For instance, with such a modest sum, you might not be able to open large positions or diversify your trades adequately. It’s a double-edged sword – it reduces your financial commitment, but it may also limit your trading capabilities and potential returns.

The FBS $1 minimum deposit is only ideal for beginners who wish to understand FBS’ platform’s dynamics and get a feel for the market without risking much. However, for those looking to make substantial gains or trade more aggressively, a more significant deposit would be advisable.

Does FBS Accept Mpesa?

One common question we’ve seen making rounds in our forex trading community is, “Does FBS accept Mpesa?” The straightforward answer is a resounding YES! But there’s more to it, and I believe we should explore this convenience a little further.

As for withdrawals, most traders have noted that once you initiate a withdrawal, the magic happens almost instantly! Your Mpesa balance starts smiling right away. However, it’s wise to anticipate potential delays – perhaps a few hours or at rare times, a day. This can be due to heavy trading traffic or the occasional Mpesa system hiccups.

Then there’s the matter of how much you can withdraw from FBS using Mpesa. The beauty of FBS’s arrangement with Mpesa is that you don’t have to wait to amass a fortune to access your money. The minimum withdrawal limit has been set at $10, ensuring that even those testing the waters with smaller amounts can comfortably retrieve their funds.

Can I Deposit on FBS Without Verification?

Yes. FBS will allow you to set up an account and even start your trading journey without immediate verification. You will be able to make an initial deposit without having completed the verification process. However, here’s the catch and why it’s crucial to understand the full picture.

While the initial deposit might seem hassle-free, when it comes time to withdraw your funds or access certain features and functionalities, that’s when verification becomes pivotal. Without a verified account, you may find yourself facing hurdles in accessing your funds or even certain trading tools and resources.

At its core, verification is an integral part of a forex broker’s “Know Your Customer” (KYC) process. It’s a global standard to prevent fraud, money laundering, and other illicit activities. Most regulated forex brokers, including FBS, adhere to these standards to maintain a secure trading environment for all its users.

While FBS might allow some initial leniency, verification is not just a ‘paperwork formality.’ It’s a protective shield, ensuring your funds and identities remain uncompromised. So, while you may start trading on FBS without immediate verification, remember that it’s an anchor step to ensure your journey is smooth and secure.

Does FBS Have Volatility 75 Index?

Yes, FBS does offer the Volatility 75 Index, and it’s a fascinating instrument to explore. But what exactly is it?

The Volatility 75 Index, or VIX 75, gauges the volatility of the US500 – which reflects the performance of the S&P500 stock index. Essentially, it’s an insight into the market’s projection of volatility over the ensuing 30 days.

Picture it as a thermometer gauging the market’s temperature, especially its moods of fear and anticipation.

Occasionally, you might hear the VIX 75 referred to by its other monikers like the “Fear Gauge” or “Fear Index”. These designations arise from its ability to encapsulate market sentiment. A heightened VIX 75 signifies a market brimming with uncertainty and apprehension.

Conversely, a subdued VIX 75 indicates a more content and confident market.

Now, a crucial reflection: Is the Volatility 75 a good index to trade?

The answer depends on your trading style, risk tolerance, and experience. The VIX 75’s high volatility means that it can offer significant profit opportunities, but it also comes with substantial risks. It’s an instrument that requires careful understanding and consideration.

Professional forex traders often lean into it for its potential diversification, particularly when other markets are stagnant. Yet, its nuanced character may not resonate with everyone, particularly novices or those with a cautious risk appetite

FBS is a forex broker that was founded in 2009 and is based in Belize. The broker offers trading in a wide range of financial instruments, including forex, metals, indices, and cryptocurrencies. FBS is regulated by the International Financial Services Commission (IFSC) of Belize.

FBS Trading Platforms

FBS offers two trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are available for desktop, web, and mobile devices. MT4 is the more popular platform and is known for its user-friendly interface and advanced charting tools. MT5 is a newer platform that offers more advanced features, such as the ability to trade multiple asset classes from a single account.

FBS Account Types

FBS offers several account types to suit the needs of different traders. The account types are as follows:

- Cent Account: This account is designed for beginners and allows traders to start trading with a small deposit of just $1. The account offers low spreads and leverage of up to 1:1000.

- Micro Account: This account is similar to the Cent Account but requires a minimum deposit of $5. The account offers low spreads and leverage of up to 1:3000.

- Standard Account: This account is designed for more experienced traders and requires a minimum deposit of $100. The account offers low spreads and leverage of up to 1:3000.

- Zero Spread Account: This account is designed for scalpers and requires a minimum deposit of $500. The account offers zero spreads and leverage of up to 1:3000.

- ECN Account: This account is designed for professional traders and requires a minimum deposit of $1000. The account offers low spreads and leverage of up to 1:500.

FBS Payment Methods Supported

The payment methods supported by FBS include bank wire transfer, credit/debit cards, electronic payment systems, and mobile payment systems like M-Pesa.

- Bank Wire Transfer: This is a traditional method of payment where clients can transfer funds from their bank account to FBS’s bank account. This method is secure and reliable, but it may take a few days for the funds to be credited to the client’s trading account.

- Credit/Debit Cards: FBS accepts payments made through Visa and Mastercard credit/debit cards. This method is fast and convenient, and the funds are credited to the client’s trading account instantly. However, some banks may charge additional fees for international transactions.

- Electronic Payment Systems: FBS accepts payments made through electronic payment systems like Skrill, Neteller, Perfect Money, and WebMoney. These methods are fast and convenient, and the funds are credited to the client’s trading account instantly. However, some electronic payment systems may charge additional fees for transactions.

- Mobile Payment Systems: FBS also accepts payments made through mobile payment systems like M-Pesa. M-Pesa is a mobile money transfer service that is popular in Kenya and other African countries. Clients can transfer funds from their M-Pesa account to FBS’s M-Pesa account, and the funds are credited to the client’s trading account instantly. This method is fast, convenient, and secure, and it is ideal for clients who do not have access to traditional banking services.

Customer Support

FBS offers customer support 24/7 via live chat, email, and phone. The broker also has a comprehensive FAQ section on its website that covers a wide range of topics.

Education and Research

FBS offers a range of educational resources for traders, including webinars, video tutorials, and a forex guide. The broker also provides daily market analysis and economic news updates to help traders stay informed about market developments.

Conclusion

FBS is a reputable forex broker that offers a wide range of trading instruments and account types to suit the needs of different traders. The broker’s customer support is excellent, and its educational resources are comprehensive. However, the broker’s regulation by the IFSC of Belize may be a concern for some traders, as this regulator is not as well-respected as other regulatory bodies.

✅ Regulation: Before anything else, safety first! FBS operates within international standards and, as always, make sure to check if they comply with our very own Capital Markets Authority (CMA) guidelines.

? User Reviews: Word of mouth is powerful. Many Kenyan traders have shared positive experiences with FBS regarding their trading conditions, responsiveness, and support. But as with everything, do your diligence and seek out recent reviews.

?️ Top-Notch Platforms: FBS offers the widely-used MetaTrader 4 and MetaTrader 5 platforms. If you’re familiar with forex, you’ll know these are industry staples! Whether you’re a newbie or a pro, these platforms cater to all.

? Affordable Trading: FBS boasts competitive spreads and fees, a vital factor to consider for long-term trading success. Every shilling counts!

? Convenient Transfers: Good news for us! FBS provides multiple deposit & withdrawal methods suitable for Kenyans. And yes, they’ve incorporated local payment solutions like M-Pesa!

?? Education on Point: If you’re just starting out, FBS provides a wealth of educational resources – from webinars to tutorials. Continuous learning is the key in forex!

? Customer Support: From my research, FBS has an active and supportive team. As traders, we know the value of timely assistance.