Navigating the forex market successfully requires more than just understanding currency pairs and technical analysis; it’s also about timing.

Knowing when to trade, based on the forex trading sessions around the world, can significantly impact your trading success.

This guide is tailored to demystify the concept of global forex trading sessions and adapt it to Kenyan time, providing you with the knowledge to capitalize on the most lucrative hours of the market.

Join the Copy Trading Revolution

Copy the trades of successful Forex traders and profit from their strategies.

*Forex and CFDs Trading involves high risk. T&Cs apply.

The article will break down the major forex trading sessions, convert them into Kenyan time, and highlight strategies to leverage these hours effectively. And don’t forget to read our comprehensive guide about the best time to trade forex in Kenya.

The Forex Trading Sessions in Kenyan Time

The forex market operates 24 hours a day during the business week. This round-the-clock action is due to the global demand for currency trading and the overlapping time zones across major financial centers.

The market kicks off each week in Sydney, Australia, moves across to Tokyo, Japan, then to London, England, and finally closes the loop in New York, USA. This continuous cycle ensures that at any given hour, somewhere in the world, currencies are being traded.

We created a tool to help you easily convert the different forex sessions into Kenyan time:

[forex_sessions_eat]

The Major Forex Sessions

There are four major forex sessions, each with its unique characteristics:

- Sydney Session: As the initiator of the trading day, the Sydney market sets the tone, offering early insights into currency trends. It’s where the forex day officially begins.

- Tokyo Session: Often representing Asia’s financial might, the Tokyo session adds volume and movement to the market, with significant impacts on Asian-Pacific currency pairs.

- London Session: The London session is where the volume spikes. It’s the forex capital of the world, with the largest share of global forex trading. The volatility and liquidity during this session mean more opportunities (and risks) for traders.

- New York Session: The last major market to open, New York, brings in the American financial power, influencing particularly the USD pairs. The overlap with London creates one of the most exciting trading periods.

Understanding these sessions is crucial for you as a Kenyan trader because it helps you identify the best times to trade.

Not all hours of the day are equal in the forex market. Some hours offer high liquidity and volatility, making them ideal for capturing significant moves.

1. Sydney Session In Kenyan Time

The Sydney session is the first to open each trading day. It’s named after Sydney, Australia, where trading begins as the city is the financial hub of the Asia-Pacific region.

However, it can still offer valuable trading opportunities, especially for currency pairs involving the Australian dollar. This session is particularly important because it marks the start of the forex market activity after the weekend pause.

- Opening and Closing Times in EAT: The Sydney session opens at 11:00 PM and closes at 8:00 AM Kenyan time. This timing places the session largely outside the typical Kenyan workday. The timeframe only suits early birds or night owls looking to catch movements in the AUD/USD pair.

- Overlap with Other Sessions: The Sydney Session has a brief overlap with the Tokyo session (from 3 AM to 8 AM EAT), which can increase liquidity and volatility, especially in currency pairs involving the Australian Dollar (AUD) and the Japanese Yen (JPY).

- Range Trading: The Sydney Session is known for its lower volatility compared to the London or New York sessions. This makes it suitable for range trading strategies, where you identify stable high and low points to place trades.

The Sydney session is crucial because it kickstarts the Forex trading day. It’s during this session that traders get the first glimpse of the market’s mood based on events that occurred during the off-market hours.

While the Sydney session might not be as volatile as the London or New York sessions, it’s an excellent time to trade currency pairs that involve the Australian Dollar (AUD), such as:

- AUD/CAD

- AUD/CHF

- AUD/JPY

- AUD/NZD

Tokyo Session in Kenyan Time

Often referred to as the Asian session, the Tokyo Session is the second major trading session of the day, following the Sydney Session. The session operates from 3 AM to 12 PM East African Time (EAT); a timing that offers unique opportunities and challenges for forex traders in Kenya.

Here’s a breakdown:

- Tokyo Open: 3 AM EAT

- Tokyo Close: 12 PM EAT

Trading during the Tokyo session from Kenya means you’re at the forefront of the day’s market movements.

Click here to learn more about the Asian Session Forex Time in Kenya.

- Market Volatility: The session is generally less volatile compared to the London or New York sessions, making it suitable for traders who prefer stable market conditions.

- Currency Pairs: The Tokyo session sees significant trading in JPY (Japanese Yen) pairs, such as USD/JPY, EUR/JPY, and GBP/JPY. If these pairs are in your trading portfolio, you should pay attention to this session.

- Opportunity to Capitalize on Asian Market Releases: Economic announcements from Japan, Australia, and China during this session can create profitable trading opportunities. Being aware and ready to act on these releases can set the tone for your trading day.

- Strategic Positioning for Later Sessions: By engaging in the Tokyo session, you’re not just taking advantage of immediate opportunities. You’re also setting the stage for potential trades during the London session overlap, preparing strategies based on the trends established in the Asian markets.

For you, the Tokyo session presents a quiet yet promising time to engage in forex trading. Its hours might seem daunting at first glance, but they offer a serene trading environment before the European sessions kick in.

Here’s why these hours are advantageous for you:

- Low Volatility, High Precision: The early part of the Tokyo session often experiences lower volatility compared to the London and New York sessions. This environment allows you to make precise trades, especially if you’re focusing on Asian currencies or looking for less aggressive market movements.

- Opportunity for Night Owls and Early Risers: If you’re a night owl, the start of the Tokyo session aligns perfectly with your late-night activities. Conversely, early risers in Kenya can capitalize on the session’s closing hours, positioning trades based on the Asian market’s day-end trends.

London Session Forex Time in Kenya

The London Session typically starts at 8:00 AM GMT and ends at 4:00 PM GMT. But you’re in Kenya, right? So, what does this mean for you?

Well, Kenya operates on East Africa Time (EAT), which is 3 hours ahead of GMT. Therefore, in Kenya, the London Session starts at 11:00 AM and ends at 7:00 PM EAT. These hours are incredibly convenient, as they span most of the Kenyan workday, allowing traders to engage with the market without having to alter their daily routines drastically.

Also known as the European trading session, is one of the most active forex trading sessions.

See: London Session Forex Time in Kenya

According to a 2019 report by the Bank for International Settlements, the UK accounted for 43.1% of the global forex market turnover, making the London Session a hotspot for forex trading.

The London forex session is the powerhouse of the forex market, a time when traders around the world are keenly focused on the unfolding market dynamics.

The session is characterized by the rapid movement of currency pairs, especially those involving:

- British Pound (GBP)

- Euro (EUR)

- US Dollar (USD).

Popular technical analysis strategies like the London Breakout Strategy can yield excellent results if utilized properly during this trading period.

Key Takeaway: For Kenyan traders, the London session offers a window into the heart of the forex market’s daily rhythm. It’s a time when your trading skills can truly shine, provided you’re prepared to take advantage of the opportunities it presents.

Related Article: Best Time to Trade EURUSD in Kenya

4. New York Session Time in Kenya

The New York session typically runs from 8:00 AM to 5:00 PM Eastern Standard Time (EST), which translates to 4:00 PM to 1:00 AM in Kenya. This time frame places the bulk of trading activity within a convenient window for Kenyan traders, especially those balancing trading with other commitments.

- According to a study published in the Journal of International Money and Finance, the New York session is one of the most volatile trading periods. This is because it overlaps with the London session, creating a high volume of trades and potentially more opportunities for you to profit.

- The overlap with the London session, which occurs from the start of the New York session until 6:00 PM Kenyan time, is a period of heightened liquidity and volatility. This overlap is a prime time for trading major currency pairs, especially those involving the US dollar (USD), Euro (EUR), and British Pound (GBP).

But remember, with great opportunity comes great responsibility. The increased volatility during the New York session can also mean increased risk.

Additionally, the fast-paced nature of the New York session can be emotionally taxing. Stay calm and objective, avoiding impulsive decisions based on fear or greed.

Employ robust risk management strategies, such as setting stop-loss orders and only trade with money you can afford to lose.

Related Article: New York Session Time in Kenya

The New York session is heavily influenced by a plethora of economic indicators and market drivers, including:

- Non-farm payrolls: This closely watched employment report, released on the first Friday of every month, provides insights into the health of the U.S. labor market and can significantly impact the value of the U.S. dollar.

- Consumer Price Index (CPI): This report measures the changes in the prices of goods and services purchased by consumers, serving as a key indicator of inflation.

- Retail sales: This report gauges consumer spending, a critical component of the U.S. economy.

- Manufacturing and industrial production: These reports shed light on the health of the U.S. manufacturing sector, a major driver of economic growth.

- Federal Reserve (Fed) announcements: The Fed’s monetary policy decisions, particularly interest rate adjustments, can have a profound impact on the forex market.

Key Takeaway: The timing of the New York session offers Kenyan traders a strategic advantage. The late afternoon to midnight window allows individuals to participate in the market after regular work hours, making Forex trading a viable side hustle or a post-work activity.

The 24-Hour Forex Market

Imagine a market that never sleeps, a continuous exchange of currencies happening around the clock—this is the forex market.

Unlike stock markets, which have specific opening and closing times, the forex market operates 24 hours a day during the weekdays.

This round-the-clock action is possible thanks to the global network of banks and financial institutions spread across different time zones.

Why does this matter to you?

Because it means opportunities are always on the horizon, no matter the hour. Whether you’re an early bird catching the first light or a night owl under the moon’s gaze, the forex market has a place for you.

Major Forex Markets: The Four Pillars

The forex market’s heartbeat is regulated by four major trading sessions, each associated with major financial centers across the world:

- Sydney Session: When the Pacific bells ring, the Sydney market opens, marking the start of the forex trading day. It’s the quiet giant, less volatile but equally important.

- Tokyo Session: As the sun rises in Tokyo, Asia gets into full swing. This session is known for its yen movements, a beacon for those interested in Asian currencies.

- London Session: Enter the world’s forex capital. The London session is where the action intensifies, boasting the highest trading volume and offering significant opportunities for traders.

- New York Session: When New York wakes, dollar movements take center stage. This session is crucial for those trading USD pairs, with overlaps with London creating peak trading conditions.

Why The Forex Trading Sessions in Kenyan Time Matter

Each session has its own personality, characterized by specific market behaviors and liquidity patterns. Understanding these can help you align your trading strategy with the most favorable times.

For instance, if you’re aiming for high volatility, the London-New York session overlap might be your golden hour.

On the other hand, if you prefer a more measured approach, the Sydney or Tokyo sessions could offer the stability you seek.

Being aware of these sessions means you can better plan your trading day.

As a Kenyan trader, you have the unique advantage of being geographically placed in a way that allows you to catch the late hours of the Asian markets and the opening of the European and American markets without sacrificing your sleep schedule.

Tools and Resources for Monitoring Forex Sessions in Kenya

Let’s explore some essential tools and resources that will keep you informed and ready to take on the forex market with confidence.

Economic Calendars

An economic calendar is a trader’s best friend. It lists all upcoming economic events, including interest rate decisions, employment reports, and GDP data, with their expected impact on the markets.

Keeping an eye on these events can help you anticipate market movements and adjust your trading strategies accordingly.

- Investing.com Economic Calendar: Offers a comprehensive view of global economic events, customizable to show the data relevant to your trading interests.

- Forex Factory Economic Calendar: Renowned for its user-friendly interface and detailed explanations of how each event may affect different currency pairs

Forex Market Hours Tools

Understanding when different forex markets open and close in Kenyan time is crucial for planning your trading day.

Forex market hours tools allow you to track the opening and closing times of major markets around the globe, helping you pinpoint the best times to trade.

- TradingView: Provides a detailed forex market hours chart that reflects the current status (open or closed) of major markets. It’s integrated with real-time charts and analysis, making it a valuable tool for planning your trades.

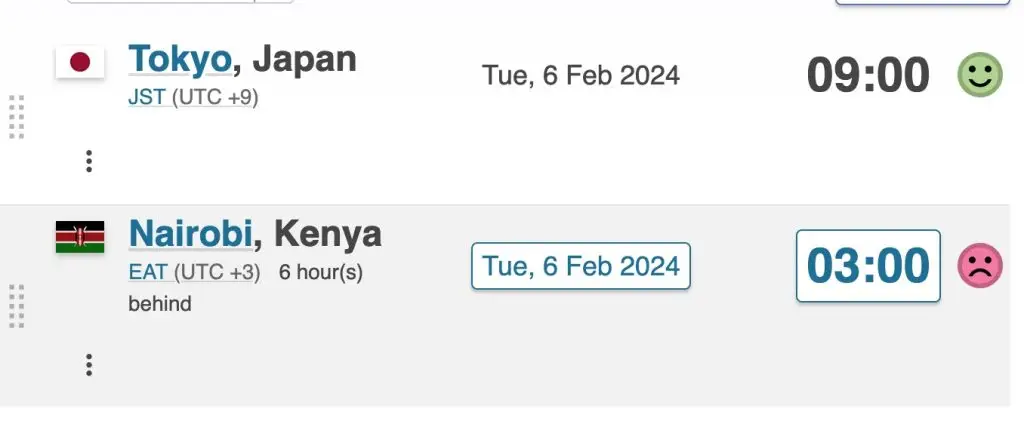

- WorldTimeBuddy: A straightforward tool for comparing time zones. It’s especially handy for quickly checking how market hours align with Kenyan time, ensuring you never miss out on prime trading opportunities.

Real-Time News and Analysis

Staying updated with real-time news and analysis is critical for forex trading.

Market sentiments can change rapidly with the release of new economic data or geopolitical events, affecting currency values.

- Bloomberg: Offers up-to-the-minute financial news, market data, and analysis, providing you with insights into how current events are shaping the forex market.

- Reuters: Another excellent source for financial news and global market trends. Its forex news section is particularly useful for understanding currency movements and market drivers.

Forex Trading Platforms with Built-In Tools

Many forex trading platforms offer built-in tools for market analysis, including economic calendars, real-time news feeds, and market hours indicators.

Choosing a platform that provides these tools can streamline your trading process.

- MetaTrader 4/5: Widely used by forex traders, these platforms offer advanced charting tools, automated trading robots (Expert Advisors), and built-in market analysis features.

- cTrader: Known for its user-friendly interface, cTrader offers advanced technical analysis tools, a comprehensive economic calendar, and detailed market hours overview.

Customizable Alerts

Setting up customizable alerts can help you stay informed of market changes without having to constantly monitor the charts.

Most trading platforms and financial news websites allow you to set alerts for specific currency pairs, economic announcements, or price levels.

- TradingView Alerts: You can set up alerts for price levels, technical indicators, or economic events, receiving notifications via email, SMS, or push notifications.

- Forex Alarm: An app specifically designed to send alerts before forex market hours or news releases, ensuring you’re always prepared for volatility spikes.

What is the Best Time to Trade Forex in Kenya?

The London-New York Overlap is the best time to trade forex in Kenya. As a Kenyan trader, these hours can work in your favor in more ways than one. For instance, the overlap of the London and New York sessions (from around 6:00 PM to 10:00 PM Kenyan time) coincides with the evening hours in Kenya. This is a time when you might be winding down from your day’s activities, giving you the perfect opportunity to focus on your trades without distractions.

When Does the London Session Start in Kenya?

The London session starts at 11:00 AM and concludes at 7:00 PM Kenyan time. Kenya is situated in the East Africa Time Zone (EAT), which is 3 hours ahead of Greenwich Mean Time (GMT+3).

The timing of the London session is particularly favorable for you if you’re trading from Kenya.

It starts in the late morning and stretches into the early evening, allowing both early birds and those who prefer to start their day a bit later to find an optimal time to trade.

This schedule accommodates various lifestyles and commitments, whether you’re trading full-time or fitting forex trading around other responsibilities.

When Does Asian Session Start in Kenya?

The Asian session starts at 3:00 AM and extends until 12:00 PM Kenyan time.

The timing of the Asian session is particularly advantageous for early risers or those who prefer trading before embarking on their day’s usual commitments.

It provides a window to engage with markets that are less volatile compared to the New York or London sessions but still offer significant opportunities, especially for currency pairs involving Asian currencies like the Japanese Yen (JPY).

However, the quieter nature of the Asian session can be a double-edged sword; while sudden spikes in volatility are less common, making it a safer playground for beginners or cautious traders, it also requires a keen eye to capture the more subtle movements in currency pairs.

When Does the Forex Market Open in Kenya?

The forex market kicks off for the week with the Sydney session at 1:00 AM Kenyan time (Sunday). This is followed by the Tokyo session starting at 3:00 AM EAT, then the London session at 11:00 AM EAT, and finally, the New York session at 4:00 PM EAT.