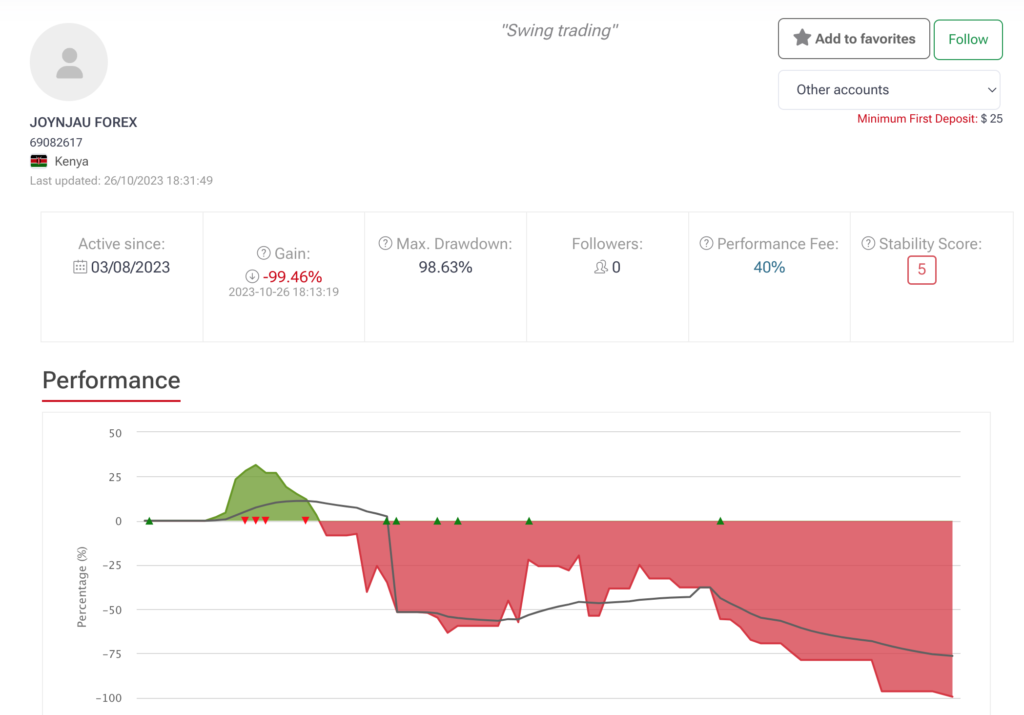

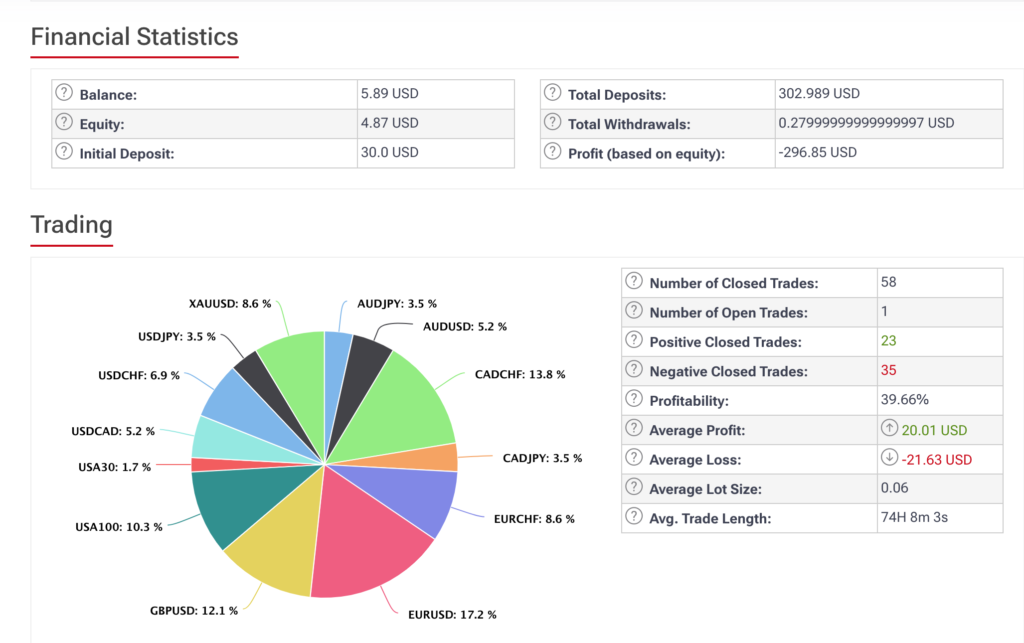

The questions surrounding Joyce Wanjiru, better known as Madam Forex, are multiplying as new reports surface that her copy trading accounts at HFM are not turning a profit. Massive drawdowns leading to margin calls have intensified the scrutiny on her trading activities.

It’s now emerging that Madam Forex’s primary source of income is actually selling fake forex signals on Telegram rather than trading itself.

She charges exorbitant fees for these false signals, capitalizing on her self-proclaimed reputation as a professional forex trader in Kenya. Unsuspecting traders, many of whom are new to the world of forex, end up purchasing these worthless signals only to find their accounts depleted.

Join the Copy Trading Revolution

Copy the trades of successful Forex traders and profit from their strategies.

*Forex and CFDs Trading involves high risk. T&Cs apply.

“I thought I was investing in a sure thing. Madam Forex had a lot of Telegram followers, and her marketing made her seem like an expert,” says Jane Muchiri, one of the victims of this scam. “But now, I’ve lost a significant portion of my savings and feel utterly betrayed.”

In an industry where performance is everything, Madam Forex’s failure to turn a profit in two of her copy trading accounts at HFM is alarming. Followers who automatically replicate her trades are increasingly worried as they witness significant losses and frequent margin calls.

Madam Forex's Copy Trading Fail at HFM

During the course of the year (2023) Madam Forex opened two HFM Strategy Provider accounts, both of which received the dreaded margin call in less than 2 months. This seriously taints her credibility as someone who claims to provide profitable forex trading signals on Telegram.

Many traders who blindly followed Madam Forex’s copy trading signals are now facing the harsh reality of substantial financial losses.

Copy trading accounts allow traders to automatically replicate the positions of a more experienced trader. Madam Forex had promoted her copy trading services as a foolproof way to profit from forex trading, attracting a large following of inexperienced traders. Shockingly, both accounts have been blown in less than two months, leaving her followers with significant losses and zero gains.

In her defense, she claims that she’s more proficient with trading synthetic indices as offered in Deriv.

The Red Flags in Madam Forex's Trading Strategy

The case of Joyce Wanjiru Njau, better known as Madam Forex, reveals glaring red flags that traders could have spotted early on. One of the most concerning aspects is her approach to trading, which includes trading any currency pair and any asset, even going as far as trading synthetic indices at Deriv, with zero specialization.

Lack of Specialization Indicates Lack of Expertise

In any financial market, but especially in something as complex as forex, specialization is key. Traders who focus on specific currency pairs or assets generally do so because they have developed a nuanced understanding of those markets.

Madam Forex's lack of focus should have been a red flag. Trading everything from major currency pairs to synthetic indices suggests a lack of in-depth knowledge in any single area, increasing the risk of poor trades.

A One-Size-Fits-All Approach Doesn't Work

Forex trading is a complex activity that demands a tailored approach. A strategy that works for trading EUR/USD is not necessarily going to work for a synthetic index at Deriv. The fact that Madam Forex purported to have a one-size-fits-all strategy for trading such disparate assets should have raised concerns about the effectiveness and reliability of her trading signals.

The Illusion of Diversification

While it may appear that trading a variety of assets and pairs is a form of diversification, it's not the same as having a well-thought-out diversification strategy. Effective diversification aims to minimize risk by allocating investments across various financial instruments, industries, or other categories.

Madam Forex's approach doesn't appear to follow any logical diversification strategy and instead seems more like a scattergun approach, which is often a recipe for disaster.

Over-Promising and Under-Delivering

One of the first signs of concern should have been any instance of Madam Forex over-promising on her Telegram forex signals. Making grandiose claims about guaranteed profits or high success rates without the verified performance data to back them up should always be considered a red flag.

Lack of Transparency

Any reputable forex signal provider should be willing to offer comprehensive performance records to prospective subscribers. Madam Forex’s reluctance or failure to provide verified trading results should have been a warning sign. Transparency is essential in establishing trust and credibility, and its absence is often a sign of fraudulent activities.

Absence of Risk Management

Risk management is a cornerstone of successful trading, and any provider who disregards this fundamental principle should be approached with caution. Madam Forex's signals did not include stop-loss orders or other risk management tools into her forex signals. This is a glaring omission that should not have been ignored by her subscribers.

Protecting Yourself from Forex Signal Scams

With the recent revelation about Madam Forex scamming unsuspecting forex traders in Kenya, it’s more important than ever to know how to protect yourself. Here’s how to avoid falling victim to forex signal scams.

1. Do Your Own Research

Before purchasing any forex signals, always conduct thorough research. Look for reviews and testimonials, preferably from sources you trust. If there’s an overwhelming number of negative reviews, consider it a red flag.

2. Verify Track Record

A legitimate forex signal provider should have a verifiable track record. If they’re unwilling to share past performance data, proceed with caution. Transparency is key in this industry.

3. Ask for a Trial Period

Many reputable forex signal providers offer a trial period for their services. Use this time to evaluate the quality of the signals and whether they align with your trading strategy.

4. Consult Financial Advisors

If you’re new to forex trading, consider consulting a financial advisor who has experience in the field. They can guide you on how to make prudent decisions, including whether or not to use a forex signal service.

5. Know the Red Flags

Be cautious of providers making promises that sound too good to be true, like guaranteed profits. Forex trading is inherently risky, and no one can guarantee outcomes.

6. Monitor Results

After you’ve chosen a signal provider, continuously monitor the results. If you notice a consistent pattern of losses, discontinue the service and report the provider if necessary.

7. Stay Educated

The best defense against forex scams is to be educated. Understand how forex trading works, familiarize yourself with common scams, and stay updated on industry news.

In conclusion, while forex trading offers great opportunities, it also comes with risks. By taking these precautions, you’re better equipped to protect yourself against scams. Always remember, if it sounds too good to be true, it probably is.