Join the Elite Trader’s Club with Our Proven Forex Trading Course

Are you tired of constantly trying to figure out the unpredictable world of forex trading on your own? Are you ready to take your trading skills to the next level and start seeing real results? Our forex trading course is here to help you do just that.

Are you ready to take your trading skills to the next level and start seeing real results? Our 5-day forex trading course is here to help you do just that.

Our course is designed to provide a comprehensive education in forex trading, covering everything from the basics of currency markets to advanced trading strategies.

Over the course of five days, you’ll receive two hours of one-on-one instruction each day, allowing us to tailor the lessons to your individual level of experience and trading goals.

Opportunity to learn from real-time market analysis and trade examples

Exposure to advanced trading concepts and techniques

Regular updates and additional content to ensure that your knowledge stays up-to-date

Discounts on other trading-related products and services

How to Start Online Forex Trading in Kenya

The Ultimate Beginners Guide to Making Money with Forex in Kenya

Learning to become a successful forex trader in Kenya is a difficult goal to achieve.

Like any other profession, it will take time to learn the basics of forex trading and even longer to successfully apply the different trading methodologies to the live market.

Kenya Forex Firm was created as a practical, no-nonsense forex education resource to help beginner forex traders in Kenya achieve their goal of financial success.

Our approach to forex trading education is different in that we teach straightforward, precise forex trading strategies that are nearly always applicable to the market.

Our goal is to create a comprehensive forex education center to help new traders get their feet wet. Feel free to browse the various sections of our forex resource center.

Why Trade Online Forex In Kenya?

Is Forex trading really that profitable?

Everybody seems to be talking about this spectacular investment opportunity. There was even a guy who flew all the way from London to Nairobi to hold a seminar for beginner forex traders in Kenya!

But is forex trading really that profitable? Is it worth it?

Yes. It is…. Let me explain.

Online forex trading is easily one of the best ways to make money in your own time from the comfort of your own home. The forex market is the largest marketplace in the world, with more than $6.5 billion dollars worth of trades being placed every day.

And it is totally legal to trade forex in Kenya. You do not need any special licenses or government authorization if you’re just trading for your own profit. However, forex brokers and money managers are supposed to get a license from the Capital Markets Authority (CMA).

Currently, there are 3 CMA licensed forex brokers in Kenya and one money management company called MansaX.

The 3 CMA regulated forex brokers include:

- FxPesa by EGM Securities

- ScopeMarkets Kenya, and

- Pepperstone Kenya

There are many advantages to trading forex for profit, but perhaps the largest benefit is the ability to continue making profits no matter whether the market is going up or down.

Regardless of how deceptively simple forex trading looks, it is important that newer traders take time to invest in adequate education about the market and forex specifically.

The forex market is incredible, and if you have not yet made up your mind about investing in forex trading, there was never a better time than this.

Before I show you how you can start investing in online forex trading, allow me to first show you why this is the best place to put your money. Investing in online forex trading is the real definition of having your money work for you.

- Largest Financial Market: For starters, the forex market is the largest financial market in the world with a daily turnover of around $4 trillion. With such a vast amount of money traded daily, it becomes increasingly easy for you to make a tidy sum of profit each trading day.

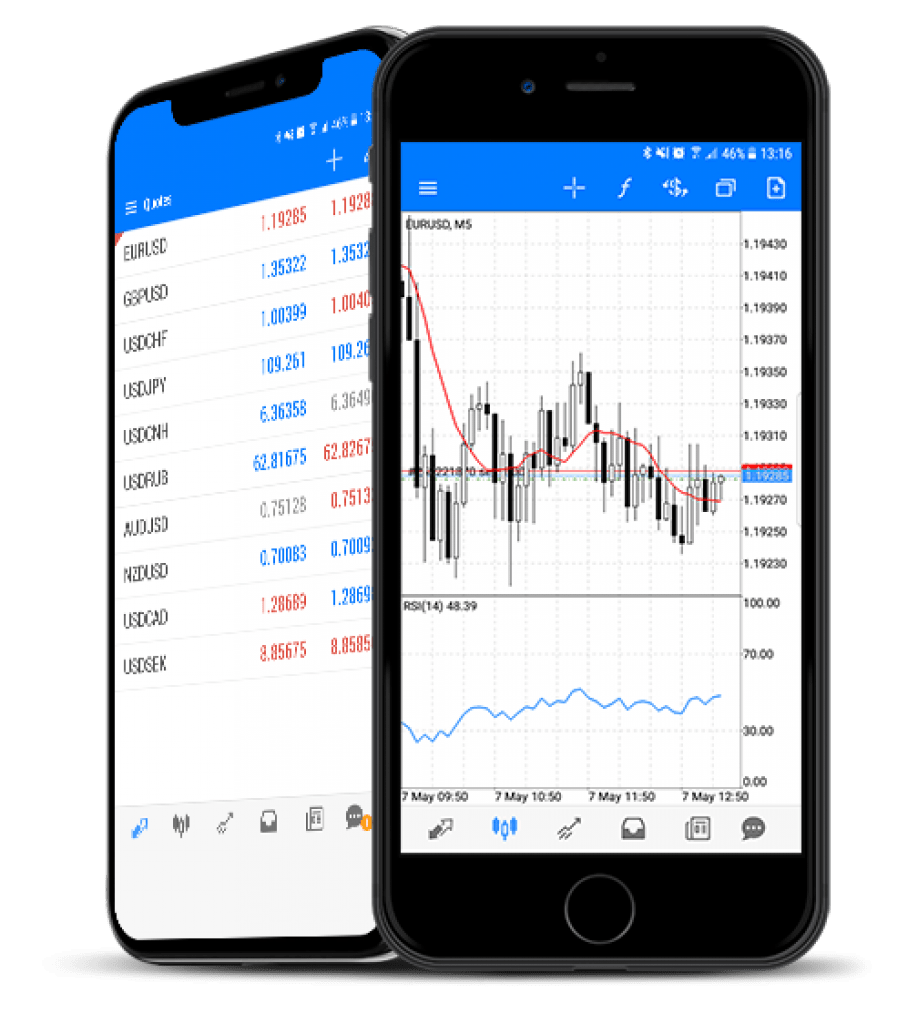

- No middle men: If you’ve tried to invest in stocks (especially on the Nairobi Stock Exchange), you know how cumbersome the whole process of opening a CDS account, buying and selling shares can be. You’ve to make a call to your broker every time you want to buy or sell stocks. Online forex trading does not have this cumbersome process. You open an account with a reputable forex broker, deposit funds into the account, and you are on your way to profs. You can do all this on your smartphone or laptop, without ever leaving your house.

- Low startup capital: You can start trading forex in Kenya with as low as 1,000 Ksh! Yes, that’s not an exaggeration. Some forex brokers such as FxPesa and XM Forex will even give you a little bonus on your account. With such a low initial capital, there is no reason why you shouldn’t invest in the forex market.

- Leverage: Remember my explanation of how you can start trading forex with ridiculously low amounts of money? That is because of leverage; an exclusive characteristic of the forex market that allows you to control huge amounts of money with very little deposited capital. Some brokers offer leverage as high as 1:1000 meaning that with a deposit of 100 USD, you can control trades worth 100,000 USD!

There are many more incredible reasons why you should invest in forex. Did you, for instance, know that there are more free stuff to help you become a better forex trader? An example is this website and my 7-day free crash course on forex investing. Plus all forex brokers available online offer demo accounts that you can use to practice what you’ve been reading.

Next, I’ll be showing you how you can start trading online forex. See you in the next chapter.

Chapter 1

What is Forex Trading and How Does it Work?

Investing in currencies is similar to investing in stocks. When you purchase stock in a company, you are buying ownership in the value of the company. When you trade currency, you are simply investing in the economy of a certain country.

The most commonly traded currencies in the Forex markets are those of countries with stable governments, stable banks and low inflation. Most transactions each day are in the major currencies including the United States Dollar, the Japanese Yen, the Euro, UK Sterling, the Swiss Franc and the Canadian and Australian dollars.

The currency exchange rates for these and all other currencies are driven by a number of factors and require investors to be armed with a good deal of insight, up to the minute info and an aptitude for crystal-ball gazing.

While variables such as the global economy and political climate exert an influence, the main factors tend to be interest rates, inflation and political stability.

Money markets are jumpy and this is why governments often trade in the Forex market in order to affect the value of their currencies.

By buying up currency or alternatively upping the supply of their currency – in similar fashion to oil producers – governments can raise or lower the price of their currency. This kind of intervention tends to be a short-lived quick fix approach due to the sheer scale of the Forex market. Highly volatile shifts in values simply cannot be sustained in the long term.

Online forex trading is done through what is called a margin account. A margin account is set up through forex brokers who will place your trade on the interbank network and oversees your account.

A margin account is like a bond account that works similar to a savings account. These margin accounts ensure that you get paid when you exit a profitable trade and ensure the banks and other traders that you can pay when you lose on a trade. Brokers also monitor your account equity and insure that you do not risk more on a trade than you have in an account.

Types of Forex Accounts

There are 3 different types of forex accounts offered by forex brokers when setting up your forex trading account.

- Forex Micro Account

- Forex Mini Account

- Forex Standard Account

Each account has different funding requirements and leverage. Each also produces different risk reward ratios. Fore more information on the types of accounts, please click on the links above.

Lots and Leverage

Currency trading is done buy purchasing lots through your margin account. Trading 1 lot is sort of like trading 1 share of stock in a company other than in forex a lot has a fixed amount of money that it is worth at the moment you buy or sell it.

A lot is a pre determined amount of currency that a bank allows you to trade based on your margin account. For example, if you are trading (1) lot on a standard account, you are typically trading 100,000 US dollars worth of currency with a leverage of 1:100.

In other words 1 lot = control of 100,000 US dollars.

By entering a trade buying 1 lot, $1000 US dollars is set aside in your margin account allowing you to control 100,000 US dollars worth of the currency you are trading.

If you are trading on a mini forex account, 100 US dollars allows you to control 10,000 US Dollars worth of a currency at 100:1 leverage. This leverage is part of the reason that trading currency is so appealing to many forex traders.

What Is A Pip?

A pip or Point Interest Spread, is the term used in the currency market to represent the smallest incremental move an exchange rate can make.

Depending on context, normally one basis point (0.0001 in the case of EUR/USD, GBD/USD, USD/CHF and .01 in the case of USD/JPY). Why is this important?

Pips are how forex traders get paid! If you are trading 100,000 US dollars worth of a currency, and the value of that currency goes up by 1 pip or , 100000 x 1.0001 = $10 for the trader.

Chapter

Forex Charting Basics

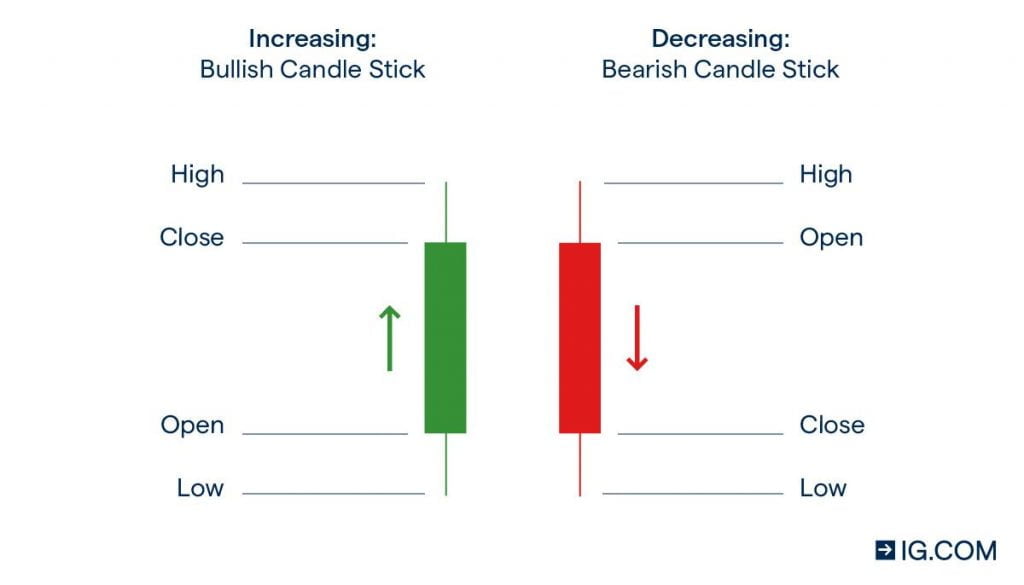

There are 3 types of charts most commonly used by forex traders when trading forex. The bar line chart, the bar chart and the candlestick chart.

Out of the three, we will concentrate on candlestick charts as they are the most common.

Japanese Candle Stick Charts

Japanese candlestick charts have been used in various forms for analysis since before the Seventeenth Century.

Today this form of displaying technical information is a very popular tool among traders. This is because Japanese candlesticks make it easy to identify price action. Candlestick charts are also incredibly easy on the eyes.

How do Japanese Candlesticks charts work?

Japanese candlestick charts display price movement versus time in a very simple and easy to read form. Each candle represents a specific amount of time. In other words, if you were looking at a 30 minute chart, each candle on the chart would represent what price did during each 30 minutes. There are 4 major parts of the candlestick.

- The Opening

- The body

- The wick

- The Close

The Opening

The opening, or price opening, part of a japanese candle stick indicates the exact price of the currency pair at the exact start of the time frame that your Japanese candlestick chart is set up to display. For example, if your chart were set up to show 30 minute candles, the opening of a candlestick at 7:30 am would show the price of that currency pair at that exact moment.

The Body

The body of a candle stick then is dictated by the direction the price moves in after it opens. If the price goes up, a body will be created to indicate the difference between current price and the price at opening. A body that demonstrates that price has moved above where it opened is called a “bullish” candle, meaning the price is moving upwards.

The Wick

A wick is created when a price opens and moves in one direction, only to reverse and move in the opposite direction. For example if the price opened at 10, moved up to 15, and closed out at 5, a wick would represent the path the price took before creating a bearish body and closing a bear candle.

The Close

At the end of the specified time for a candlestick, a second horizontal line appears to indicate the last price that currency reached before starting a new candle.

Japanese Candlestick Formations

A Japanese candlestick chart is then made up of several of these price vrs time candlesticks that together created different patterns and signals. All of this creates a sort of story board that tell the trader what the market has been doing. As the market can only do 1 of 3 things, move up, move down, or move sideways, there are many different looking candlsticks that fit into those 3 catagories. We will focus on a few of the most usefull formations.

Chapter

Basic Forex Trading Strategies

Technical vs Fundamental Analysis

There are two different strategies to trading the forex markets that are very different from each other. Technical analysis and fundamental analysis. Although most of the strategies taught by Kenya Forex Firm are considered technical analysis, there is a lot of merit in understanding both strategies.

Technical Analysis

Technical analysis traders take trades based on the information provided to them by the charts. They consider trends, past performance, candlestick formations, resistance and support and other mathematical equations and build a case for why to or why not to make a trade.

Although technical traders do take into consideration when a fundamental economic announcement might be released in order to time market entry, for the most part they assume that the state of a countries economy, political stability, and currency demand is already reflected in the charts.

Fundamental Analysis

On the other hand, fundamental traders consider economic data, political stability, supply and demand, and current events and base their entry and exit strategies off of that information.

Instead of spending their time working with and analyzing charts, fundamental traders study economic reports and stay in tune with global news. There are hundreds of economic reports released from many countries on a daily basis.

Support and Resistance

Understanding support and resistance is critical to becoming a successful forex trader. One of the great advantages to trading forex is that it tends to react similarly at price highs and lows.

- Highs are areas in price movement where a currency runs out of steam and a price retracement or reversal is eminent.

- Lows are the same thing accept in the opposite direction.

When the market reaches a certain high and cannot break through it, that price becomes market resistance. Likewise when the market reaches a low price and can not break through it it becomes price support.

The more times the price hits a certain high or low and fails to break through it, the stronger the resistance or support of that price. Often times when price finally breaks through the support or resistance, that past support becomes future resistance and likewise the past resistance becomes future support.

Support and Resitance

Foreign currency trading, or forex, is easily one of the best ways to make money in your own time from the comfort of your own home. The forex market is the largest marketplace in the world, with more than $6.5 billion dollars worth of trades being placed every day.

It is totally legal to trade forex in Kenya. You do not need any special licenses or government authorization if you’re just trading for your own profit. However, forex brokers and money managers are supposed to get a license from the Capital Markets Authority (CMA).

The industry is regulated by the Capital Markets Authority (CMA), making sure that retail traders like you are me are safeguarded from unfair trade practices by forex brokers. Currently, there are 3 CMA licensed forex brokers in Kenya.

There are many advantages to trading forex for profit, but perhaps the largest benefit is the ability to continue making profits no matter whether the market is going up or down.

Regardless of how deceptively simple forex trading looks, it is important that newer traders take time to invest in adequate education about the market and forex specifically.

Currency Trading Basics

Currency trading for profit is the act of exchanging your base currency for a foreign currency. As the values of each currency change, it’s possible to exchange the foreign amount back for your base currency again and receive more than you originally paid for the trade. You get to keep the profits.

Forex Pricing

Each foreign currency is given a value that is shown down to four decimal places, with the exception of the Japanese Yen, which is shown to two decimal places. These pricing increments are called pips. The value of each currency shown within your forex currency trading account is likely to change several times daily.

To someone unfamiliar with forex currency trading, watching the value of a currency change by a few pips seems barely worth the effort. However, each pip of change could potentially mean hundreds of thousands of dollars in profits or losses.

Online Currency Trading

Online currency trading can give traders the advantage of being able to trade at any time of the day or night from anywhere in the world, using only a computer and an internet connection.

The ability to add specific automated forex trading software to an online currency trading account also allows investors the ability to automate many areas of their trading activities.

This kind of software is able to monitor and track the minute changes in currency values even when you’re away from your computer. It can recognize pricing trends and analyze the likelihood of a profitable trade.

It’s also possible to allow automated currency trading software to place trades on your behalf. Once a potentially winning trade has been identified, the software can place a trade immediately. It can also close out that same trade once a profit has been realized. All of this can be done even while you’re away from the computer.

Leverage

Currency trading on margin, or using leverage, can be a great way to magnify your profits. The vast majority of forex brokers will offer traders the ability to trade using leverage of up to 200:1.

Effectively, this means you’re able to control vast sums of money and reap the profits of much bigger trades while only using a relatively small amount of your own capital.

Of course, just as leverage has the ability to magnify your profits, it can also mean increasing your losses if you’re not careful about creating a currency trading strategy to help reduce that risk.

Forex Educational products and seminars can be found just about anywhere these days. The aim of this site is to simply provide as much as we can to our visitors for FREE. Yes, we do not ask for a single cent from you. We are a group of successful forex traders in Kenya who have muscled our way through the markets over the years with sheer and unrestrained resilience.

But the truth is, it shouldn’t be this hard. Trading Forex, or anything else, for that matter, shouldn’t be such a mystery.

The key to becoming a successful trader is not to embrace the market with some magical system that never fails. (No such thing exists.) The key to success in the Forex markets is to enter the career as a trader (it can be a side job as well… one of our team members simply trades swing approaches because he loves running his other business on the side).

You don’t need to be a mathematician of the highest regard to trade Forex successfully.

You don’t need to be a computer programmer to trade Forex successfully.

All you need is to be proficient as a learner (with a capacity for learning from your mistakes), disciplined, disciplined, (note the repeated use), and willing to work on your emotional state to firm up any of the weaknesses or tendencies that will keep you from performing consistently.

The online forex market is a place where currency is either bought or sold. Trades are placed through a forex broker, and the mechanics of the trade are managed just as they are with other markets. Traders have four option when making a trading:

- a market order

- a buy limit

- a sell limit

- a buy stop

- and a sell stop

The object for any trader is to trade in the direction of the currency the trader feels the market will move. The challenges that face all traders, particularly Forex traders in Kenya, are the challenges of entering a trade and reaching a target before the market goes against the said entry.

Both fundamental and technical traders are challenged by this obstacle, and many approaches for managing this challenge have been construed.