Volatility indices on Deriv are synthetic assets that simulate the volatility of real-world financial markets. They are backed by a cryptographically secure random number generator, ensuring fair and transparent pricing.

The beauty of Deriv’s synthetic indices is that they are available for trading 24/7, giving you the flexibility to trade at any time that suits you.

Deriv offers various synthetic indices such as the Volatility 10 Index, Volatility 25 Index, Volatility 50 Index, Volatility 75 Index, and Volatility 100 Index.

Join the Copy Trading Revolution

Copy the trades of successful Forex traders and profit from their strategies.

*Forex and CFDs Trading involves high risk. T&Cs apply.

These indices are defined by their constant volatility levels, ranging from 10% to 100%, allowing traders to select an index that best suits their trading strategy and risk tolerance.

For example, the Volatility 10 Index offers lower price swings or fluctuations, making it suitable for those who prefer minimal risk.

In contrast, the Volatility 100 Index maintains volatility at 100%, presenting much stronger price swings and opportunities for traders looking for high volatility markets.

The Best Volatility Index to Trade in Deriv MT5

- Volatility 75 Index – The Big Kahuna The Volatility 75 Index, or VIX 75, is a favorite among traders due to its high volatility. This index typically offers larger price movements, which can translate to higher profit potential. However, remember that with great volatility comes great risk, so ensure you’re equipped with a solid risk management strategy.

- Volatility 50 Index (VIX 50) – The Middle Ground. For those who find VIX 75 a tad too wild, the Volatility 50 Index offers a middle-of-the-road option. It’s less volatile than VIX 75, providing a balance between sizeable market movements and manageable risk.

- Volatility 10 Index (VIX 10) – The Steady Eddy. If you’re new to volatility indices or prefer a more conservative approach, the Volatility 10 Index is your go-to. It offers lower volatility, making it a safer bet for those looking to dip their toes into these waters without the risk of big waves.

4. Volatility 100 Index

The Volatility 100 Index is a synthetic index offered by Deriv that simulates a market with very high volatility. This means that the index experiences rapid and significant price movements within a short period of time.

It’s designed for traders who are looking for the potential of high returns and who are comfortable with a higher level of risk.

If you’re a seasoned trader with a good understanding of how to price and trade implied volatility, the Volatility 100 Index could be a good addition to your trading strategy. However, if you’re new to trading or don’t fully understand the complexities of the Volatility 100 Index, it might be best to gain more experience and knowledge before diving in.

Related Article: Is Deriv Legit in Kenya?

When trading the Volatility 100 Index, it’s crucial to have a strategy that can handle the swings. Here are some tips to guide you:

- Use Trendlines: Drawing trendlines can help you identify potential support and resistance levels. This can be a simple yet powerful tool to gauge market direction and make informed decisions.

- Avoid Herd Mentality: Don’t just follow the crowd. Make sure to do your own analysis and trust your judgment. Sometimes the most profitable trades are those that go against the grain.

- React Quickly to News: If you’re trading based on news events, timing is everything. Try to take your positions early to capitalize on the initial market reactions.

- Gap Trading: Look for gaps in the market that might be filled. For instance, if the index drops suddenly, it might rebound to fill the gap.

Deriv offers several platforms for trading the Volatility 100 Index, but the most user-friendly and versatile is the Deriv MT5 (DMT5) platform. It’s designed for traders of all levels and provides advanced charting tools, which can be very helpful when dealing with a volatile market like the Volatility 100 Index.

1. Volatility 10 Index – Best for Beginners

The Volatility 10 Index is one of the several volatility indices available on the Deriv platform.

It’s designed to simulate a market with low volatility. In other words, it’s a synthetic index that mimics the behavior of a financial market with relatively stable price movements.

- Average Daily Range: On average, the Volatility 10 Index fluctuates within a range of 5% to 7% per trading day.

- Historical Performance: Over the past year, the Volatility 10 Index has experienced periods of both growth and decline, with an overall average return of 5.2%.

The Volatility 10 Index is a great starting point if you’re new to trading volatility indices. It offers a balance of risk and reward, allowing you to dip your toes into the world of trading without exposing yourself to excessive risk.

The Volatility 10 Index might not give you quick profits, but it offers stability and predictability.

The main advantage of the Volatility 10 Index is its lower risk compared to higher volatility indices. It’s less likely to experience sudden, dramatic price changes, which can lead to significant losses.

However, the downside is that the potential profits are also lower. If you’re looking for quick, large gains, this might not be the index for you.

2. Volatility 75 Index

The Volatility 75 Index, often referred to as VIX 75, is a synthetic index that measures the volatility of financial markets. It is one of the most popular volatility indices on Deriv.

Unlike traditional assets, which are influenced by economic events, geopolitical tensions, and market sentiment, the Volatility 75 Index is engineered to reflect volatility levels, making it somewhat predictable and not directly affected by real-world happenings.

The index is designed to simulate a market with significant price movements, offering traders the potential for substantial gains and losses.

- Trading Volume: The Volatility 75 Index generally has a high trading volume, indicating that many traders are actively participating in the market. This liquidity can make it easier to enter and exit trades quickly.

- Risk: Due to its high volatility, the Volatility 75 Index carries a higher level of risk compared to lower volatility indices. This means you could potentially lose more money than you invest.

The Volatility 75 Index is best suited for experienced traders who are comfortable with high-risk, high-reward trading. It’s not recommended for beginners or those who prefer a more cautious approach.

To trade the Volatility 75 Index effectively, you can employ various strategies.

- For beginners, a simple strategy using the Relative Strength Index (RSI) can be a good start. This involves looking for specific entry and exit points based on the RSI levels to potentially make profits.

- More experienced traders might use more complex strategies, incorporating technical analysis tools like moving averages, Bollinger Bands, and Fibonacci retracements to identify potential entry and exit points

3. Volatility 50 Index – Best for Intermediate Traders

The Volatility 50 Index is one of several volatility indices available for trading on Deriv.

As the name suggests, it simulates a market with a moderate level of volatility. Specifically, it aims to mimic the volatility of some of the most liquid stocks in the US market.

It’s designed to provide traders with more trading opportunities and the potential for higher returns compared to lower volatility indices, while still maintaining a manageable level of risk.

- Volatility 50 (1s) is a faster version of the Volatility 50 Index. The “1s” stands for 1-second ticks, meaning that the prices update every second. This creates a more dynamic trading environment with quicker changes in price, offering opportunities for traders who prefer fast-paced trading and are comfortable with higher risk.

- Since the Volatility 50 Index moves at a moderate pace, using price action strategies can be very effective. This involves analyzing the historical price movements to predict future price behavior. You can look for patterns, trends, and support/resistance levels to make your trading decisions.

- Scalping: Given the fast pace of the Volatility 50 (1s), scalping is a suitable strategy. This involves making numerous trades over the course of a day to profit from small price movements. Since the index updates every second, you can take advantage of the quick fluctuations

To help you decide if the Volatility 50 Index is a good fit for your trading style, let’s look at some key metrics:

- Volatility: The Volatility 50 Index has a higher volatility level compared to indices like the Volatility 10 or 25. This means that price movements tend to be more frequent and more significant.

- Trading Volume: The Volatility 50 Index typically has a higher trading volume compared to lower volatility indices. This means that there are more traders actively buying and selling, which can lead to more liquidity and tighter spreads.

- A Test of Strategy and Skill: Trading the Volatility 50 Index can be an excellent way to refine your trading strategies and decision-making skills under pressure.

Trading the Volatility 50 Index is not a decision to be taken lightly. It requires a good understanding of market movements, a solid trading strategy, and an ability to stay calm under pressure.

If you’re someone who enjoys a challenge and is willing to dedicate time to learn and adapt, this index could be a thrilling addition to your trading portfolio.

However, if you’re new to trading or prefer a more conservative approach, you might want to start with indices that simulate lower volatility markets, such as the Volatility 10 Index, and gradually work your way up.

How to Choose the Best Volatility Index to Trade in Deriv

Selecting the best volatility index to trade on Deriv depends on your risk tolerance, trading strategy, and market outlook.

Beginners may want to start with lower volatility indexes to get a feel for the market dynamics, while more experienced traders might seek the adrenaline rush of higher volatility.

Here are some factors to consider:

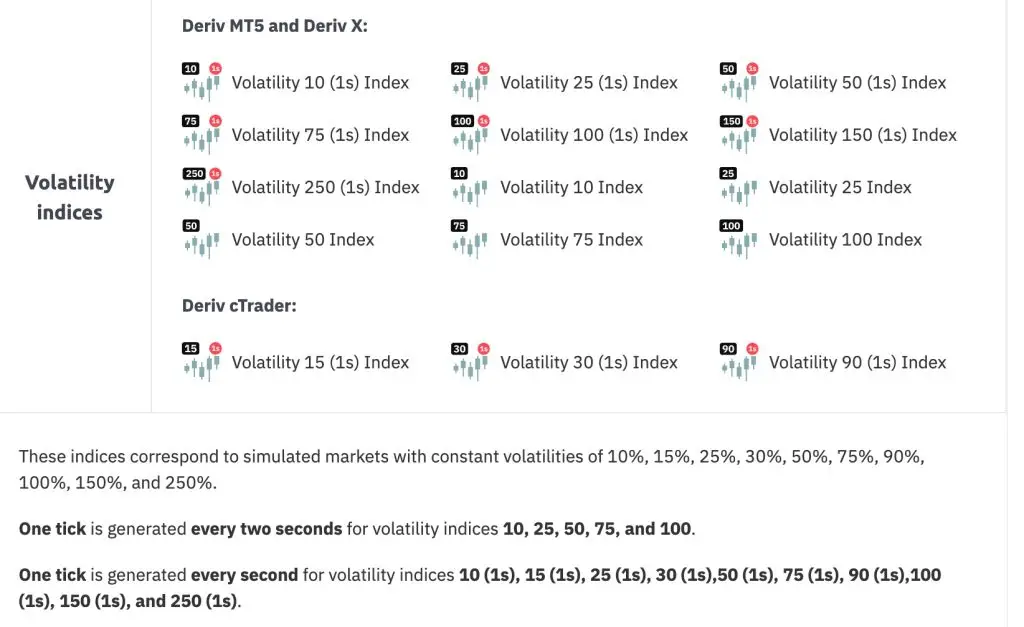

- Tick Frequency: If you prefer a fast-paced trading environment, you might opt for indices that generate ticks every second, such as the Volatility 100 (1s) index.

- Volatility Level: Higher volatility indices, like the Volatility 75 (1s) or Volatility 100 (1s), offer more significant price movements, which could mean higher profit potential but also increased risk.

- Market Simulation: Crash and Boom indices can be attractive if you have strategies that can capitalize on these extreme price movements.

Advantages of Trading Volatility Indices on Deriv

Trading the Volatility Index on Deriv with constant volatility offers several advantages:

- Predictability: With constant volatility indices, you know exactly what level of volatility to expect, as these indices simulate markets with fixed volatilities such as 10%, 25%, 50%, 75%, and 100%. This predictability can help you develop and stick to trading strategies that are tailored to specific volatility levels.

- Availability: Deriv’s synthetic indices, which include the volatility indices, are available for trading 24/7. This means you can trade at any time that suits you, without being constrained by the opening hours of traditional financial markets.

- Diversification: Trading on volatility indices can be a good way to diversify your trading portfolio. Since these indices are not directly affected by real-world events, they can provide a hedge against unexpected market movements in traditional assets.

- Simulated Market Conditions: The volatility indices on Deriv are based on a cryptographically secure random number generator, which means they replicate market movements in a structured way, free from market and liquidity risks. This can offer a cleaner trading experience without the noise of actual market events.

- Risk Management: You can employ risk management strategies more effectively due to the controlled environment provided by constant volatility indices. Tools like stop-loss and take-profit can be used to manage your trades with precision.

- Cost-Effectiveness: Trading the VIX on Deriv can be relatively low-cost compared to other forms of trading, making it accessible to a wider range of traders.

- Leverage: Deriv allows you to trade CFDs on volatility indices with high leverage, which means you can control a large position with a relatively small amount of capital. However, it’s important to remember that leverage can also amplify losses.

- No Direct Impact from Global Events: Since synthetic indices are not based on real-world assets, they are unaffected by global events, market, and liquidity risks, which can provide a more stable trading environment.

- Strategy Testing: The constant volatility environment is ideal for testing and refining trading strategies. You can see how your strategies perform under different volatility conditions and make adjustments as needed.

- Educational Resources: Deriv provides educational resources and tools to help you understand how to trade these indices effectively, which can be beneficial for both new and experienced traders

Tips for Trading Volatility Indices on Deriv

- Start with a Demo Account: Get your feet wet without risking real money. Deriv offers demo accounts where you can practice trading volatility indices and hone your strategy.

- Keep an Eye on the Economic Calendar: Even though synthetic indices aren’t directly affected by real-world events, global economic news can influence market sentiment, so stay informed.

- Use Stop-Loss and Take-Profit Orders: Protect your capital and lock in profits by setting clear entry and exit points.

- Educate Yourself: Take advantage of Deriv’s educational resources to understand the nuances of volatility index trading.

It’s important to note that while there are advantages, trading on volatility indices also comes with risks.

High volatility can lead to rapid and significant price movements, which can result in substantial losses as well as gains. Therefore, it’s crucial to have a solid understanding of the instruments and to use risk management strategies effectively.

Before you start trading the Volatility Index on Deriv, make sure you understand the nature of synthetic indices, the platform’s terms and conditions, and the risks involved in trading highly volatile instruments.

Frequently Asked Questions

Does Deriv Have Volatility 75 Index?

Yes, Deriv offers the Volatility 75 Index for trading. You can trade this index through synthetic indices, which are financial instruments that mimic the price movements of an underlying asset, in this case, the Volatility 75 Index.

Synthetic indices allow you to speculate on the price movements of the Volatility 75 Index without owning the underlying asset. This makes them a convenient and accessible way to trade this index, especially for retail traders.

To trade the Volatility 75 Index on Deriv using synthetic indices, you can follow these steps:

- Open a Deriv trading account.

- Fund your account with sufficient funds to cover your trades.

- Choose the Volatility 75 Index as the underlying asset for your synthetic index trade.

- Select the trade direction (buy or sell) based on your market analysis.

- Set the contract size and other trade parameters.

- Monitor your trade and adjust it as needed.