As someone who’s deeply immersed in the world of online forex trading and as a financial writer in Nairobi, I’ve had the pleasure of exploring various forex brokers to provide you with the most reliable reviews.

You’ve probably come across Deriv. It’s an online trading platform that’s been generating buzz, and you might be wondering, “Is Deriv legit in Kenya?”

Well, you’ve come to the right place for answers. I’ve taken a deep dive into every aspect of Deriv, from opening an account, and depositing funds to trading and withdrawing earnings, to give you a well-rounded view.

Join the Copy Trading Revolution

Copy the trades of successful Forex traders and profit from their strategies.

*Forex and CFDs Trading involves high risk. T&Cs apply.

Is Deriv Regulated in Kenya?

First off, let’s talk about Deriv’s legal standing.

Deriv is a rebranding of the well-known Binary.com, a platform with over 20 years of online trading presence.

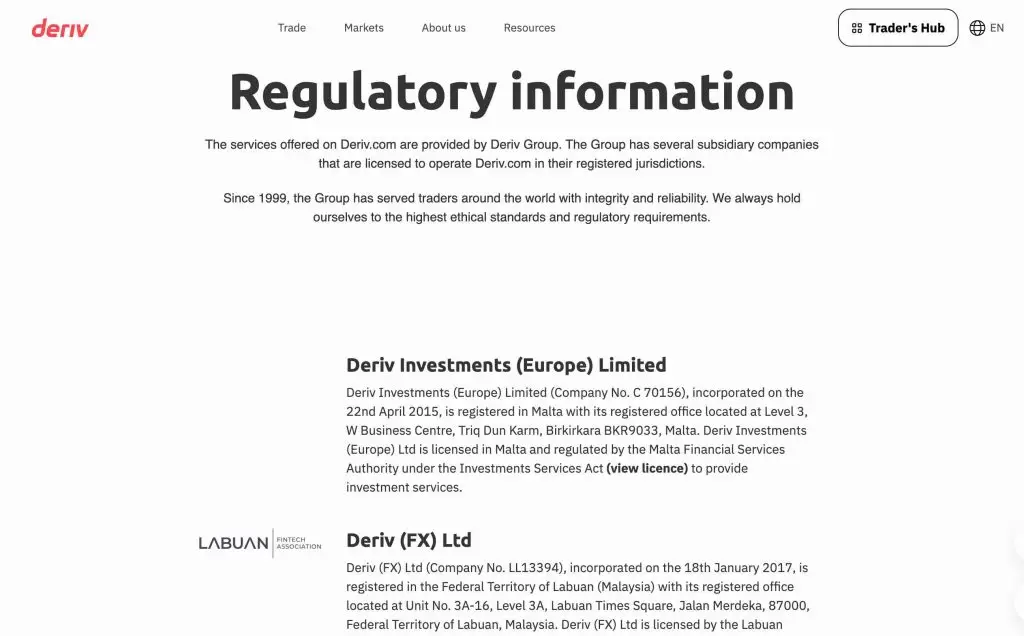

In Kenya, online forex brokers are regulated by the Capital Markets Authority (CMA), and while Deriv itself is not directly regulated by the CMA, it operates under the regulatory oversight of multiple international bodies. This includes:

- The Malta Financial Services Authority (MFSA)

- The Vanuatu Financial Services Commission (VFSC), among others.

These regulatory bodies ensure that Deriv adheres to strict financial regulations and standards, providing you with a safe and secure trading environment.

My Personal Experience with Deriv

I’ve personally tested Deriv’s services, and I can confidently say that it is a legitimate and reliable forex broker in Kenya. The platform is user-friendly, the customer support is excellent, and the deposit and withdrawal processes are smooth and efficient.

Deriv’s Deposit and Withdrawal

When it comes to funding my account, I appreciate a hassle-free process, simplicity, and speed. The deposit process in Deriv didn’t disappoint.

I’ve used M-Pesa for deposits, and the transactions were seamless, with funds appearing in my account almost instantly. This is a big plus for you if you value efficiency and convenience.

Withdrawals were just as smooth. I submitted a withdrawal request, and to my satisfaction, the funds landed in my account within the expected timeframe. No unnecessary delays or hiccups, which speaks volumes about Deriv’s reliability.

Although withdrawals in Deriv aren’t quite instant, the waiting period is reasonable, and I usually see the funds in my account within a few hours, which aligns with their stated processing times.

Deriv’s Minimum Deposit

Deriv’s minimum deposit is quite competitive when compared to other forex brokers.

Deriv requires a minimum deposit of only $5, which is quite accessible for beginner and smaller retail traders.

This low entry barrier is beneficial for those who are new to forex trading or those who wish to start with a smaller capital investment.

Click here to open an account.

Deriv’s Customer Support

No matter how experienced you are, having access to responsive customer support is crucial.

Customer service can make or break a trading experience. I reached out to Deriv’s support team with a few queries, and their prompt and knowledgeable responses were impressive. It’s reassuring to know that, as a trader, you have a reliable team ready to assist you around the clock.

Deriv Account Verification Process

The initial step to verifying my Deriv account was quite straightforward. After logging into my account, I navigated to the “Account Verification” section under the account settings.

The platform required me to upload documents to prove my identity and residence. This is a standard procedure across many trading platforms, aimed at enhancing security and complying with anti-money laundering regulations.

For identity verification, I uploaded a clear, legible copy of my national ID card. Deriv also accepts passports and driver’s licenses for this purpose.

The process was user-friendly, with Deriv providing clear instructions on the types of documents accepted and how to upload them.

To verify my address, I submitted a recent KRA e-tax certificate that had my name and address clearly indicated. The e-tax certificate was less than six months old, meeting Deriv’s requirements for proof of residence.

Challenging Aspects of Using Deriv In Kenya

- One of the main challenges of using Deriv in Kenya is that the tutorials provided on the site may not be sufficient for novice traders. This means that if you’re new to trading, you might find it difficult to understand some of the platform’s features and how to use them effectively.

- Deriv does not serve clients from several countries, such as the USA, Canada, Malaysia, Israel, and others. This could be a challenge if you are based in one of these countries or if you travel frequently like I do.

Is Deriv Legit in Kenya? My Verdict

After thoroughly testing every aspect of Deriv, from depositing funds to trading and withdrawing earnings, I can confidently say that Deriv is a legit investment platform for Kenyan traders. While the lack of a specific CMA license might raise questions, Deriv’s international regulatory framework ensures a safe and secure trading environment.

Deriv also employs a range of security measures to protect your funds and personal information. These include data encryption, secure payment gateways, and segregated client funds. This means that Deriv keeps its operational funds separate from your trading funds, which is a standard practice among reputable brokers.

Unbiased Deriv Review

At Kenya Forex Firm, we take the task of reviewing forex brokers like Deriv very seriously. We understand that your hard-earned money is at stake, and we want to ensure that you’re making the best possible decision.

So, how do we review forex brokers?

Let’s break it down.

Firstly, we dive deep into the broker’s background. We look at their history, their regulatory status, and their reputation in the industry.

We believe that a broker’s past performance and regulatory compliance are strong indicators of their reliability. We don’t just take the broker’s word for it – we verify all the information independently.

Next, we scrutinize the trading conditions. This includes the spreads, leverage, and the variety of trading instruments available. We understand that these factors can significantly impact your trading experience and profitability. We compare these conditions with other brokers in the market to give you a clear picture of where Deriv stands.

We also take a close look at the trading platform. We evaluate its user-friendliness, features, and stability. We know that a good trading platform can make all the difference in your trading journey. We even go the extra mile to test the platform ourselves to give you a first-hand account of what you can expect.

Customer service is another crucial aspect we review. We believe that a good broker should provide excellent customer support. We test their response time, the quality of their answers, and their overall willingness to assist their clients.

Lastly, we consider the feedback from other traders. We scour the internet for reviews and testimonials from real users. We believe that this gives us a more holistic view of the broker.

Our forex broker reviews are comprehensive, unbiased, and most importantly, crafted with you in mind. We understand the importance of trust in this industry, and we strive to provide you with the most accurate and reliable information.

Deriv Safety & Regulation In Kenya

The legitimacy of any forex broker largely hinges on its regulatory status. Deriv, formerly known as Binary.com, is a well-established online trading platform that has been in operation since 1999.

In Kenya, forex trading is overseen by the Capital Markets Authority (CMA), which is the watchdog ensuring that all financial market players operate within the set legal framework.

While Deriv itself is not directly regulated by the CMA, it operates under the regulatory purview of multiple international bodies. This includes:

- Malta Financial Services Authority (MFSA)

- The Vanuatu Financial Services Commission (VFSC)

- The British Virgin Islands Financial Services Commission (BVI FSC), among others.

Forex brokers with multiple regulations tend to adhere to higher safety standards. This is because they must comply with stringent rules and undergo regular audits, which ultimately benefits you as a trader.

- Safety Measures: Deriv employs a range of security measures to protect your funds and personal information. These include data encryption, secure payment gateways, and segregated client funds. This means that Deriv keeps its operational funds separate from your trading funds, which is a standard practice among reputable brokers.

- Negative Balance Protection: Deriv offers negative balance protection, a feature that safeguards you from owing more money than your account balance. This protection acts as a safety net, preventing you from incurring significant losses that could exceed your initial investment.

- Deriv's commitment to safety and regulation is evident in its compliance with reputable regulatory bodies, robust security measures, segregated client funds, and negative balance protection. By choosing Deriv as your forex and CFD broker, you can trade with confidence, knowing that your funds and personal information are well-protected.

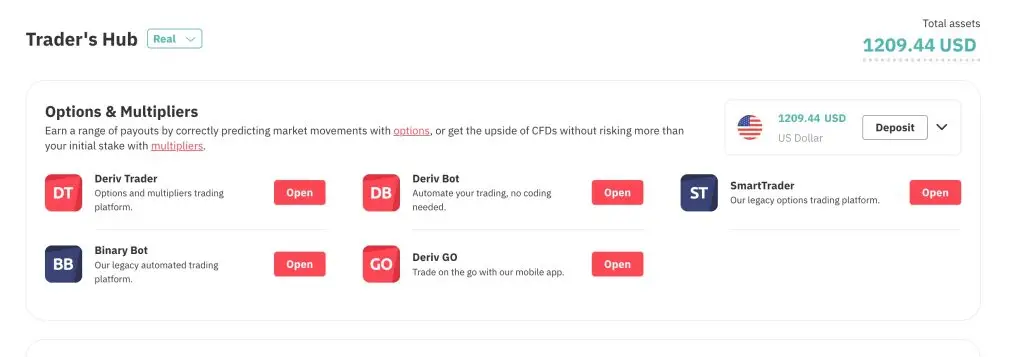

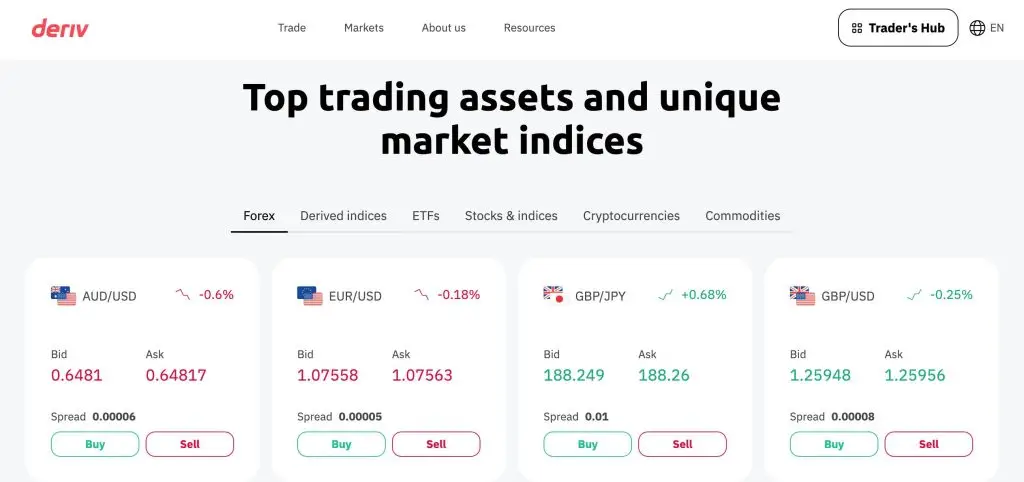

Assets Available on Deriv

Deriv offers a wide variety of assets to trade. From major currency pairs in forex to stock indices, commodities, cryptocurrencies, and proprietary synthetic indices, Deriv aims to cater to traders of all levels and interests.

- Currency Pairs: You can trade over 50 major, minor and exotic currency pairs on Deriv’s forex market. This includes all the most popular pairs like EUR/USD, GBP/USD, USD/JPY as well as less common pairs like USD/MXN.

- Synthetic Indices: One of Deriv’s unique offerings is its proprietary synthetic indices. These simulate real-world markets but are completely virtual, meaning you can trade them 24/7. Synthetics include volatility indices, crash/boom indices, drift switch indices, and more.

- Stocks & Indices: Deriv allows you to trade CFDs on a wide range of stocks and indices. This includes American indices like the US 500, US Tech 100, and Wall Street 30, as well as indices from other countries like the Netherlands 25, Spain 35, and UK 100

- Cryptocurrencies: Cryptocurrency trading is another option available on Deriv. This includes popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

- Options: Options trading on Deriv allows you to predict the market movements and earn a payout if your prediction is correct. This includes digital options and lookbacks. Options trading can be a good choice for those looking to enter the market with minimal capital.