When you’re looking to invest your hard-earned money, it’s important to choose platforms that are not only legit but also align with your investment goals and preferences.

In Kenya, several investment platforms cater to different types of investments such as stocks, forex, cryptocurrencies, and real estate. Let’s dive into some of the top investment platforms available to you in Kenya.

10 Legit Investment Platforms in Kenya

| Platform Logo | Platform Name | Founded Year | Minimum Deposit | Regulation | Best For |

|---|---|---|---|---|---|

| Pepperstone | 2010 | N/A | CMA (among others) | Best ECN Forex Broker in Kenya |

| HF Markets | 2010 | $10 | Licensed in Kenya by the CMA | Physical Stocks |

| FxPesa | 2019 | $10 | CMA | Best Trading Platform for NSE Derivatives |

| Exness | 2008 | $10 | CMA (among others) | Best Copy Trading Platform in Kenya |

| XM | 2009 | $5 | - | Best trading platform for those who like bonuses |

| Binance | 2017 | $1 | - | Best cryptocurrency investment platform |

| Deriv | 1999 | $5 | - | Best platform for trading synthetic indices |

| Olymp Trade | 2014 | $10 | - | Best binary options traidng platform |

| MansaX | 2021 | 250,000/= | CMA | Best managed investment platform in Kenya |

| FBS | 2009 | $10 | - | Best high leverage forex broker |

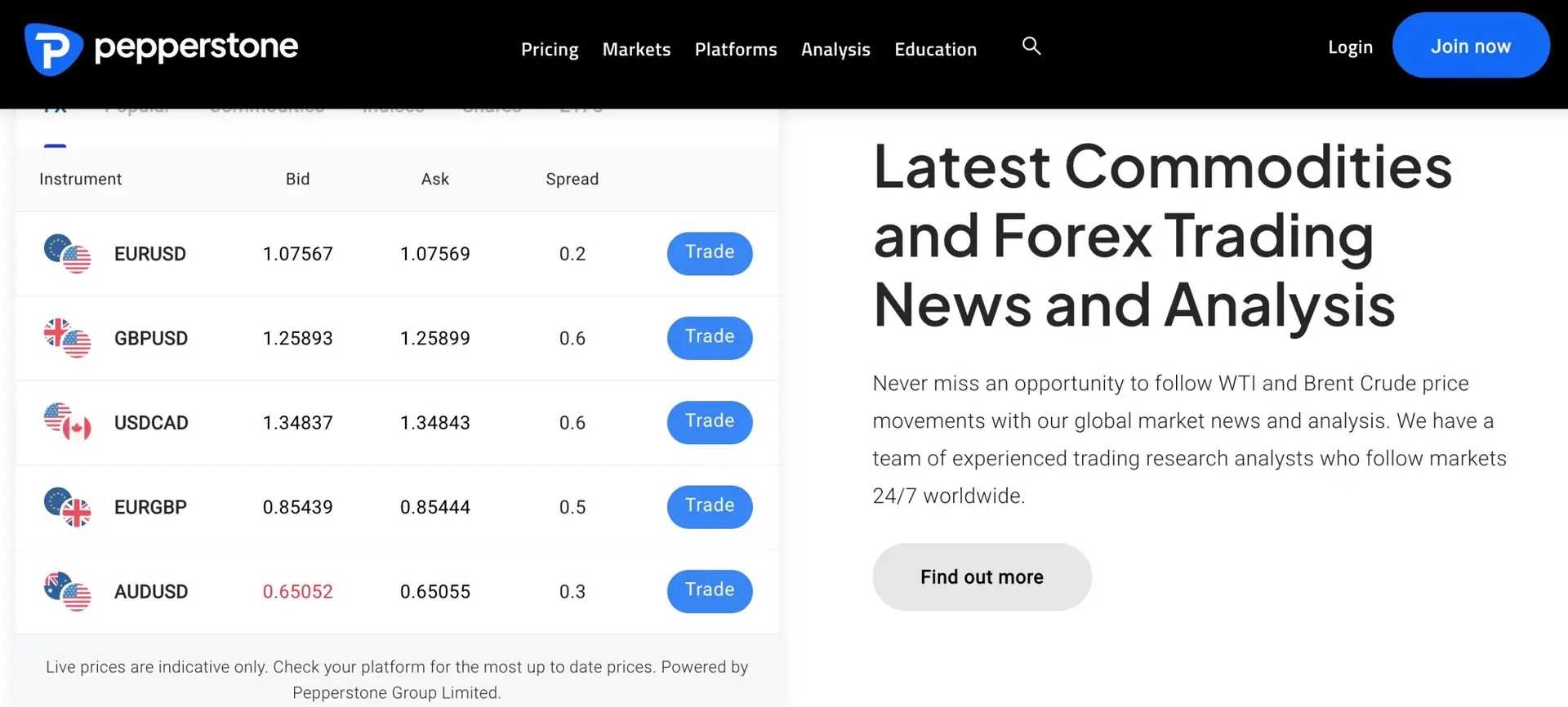

1. Pepperstone Markets LTD

Pepperstone is not your average investment company. It’s a renowned online brokerage firm that has been making waves in the financial markets.

Founded in 2010, this Australian-based company offers a platform for trading a variety of financial instruments like forex, CFDs (Contract for Difference), and even cryptocurrencies.

Now, I know what you’re thinking: “That sounds complex!” But here’s the thing – Pepperstone simplifies this complexity. They’re known for their user-friendly platforms, excellent customer service, and commitment to providing educational resources for beginners.

But is it legit?

Yes. Pepperstone is legit, highly trusted investment platform that is regulated in several Tier-1 jurisdictions, including the U.K., EU, and Australia, as well as in Kenya, making it a safe and reliable choice for your investment.

Pepperstone processes an average of $12.55 billion in trades daily for more than 300,000 retail trading accounts.

Pepperstone offers a wide range of trading instruments. You can trade CFDs across:

- Forex

- Crypto

- Indices

- Commodities

- Shares

They offer over 1,250 assets, including 90+ major, minor, and exotic currency pairs, stocks from the US, UK, AU, HK, and EU, and a strong selection of indices. This wide range of options opens up a world of possibilities for you to diversify your investment strategy and take advantage of different opportunities across global equity markets.

To begin trading with Pepperstone, you’ll need to follow a few steps:

- Learn the Basics: Before you dive in, it’s crucial to understand the fundamentals of share and CFD trading. Pepperstone offers comprehensive guides and educational resources to help you grasp the essentials.

- Open an Account: You can choose between different account types such as Razor and Standard, each with its own set of features tailored to different trading styles. Click here to open an account.

- Choose a Trading Platform: Pepperstone provides access to popular platforms like MT4, MT5, and cTrader, which come with advanced features and tools.

- Fund Your Account: There are several fee-free funding methods available, and Pepperstone doesn’t require a minimum account opening balance.

- Start Trading: Once your account is set up and funded, you can start trading. You have the option to trade CFDs on shares, indices, forex, and even cryptocurrencies.

- Demo Account: If you’re not ready to trade with real money, Pepperstone offers a demo account where you can practice with virtual funds

Pepperstone Markets LTD is more than just an online brokerage firm; it’s a partner in your investment journey. With its user-friendly interface, educational resources, and dedicated customer support, it stands as an excellent choice for beginners.

But remember, investing always comes with risks. So, it’s important to educate yourself and understand the market before you start trading. Pepperstone offers a demo account where you can practice your trading strategies in a risk-free environment. This is a great way to get started and gain some experience before you start trading with real money.

Visit Pepperstone Now2. HF Markets

HF Markets, formerly known as HotForex, is a leading CFD broker that offers a wide range of assets for trading, including over 2000 physical stocks for direct purchase with zero commissions.

Established in 2010, HF Markets has grown to become a trusted investment platform for both beginners and experienced traders, thanks to its user-friendly app, rich educational content, and a suite of extra tools.

HF Markets has received generally positive reviews from its users. Many Kenyans have praised the platform for its low deposit requirement, easy account funding, wide market access, and industry-leading trading platforms.

There are several reasons why HF Markets stands out as a legitimate investment platform in Kenya:

- Regulation: HF Markets is licensed in Kenya by the CMA, ensuring that it operates under strict regulatory standards.

- Diverse Portfolio: With HF Markets, you have access to over 3,500 trading instruments, including forex, metals, energies, stocks, indices, ETFs, bonds, commodities, and cryptocurrencies.

- User-Friendly Platform: HF Markets offers a user-friendly trading platform with ultra-fast execution speeds. It also provides various analysis tools, education, news, and analytical support.

- Local Presence: HF Markets has a local office in Nairobi, Kenya, and accepts deposits from Kenyan traders via mobile money payments.

- Physical Stocks: HF Markets offers traditional stock investing, where you can invest free of commissions. This is a significant advantage for investors looking to diversify their portfolios with shares from leading companies.

- Education and Support: HF Markets provides wide-ranging education and support to its clients, including online trading courses, educational videos, webinars, and 24/5 customer support.

- Security of Funds: HF Markets ensures the security of clients’ funds by holding them in segregated bank accounts

To reiterate, one of the key factors that contribute to the legitimacy of HF Markets is its strong regulatory oversight. The platform is regulated by several financial watchdogs, including the Cyprus Securities and Exchange Commission, the UK Financial Conduct Authority, and notably, the Capital Markets Authority (CMA) in Kenya.

This regulatory oversight ensures that HF Markets operates within the confines of financial laws and regulations, providing an added layer of security for its users.

HF Markets offers its clients the opportunity to invest in physical stocks, which refer to the shares of companies traded in regulated exchanges. This means you can buy shares from leading companies like Amazon, Apple, Alphabet, and Tesla, among others, and have dividends deposited directly into your account.

Trading physical stocks on HF Markets comes with several advantages. For instance, you can buy fractional shares with a minimum of $5, and shareholders can receive dividends directly into their accounts. Plus there are zero commissions on buy and sell transactions of shares, and there are no exchange fees.

Visit HF Markets3. FxPesa

FxPesa is a fully regulated online broker that champions financial freedom and literacy in Kenya and across East Africa. The company is owned and operated by EGM Securities Limited, a company registered under the Companies Act in Kenya. It’s also licensed and regulated by the Capital Markets Authority (CMA) of Kenya, which is a significant milestone in its growth.

FxPesa has become Kenya’s first online trading broker to offer derivative contracts on the NSE Derivatives Market. This means you can trade derivatives of Kenya’s top companies like Safaricom, KCB Group, Equity Group, BAT Kenya, East African Breweries, ABSA Bank Kenya, and the NSE 25 share index.

Trading NSE derivatives involves speculating on the price movements of underlying assets, such as stocks, without actually owning the assets. This can be done through contracts for difference (CFDs), which allow you to profit from price movements without owning the underlying asset.

One of the main advantages of trading NSE derivatives with FxPesa is the lower margin and transaction costs. The platform charges a flat rate of 0.14% for trading NSE derivatives, which is typically lower than the costs associated with trading physical stocks.

Another advantage is the ability to trade on margin, which means you can open positions larger than your account balance.

There are several reasons why FxPesa stands out as one of the best and legit investment platforms in Kenya:

- Regulation: FxPesa is regulated by the Capital Markets Authority (CMA) and the Financial Conduct Authority (FCA), ensuring that your investments are safe and secure.

- Diverse Portfolio: FxPesa allows you to diversify your portfolio by trading NSE derivatives of Kenya’s top companies.

- Quick Onboarding: FxPesa provides a quick onboarding process that takes less than five minutes, allowing you to start trading almost immediately.

- Educational Resources: FxPesa offers free training through regular online webinars, helping you to become an expert trader.

- Customer Support: FxPesa provides dedicated customer support available 24/6 to answer any queries you may have.

FxPesa, as the first online trading broker to offer NSE derivatives in Kenya, provides a platform where these financial instruments can be traded. This allows investors to profit from price movements in the market without the need to physically hold the stocks, and you can also use these instruments for hedging purposes to protect their portfolios against adverse price movements.

4. Exness – Best Copy Trading Platform in Kenya

If you’re looking for an investment app in Kenya that is not only simple to use but also fully regulated by the Capital Markets Authority, Exness is your best bet.

Exness is a safe and legitimate investment platform. It’s regulated by multiple authorities, including the Financial Conduct Authority (FCA) in the UK, the Financial Service Commission (FSC) in Mauritius, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Competition and Market Authority (CMA) in Kenya. These regulatory bodies monitor the activities of Exness to ensure it adheres to strict financial standards and practices.

Exness Copy Trading is a feature that allows you to mirror the trades of professional investors. This means you can rake in profits by leveraging the expertise of trading pros, even if you’re not quite the expert yourself. It’s like having a mentor guide your investment journey.

Here is a step-by-step overview of how it works:

- Sign Up: Investors first need to open an Exness trading account to access copy trading. The signup process is straightforward.

- Choose Traders: Investors can browse strategy providers on the platform based on performance statistics, risk levels, past returns etc. It’s important to do thorough research before selecting who to follow.

- Copy Trades: Once a strategy provider is selected, the investor inputs the percentage of their account equity they wish to allocate to that trader. All future trades are then automatically copied proportionally into the investor’s account.

- Adjust Settings: At any time, the investor can stop copying a trader, adjust the copy percentage, or add/remove other traders to follow. This gives full control over the copy trading portfolio

One of the key features of Exness Copy Trading is that it gives investors complete control over their funds. You can copy trades from multiple strategy providers, which allows you to diversify your investment and potentially spread your risk.

The platform is also quite user-friendly. It’s designed for investors who may not know how to trade but have the capital to invest. The copy trading feature is based on an equity rate, meaning that the size of your copied trade is proportional to your investment compared to the strategy provider’s equity.

Investors using Exness to copy trades pay the strategy provider a pre-defined commission rate. The commission rate is not uniform; it varies for different strategy providers.

Getting started with Exness copy trading is quite straightforward. You’ll need to set up an account, choose the traders you want to follow, and then start copying their trades. Make sure you choose traders with a consistent track record and a risk level that you’re comfortable with.

5. XM – Best Investment Platform for Beginners

There’s a reason why we just can’t get enough of this investment platform by the name of XM. This was the first trading platform that we registered with and it was a godsent during those days when we were new to the forex trading world.

XM offers a wealth of educational resources including online video lessons, webinars, and live market analysis, making it one of the best choices for beginner investors.

They also launched a copy trading platform, where you can copy trades of the most successful forex traders, and piggyback on their strategies.

In the world of online trading and investing, legitimacy is everything. You want a platform that not only understands your investment journey but also respects and secures your hard-earned money. XM, a globally recognized broker, has been making waves not just internationally, but right here in Kenya.

XM operates under the watchful eyes of several financial authorities. These include:

- Cyprus Securities and Exchange Commission (CySEC)

- Australian Securities and Investments Commission (ASIC)

- Belize International Financial Services Commission (IFSC)

This level of regulation ensures that XM adheres to industry standards and best practices, providing a secure environment for your investments. XM has a clean track record with no major regulatory incidents or fines, which is a testament to its legitimacy and reliability.

When it comes to trading conditions, XM provides high leverage of up to 1:1000, which can amplify your trading results. However, it’s crucial to understand that while high leverage can increase your profit potential, it also raises the risk of losses.

XM is known for offering attractive bonuses to its clients. For instance, they provide a $30 no-deposit bonus, which allows you to start trading without investing your own funds. This is a fantastic way for you to dip your toes into the Forex market without the risk of losing your own money.

Additionally, XM offers a 20% deposit bonus up to $5,000, which means if you deposit $1,000, you get an additional $200 to trade with.

These bonuses are not just about giving you extra trading funds; they also serve as a confidence booster and a way to familiarize yourself with the platform’s features without immediate financial commitment.

6. Binance – Best Crypto Investment Platform

Cryptocurrency has emerged as an increasingly popular investment in Kenya, with over 4.5 million people now owning cryptocurrencies. This number places Kenya 5th globally in crypto adoption. The crypto market cap in Kenya is estimated to be around $20 billion and continues to grow rapidly.

Binance is one of the key players in the Kenyan cryptocurrency market. It’s among the most legit cryptocurrency investment platforms in the world, offering services for buying, selling, and trading digital assets. Whether you’re a professional investor or a newbie in the crypto world, Binance has something for you.

This legit investment platform has gained significant popularity in Kenya, and it’s not hard to see why.

- Competitive Fees: Binance is known for its low trading fees, starting at 0.1%, which is quite attractive for any trader. They also have a VIP level system that further reduces rates as your trading volume increases.

- Wide Range of Cryptocurrencies: With support for over 500 cryptocurrencies, Binance gives you a plethora of options to diversify your portfolio.

- User-Friendly Mobile Trading: Binance offers a mobile app that allows you to trade on the go, which is a huge plus in today’s fast-paced world.

- Affiliate Program: If you’re into affiliate marketing, Binance’s affiliate program could be an additional revenue stream for you

Binance is committed to user protection and employs advanced security measures to ensure the safety and integrity of users’ funds. It also provides education to its users on how to recognize and avoid common threats and scams.

Investing in cryptocurrencies offers exciting opportunities for growth and financial independence. For Kenyan investors stepping into the crypto world, Binance offers a compelling blend of user-friendliness, security, and educational support. It’s a legit investment platform that not only allows you to trade but also educates and empowers you along the way.

7. Deriv

Deriv is a legitimate online trading platform with a 22-year track record in the industry. It offers a wide range of trading instruments, including forex assets, stocks, indices (including synthetic ones), CFDs, commodities, and options.

Deriv is licensed and regulated by several bodies, including:

- Vanuatu Financial Services Commission (VFSC)

- Malta and Labuan Financial Services Authority (MFSA and Labuan FSA)

- and BVI FSC

One of the unique offerings of Deriv is its synthetic indices. These are unique indices that mimic real-world market movement but with a twist — they are based on a cryptographically secure random number generator, have constant volatility, and are free of market and liquidity risks.

Synthetic indices have carved out a unique niche for themselves, offering traders a way to diversify their portfolios and engage with the market in a new and exciting way.

Some of the most popular synthetic indices include the Volatility Indices, such as the Volatility 75 Index, which maintains a constant level of 75 percent volatility. These indices are popular due to their fixed volatility component, which gives traders a clear understanding of the risk involved.

Another popular synthetic index is the Crash and Boom index, which is gaining traction among investors due to its unique market behavior. These indices simulate drastic market movements, providing traders with opportunities to profit from significant market crashes or booms.

Also See: Best Time to Trade on Deriv in Kenya

Deriv’s synthetic indices are available to trade 24/7, giving investors more flexibility and opportunity. They offer tight spreads and leveraged trades, which can magnify both your potential profits and losses.

Trading synthetic indices on Deriv comes with several advantages:

- 24/7 Trading: One of the most distinct advantages of Deriv’s synthetic indices is that they are available for trading 24 hours a day, 7 days a week. This gives traders more flexibility and opportunity, as they are not restricted by traditional trading hours.

- Unaffected by Market Risks: Synthetic indices are based on a cryptographically secure random number generator, have constant volatility, and are free of market and liquidity risks. This means they are not affected by global events, market fluctuations, or liquidity risks, providing a more predictable trading environment.

- High Leverage: On Deriv, you can trade synthetic indices with high leverage, enabling you to pay just a fraction of the contract’s value. This can amplify your potential gain but also increase your potential loss.

- Tight Spreads: Synthetic indices offer tight spreads, which can reduce the cost of trading.

- Variety of Trading Platforms: Deriv offers several platforms for trading synthetic indices, including DTrader and Deriv MT5, providing flexibility and convenience for traders.

- Unique Trading Opportunities: Deriv’s proprietary synthetic indices simulate real-world market movements, offering new trading opportunities that are not available with traditional financial assets.

One of the key features of Deriv synthetic indices is the potential for profit. Deriv offers a function called multipliers, which allows traders to increase their profits when the market moves in their favor. This feature combines the upside of leverage trading with the limited risk of options, meaning you can multiply your potential profits without risking more than your stake.

If you’re intrigued by the unique investment opportunities that synthetic indices offer, why not consider signing up on Deriv? As one of the leading platforms offering synthetic indices trading, Deriv provides a user-friendly interface, a variety of trading platforms, and a wealth of educational resources to help you navigate the exciting world of synthetic indices.

8. Olymp Trade

Olymp Trade is a legit trading platform that is regulated by the Vanuatu Financial Services Commission (VFSC) under license number 40131. This regulatory body is responsible for overseeing financial services outside of banking in Vanuatu, including trading platforms like Olymp Trade.

Olymp Trade is also a member of the International Financial Commission (FinaCom), which is an independent self-regulatory organization that provides a dispute resolution service. While FinaCom is not a government-backed regulatory authority, its membership indicates a commitment to maintaining certain standards of conduct.

If a trader has an issue with Olymp Trade that cannot be resolved directly with the broker, they can seek assistance from FinaCom. In cases of proven broker misconduct, traders may be eligible for compensation of up to €20,000.

Olymp Trade’s FTT is a type of trading where assets are traded within a fixed time range. Traders predict whether the price of an asset will go up or down within a specified time frame. The trade time frame can be set at as little as 1 minute or up to a maximum of 23 hours.

Olymp Trade has made a name for itself by offering a user-friendly platform that’s easy to navigate, even for beginners. The platform features a multi-chart layout, which makes it easy to monitor several different assets at the same time.

One of the most unique features of Olymp Trade is the Quickler trading mode. This mode allows you to make trades within a 5-second time span. While it requires some getting used to, the results can be worth it. Olymp Trade also offers a wide range of underlying assets to trade binary options on, with a particular emphasis on cryptocurrencies. They offer 12 different crypto pairs, more than most other binary options brokers.

The online trading platform places a strong emphasis on education and support for traders. They offer a wealth of free educational resources, including webinars, video lessons, trading tips, and market news. They also provide a demo account feature that allows you to practice trading and test different strategies before trading with real funds. Their customer support is also commendable. They have a dedicated customer support team that can assist traders with their concerns.

For beginners, Olymp Trade offers a demo account with a balance of $10,000. This allows new traders to practice placing real-time trades and testing strategies without risking real money.

9. MansaX

MansaX is a multi-asset strategy fund managed by Standard Investment Bank (SIB), one of Kenya’s most trusted investment firms. It’s a CMA-certified fund that invests in a diversified portfolio including local and international money markets, equities, derivatives, and more. The fund was launched in 2019 and has since been a part of SIB’s offerings.

MansaX is 100% legit. It’s regulated by the Kenya Capital Markets Authority (CMA), and Standard Investment Bank, one of Kenya’s most trusted investment firms, owns the fund. This gives investors confidence in the platform’s legitimacy and reliability.

The minimum investment amount for MansaX is Ksh 250,000, with a minimum top-up amount of Ksh 100,000. This indicates that the fund targets investors who have a significant amount of capital to invest and are likely looking for a diversified investment portfolio. This entry point may be high for beginner investors or those with limited capital, suggesting that MansaX is geared towards more serious investors who are able to commit a substantial amount of money for at least six months, given the lock-in period.

In terms of performance, MansaX has shown impressive results. For instance, the fund delivered an actual net return of 4.69% in Q4 2023, culminating in a full-year performance of 18.01% net. This is quite attractive, especially when you consider the average returns on traditional savings accounts.

MansaX charges a 5% management fee and a 10% performance fee on returns earned above a 25% hurdle rate. These fees are relatively standard for managed funds, but it’s something to keep in mind as they can affect your net returns.

10. FBS

Established in 2009, FBS has grown to become a global player in the financial markets, serving over 17 million traders in more than 150 countries.

The company is regulated by several top-tier financial authorities, including:

- Cyprus Securities and Exchange Commission (CySEC)

- Australian Securities and Investments Commission (ASIC)

- International Financial Services Commission (IFSC) of Belize

- Financial Sector Conduct Authority (FSCA) in South Africa

This robust regulation ensures that FBS operates with transparency and integrity, providing a secure trading environment for its clients.

One of the other key aspects that make FBS stand out is its favorable trading conditions. FBS offers two types of real accounts and two options for demo trading accounts.

The standard account, for instance, requires an initial deposit from as low as $5, with a floating spread from 0.7 pips, and leverage up to 1:3000. This makes it accessible to both novice and experienced traders.

FBS also offers good liquidity and quotes using 5 points after the decimal point. The spreads start from 0.5 points for volatile Forex pairs, such as EURUSD, XAUUSD, GBPUSD, USDJPY, and AUDUSD. These conditions provide traders with the flexibility to choose a currency pair most appropriate for their trading strategy and make the most of market volatility.

Like other reputable online trading platforms in Kenya, FBS is not just about trading; it’s also about learning. The platform offers optimal trading conditions and good education for beginners from Kenya. It provides educational videos and trading platform tutorials. Traders can also start with a free demo account to acquaint themselves with the platform.

There You Have it

Well, you’ve made it to the end of our journey through the “10 Legit Investment Platforms in Kenya,” and what a ride it’s been! You’ve discovered a treasure trove of opportunities right at your fingertips, and I hope you’re as excited about them as I am.

Now, I know that diving into the world of investments can be as thrilling as it is daunting. But remember, every great investor started somewhere, and you’ve got the advantage of having these ten solid platforms to explore.

But I can’t help but wonder, which of these platforms sparked your interest the most? Was it the one with the cutting-edge technology, or perhaps the one with the most user-friendly interface? Or maybe it’s the platform that aligns perfectly with your investment goals and values?

Your thoughts and experiences are incredibly valuable, not just to me, but to the entire community we’re building here. So, I invite you to share your insights and questions in the comments below. Let’s keep the conversation going!

What’s your take on the investment landscape in Kenya? Any surprises, any particular platform you’re keen on trying out?

Don’t be shy—drop a comment, share your wisdom, or simply say hello. I’m all ears, and I can’t wait to hear from you!