If you’re a trader in Kenya or someone interested in online forex trading, you’ve probably heard about proprietary trading firms, also known as prop firms. These firms provide traders with the capital to trade, allowing you to access larger sums of money than you might have on their own.

- Our Prop Firms Testing Process

- 10 Best Prop Firms in Kenya

- The5%ers - Best Overall Prop Firm

- The Funded Trader Program

- FTUK - Best Instant Funding Prop Firm

- True Forex Funds - Best One-Step Evaluation Prop Firm

- FTMO - Most Trusted Prop Firm in Kenya

- Funding Pips

- SurgeTrader

- Funded Trading Plus

- FundedNext Prop Firm

- Darwinex Zero

There are probably over 500 prop firms out there, and with this high a number, it can be tough to know which prop firms are the best to work with. That’s why we’ve taken it upon ourselves to thoroughly test various platforms to determine which ones truly stand out.

We didn’t just rely on hearsay or online reviews; we put our own money on the line to ensure we’re giving you prop firm recommendations that you can trust.

Join the Copy Trading Revolution

Copy the trades of successful Forex traders and profit from their strategies.

*Forex and CFDs Trading involves high risk. T&Cs apply.

Our recommendations are the product of extensive research, testing, and a genuine desire to see our fellow Kenyan traders succeed. We've gone beyond surface-level features to understand the essence of what each prop firm offers. By pairing our findings with insights from seasoned traders, we ensure that our recommendations are not just theoretical but practically beneficial.

Our Prop Firms Testing Process

Capital & Leverage

One of the primary attractions of prop firms is the access to significant trading capital they offer. We evaluate the amount of capital provided and the leverage options available. This is important because the right amount of capital and leverage can significantly impact your trading strategies and potential profits

Profit Sharing Model

The profit-sharing model is a key consideration. We look at how profits are split between the firm and the trader, aiming to find firms that offer a favorable and motivating profit share to their traders. This directly impacts your potential earnings from trading with the firm

Technology and Trading Platforms

The technology and tools a prop firm offers can greatly affect your trading efficiency and success. We assess the stability and execution speed of their trading platforms, as well as the availability of real-time data and analytical tools. A great trading environment is essential for peak performance

Evaluation Process

Many prop firms require traders to pass an evaluation process or trading challenge before offering them funding. We considered the fairness and transparency of this process, including the criteria used to assess traders, the profit targets set, and the risk management rules in place

Growth Opportunities

Finally, we evaluate the opportunities for growth within the firm, including the potential for increased funding based on performance and the availability of advanced trading accounts. We rated prop firms that support trader growth and development highly compared to those that don't.

10 Best Prop Firms in Kenya

The5%ers - Best Overall Prop Firm

The5%ers is a well-established firm, having been in business since 2016, and it has built a reputation for trustworthiness and reliability

- During our testing, we found that The5%ers to have a set of clear and achievable objectives for traders to reach different levels of funded accounts. The firm's structure is designed to support trader growth, with the potential to manage up to $4,000,000 in trading capital at the highest level.

Top Reasons to Choose The5%ers

- Instant funding: The5ers provides traders with immediate access to trading capital once they pass the evaluation process

- High funding amounts: Traders can access up to $4 million in funding, which is significantly higher than most other prop firms

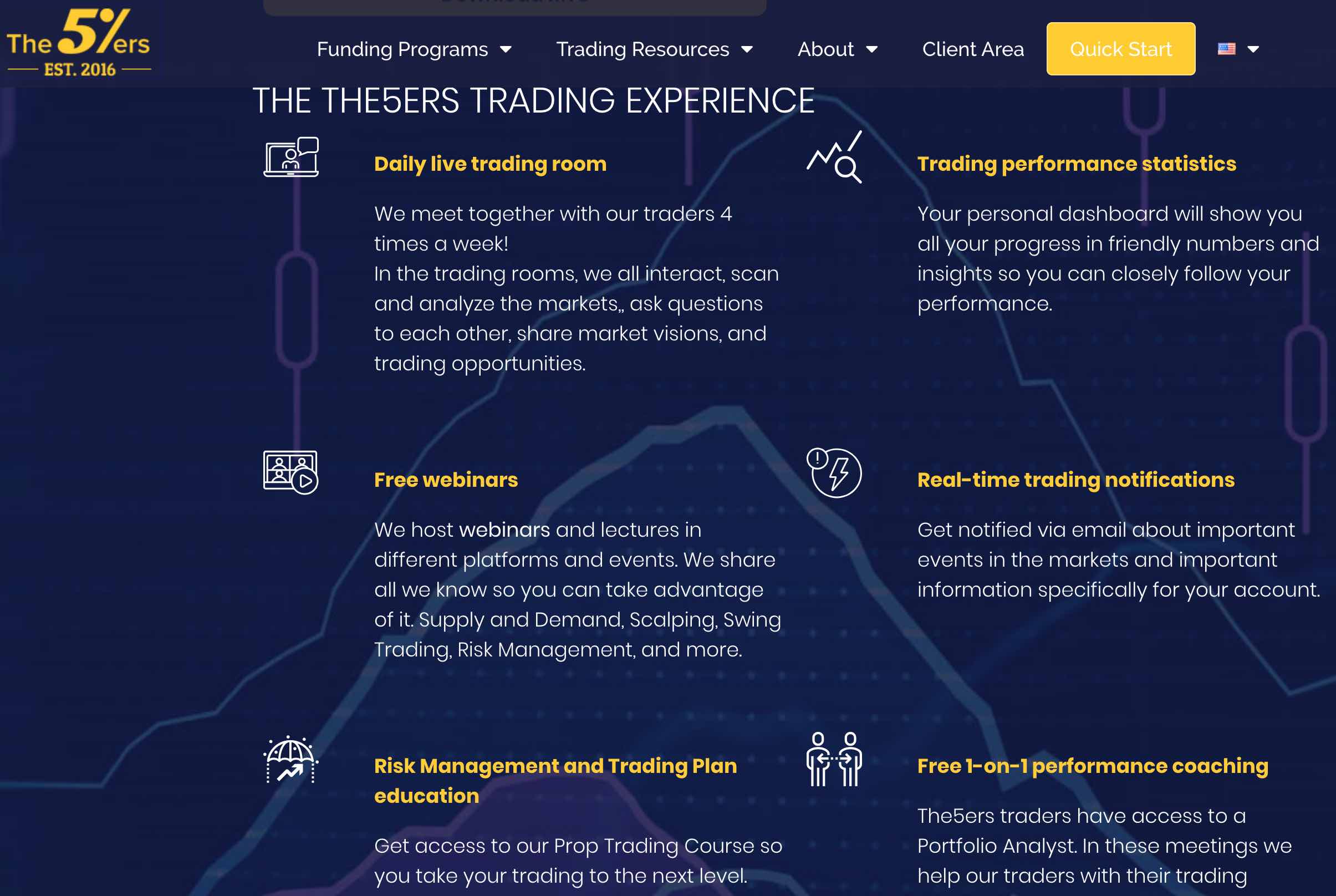

- Comprehensive educational resources: The firm provides webinars, live trading sessions, one-on-one mentorship, a free trading course, and a blog with helpful articles

- MetaTrader 5 platform: The5ers uses the advanced, stable, and user-friendly MT5 trading platform

reasons to Avoid

- Mandatory stop-loss and low risk ceiling: Traders must set a stop-loss for every trade, and the maximum risk allowed is only 2% of the account balance

- Account termination for inactivity: Accounts that are inactive for more than 21 days are terminated

- No copy trading allowed: Traders cannot engage in copy trading strategies

More Details About The5%ers

After a thorough testing process where we put more than 100 prop firms to the test, The5%ers emerged as the best prop firm in Kenya for several compelling reasons.

This platform offers a unique blend of features and benefits that cater to both novice and experienced traders, making it an ideal choice for those looking to venture into the world of proprietary trading.

- Funding and Leverage: The5%ers provides traders with a significant amount of capital to trade, starting from $6,000, with a leverage of up to 1:100 . This allows traders to access larger positions and potentially increase their profits without risking their own capital.

- Transparent Evaluation Process: The5%ers has a clear and transparent evaluation process for traders, ensuring that skilled traders who pass the evaluation receive a funded trading account. This process is designed to protect investors and maintain a high standard of trading on the platform.

- Trading Platform and Instruments: The5%ers utilizes the MetaTrader 5 platform, which is known for its stability, execution speed, and advanced analytical tools. The platform supports trading in various instruments, including currency pairs, precious metals, indexes, and securities.

- Education and Support: The5%ers offers an in-depth education program and a convenient demo account, allowing traders to quickly improve their skills and familiarize themselves with the platform. Additionally, their responsive customer support ensures that traders receive assistance when needed.

- Profit Split and Payout: The5ers offers up to 100% profit share on their Bootcamp Program. and 50% profit split of the trader’s profit from bonus funds, which is a competitive rate compared to other prop firms. The prop firm also allows traders to take payouts whenever needed, offering more flexibility than firms with specific withdrawal dates.

- Risk Management: The5ers emphasizes risk management by limiting the daily loss limit of traders and providing a maximum drawdown limit to prevent excessive losses. This approach protects both the traders and the investors.

- Long-Term Trading and Weekend Holding: The5%ers is an excellent platform for long-term traders, as it allows for weekend trade holding, which is not an option in many other prop firms. This feature enables traders to hold positions over the weekend and capitalize on potential market movements.

If you’re a trader who values education and hands-on trading interaction with experienced prop firm traders, you’ll definitely love The5%ers.

The5%ers offers a wealth of educational resources, making it one of the best prop firms for beginners. They have free weekly webinars, risk management coaching as well as 1-on-1 performance coaching.

The Funded Trader Program

The Funded Trader Program offers an attractive profit split, with traders keeping up to 90% of their profits

Our team of experienced forex traders in Kenya personally put this prop firm through its paces, investing our own money and time to ensure that our assessment is based on firsthand experience and genuine performance evaluation.

Top Reasons to Choose the Funded Trader

- Access to significant trading capital: Successful traders can receive up to $400,000 in funding

- Attractive profit-sharing model: Traders can keep up to 90% of their profits

- Multiple trading platforms: The firm supports popular platforms such as MetaTrader 4, MetaTrader 5, and cTrader

- Opportunity to improve trading skills: The evaluation process and ongoing mentorship help traders refine their strategies and risk management techniques

Reasons to Avoid TFT

- Initial fees: Traders must pay a fee to participate in the evaluation process, although these fees are refundable if the trader is successful

- Limited information on scaling requirements: The specific requirements for account scaling are not clearly outlined on the firm's website

- No guaranteed success: As with any trading endeavor, there is no guarantee of success, and traders must still exercise caution and employ sound risk management strategies

More Details About TFT

- Evaluation Process and Funding Opportunities: The Funded Trader employs a two-step evaluation process, consisting of the Trading Combine and the Funded Account Verification. While this process does require an initial fee, it is refundable for successful traders. Once you pass these stages, you’ll gain access to a funded account with up to $400,000 in trading capital.

- Trading Conditions and Platforms: One of the standout features of The Funded Trader is the wide range of trading instruments available, including forex, indices, metals, commodities, stocks, and cryptocurrencies. This diversity allows you to apply your strategies across multiple markets. The firm also supports popular trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader, ensuring a seamless trading experience.

- Profit Split and Account Scaling: The Funded Trader offers an attractive profit-sharing model, allowing you to keep up to 90% of your profits. This is a significant advantage compared to many other prop firms. Additionally, successful traders have the opportunity to rapidly scale their accounts, increasing their earning potential.

- Risk Management and Drawbacks: While The Funded Trader has many advantages, there are some drawbacks to consider. The firm requires traders to set a mandatory stop-loss for every trade and adhere to a maximum daily loss limit. This may restrict your trading style and limit your flexibility. Additionally, accounts that remain inactive for an extended period may be subject to termination.

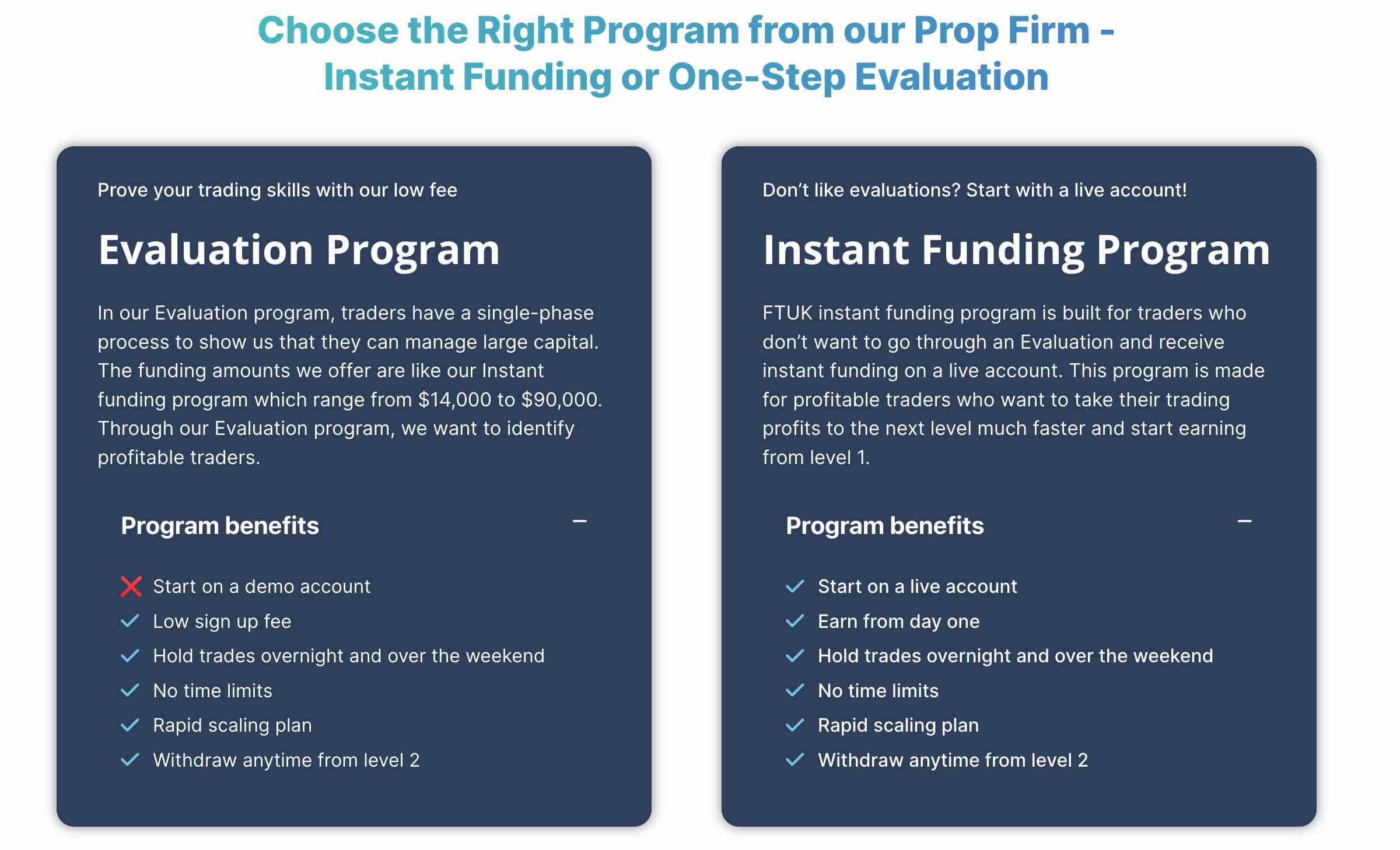

FTUK - Best Instant Funding Prop Firm

FTUK's evaluation process consists of a single-step challenge, where traders must achieve a 10% profit target while adhering to a 8% maximum drawdown.

FTUK’s single-step challenge is just one of the many reasons why we highly recommend this prop firm to Kenyan traders. This challenge sets clear and achievable objectives: a 10% profit target with a maximum drawdown limit of 8%.

In addition to the single step evaluation program, FTUK also offers the option for instant funding. The most outstanding aspect of the Instant Funding Program is the opportunity it presents for traders to start with a live account immediately.

This feature is particularly advantageous for experienced traders confident in their trading strategies and risk management skills.

Top Reasons to Choose FTUK

- Instant Funding Program: Direct access to live trading accounts with an 80% profit share

- Single-Step Challenge: A streamlined evaluation process for those who prefer a traditional route to funding

- Flexible Trading Capital: Traders have the option to choose from different levels of trading capital, including $14,000, $40,000, $60,000, or $90,000.

- Zero Withdrawal Fees: FTUK offers the advantage of withdrawing profits with $0 fees, ensuring that traders keep a maximum amount of their earnings

Reasons to Avoid FTUK

- Gaps Between Balance Steps: One of the disadvantages noted is the large, non-standard gaps between balance steps. This can be a hurdle for traders looking to scale their accounts smoothly

- Pressure to Perform: With instant funding, there's an inherent pressure to perform well from the outset. Traders are thrust into a live trading environment where real capital is at risk from day one

More Details About FTUK Prop Firm

FTUK’s Instant Funding Program is a game-changer for experienced traders who are ready to hit the ground running.

By offering direct access to a live trading account and an impressive 80% profit share, FTUK demonstrates a strong belief in the abilities of its traders. This program is ideal for those who have honed their skills and are confident in their trading strategies.

For traders who prefer a more traditional route, FTUK’s single-step evaluation process is a breath of fresh air.

The clear objectives and streamlined nature of this challenge allow traders to focus on what matters most – demonstrating their trading prowess. Successful completion of the challenge opens the door to a funded account and the opportunity to trade with significant capital.

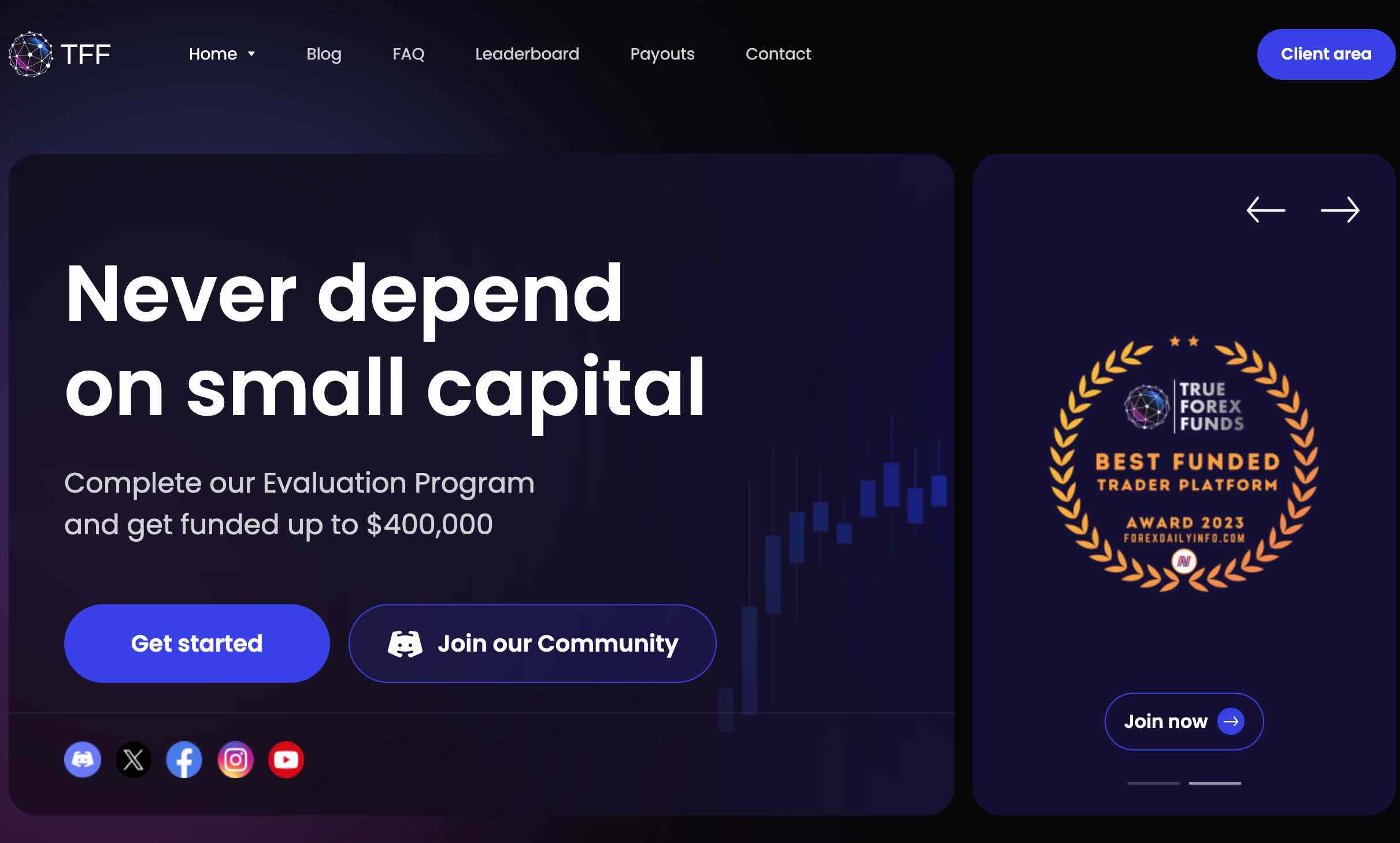

True Forex Funds - Best One-Step Evaluation Prop Firm

TFF understands that time is money. With their One-Phase Funding, you can become a funded trader in as little as five days

Despite being a relatively new player in the prop trading industry, TFF has quickly established itself as a reliable and reputable firm. With verified payouts and a rapidly growing user base spanning 110 countries, TFF is attracting traders from all corners of the globe

More Details About True Forex Funds

Beyond the One-Step Evaluation, TFF offers a suite of features that cater to the needs of modern traders:

- No Stop Loss Requirement: This gives you the flexibility to implement your own risk management strategies without being constrained by mandatory stop losses.

- Weekend Crypto Trading: A unique offering that allows traders to engage in cryptocurrency trading over the weekend.

- Expert Advisors (EA) and News Trading Allowed: TFF supports the use of EAs and trading during news releases, providing traders with the tools and opportunities to execute their strategies effectively.

- Scalable Capital: Starting with an initial capital, traders have the opportunity to scale up to $2,500,000, offering significant growth potential.

- Swap-Free Account and Weekend Position Holding: Catering to a diverse range of traders, TFF offers swap-free accounts and allows positions to be held over the weekend

Community Trust and Transparency

True Forex Funds has garnered positive feedback from the trading community, with an excellent Trustpilot rating of 4.6/5.

This reflects the firm’s commitment to providing a transparent and supportive trading environment.

Traders have praised TFF for its professional service, prompt payments, and the fair trading parameters it offers

News Trading with TFF

News trading involves taking positions in the financial markets based on the release of economic news or data.

This strategy can be highly profitable for traders who can quickly analyze and react to new information.

True Forex Funds allows traders to engage in news trading, a practice often restricted by other prop firms due to the volatility and risk involved.

This freedom is not just a mere policy but a strategic advantage for traders who have the acumen to interpret and act on economic announcements.

- By permitting news trading, TFF empowers traders to use their analytical skills to their full potential, leveraging economic indicators and news releases to make informed trading decisions.

- No Restrictions on Trading Times: Unlike some prop firms that impose restrictions during news events, TFF offers the flexibility to trade without limitations, ensuring that traders can take advantage of opportunities as they arise.

FTMO - Most Trusted Prop Firm in Kenya

FTMO's commitment to their traders is evident through their comprehensive support system, including educational applications, Account Analysis, and Performance Coaches, all designed to help you on your journey to financial independence

FTMO caught our attention with its unique 2-step Evaluation Process, designed to identify and nurture trading talent.

We dove headfirst into the FTMO Challenge and Verification stages, adhering to their Trading Objectives to demonstrate discipline and experience.

Our journey wasn’t just about passing tests; we engaged with their educational resources, account analysis, and even sought guidance from their Performance Coaches. We wanted to experience everything FTMO had to offer, just like you would.

We were particularly impressed by FTMO’s commitment to building long-term relationships with traders. Their Scaling Plan, which increases your account balance by 25% every four months if you’re consistent and profitable, is a testament to this.

Top Reasons to Choose FTMO

- High profit payouts: FTMO offers some of the best profit splits in the prop trading industry. New traders start at 80% and can scale up to 90%.

- Trustworthy and reliable: FTMO has an excellent reputation for making timely payouts.

- Advanced trading technology: FTMO provides a suite of apps and tools to help with risk management, performance tracking and profit maximization.

- Scaling opportunities: Consistently profitable FTMO traders can access up to $2 million in trading capital through the Scaling Plan.

Reasons to Avoid FTMO

- Demo accounts only: Even after passing the FTMO Challenge, traders operate on demo accounts with fictitious capital.

- Two-step evaluation process: To receive funding, traders must first pass the FTMO Challenge and then a Verification stage. Some find this process lengthy.

- Emphasis on discipline: FTMO's trading rules are designed to instill disciplined risk management. Some traders may find these rules restrictive.

More Information About FTMO

FTMO offers a range of account funding packages, from $10,000 to $200,000, catering to traders of various experience levels and capital requirements. This flexibility allows traders to choose a package that best fits their trading strategy and risk tolerance.

- By successfully navigating the FTMO Challenge and Verification stages, traders can access an account with up to $200,000 in trading capital. This rigorous process ensures that only disciplined and skilled traders are entrusted with significant capital, which is crucial in a high-stakes environment like Forex trading.

- If you consistently demonstrate profitability and sound risk management, FTMO rewards you by increasing your account balance by 25% every four months. This is a game-changer for traders looking to scale their strategies without the added pressure of risking personal funds.

- FTMO also offers an Affiliate Programme, which can be an attractive opportunity for those involved in affiliate marketing, providing a way to earn commissions by referring new traders to the platform.

Demo Accounts in FTMO

FTMO’s 2-step Evaluation Process, consisting of the FTMO Challenge and Verification stages, is designed to identify skilled traders who can manage risk effectively.

During these stages, traders operate on demo accounts with fictitious capital, trading in a simulated environment. This approach allows FTMO to assess a trader’s abilities without putting real funds at risk.

While some may argue that demo trading doesn’t fully reflect the psychological pressures of trading with real money, it’s important to note that FTMO’s Trading Objectives are designed to test a trader’s discipline and consistency.

By setting clear profit targets and drawdown limits, FTMO can evaluate a trader’s ability to adhere to a structured trading plan, which is a crucial skill in real-world trading.

Once a trader successfully completes the Evaluation Process, they are provided with an FTMO Account, which is also a demo account with fictitious capital. This may seem counterintuitive, but it’s essential to understand FTMO’s business model.

FTMO itself trades on its own account using data from simulated trades executed by selected FTMO clients. By providing traders with demo accounts, FTMO can monitor and analyze their trading strategies without exposing the firm to unnecessary risk.

Traders are rewarded with a share of the profits generated on their FTMO Account, provided they meet certain conditions. This model allows FTMO to scale their business while maintaining a controlled risk environment. It also provides opportunities for traders who may not have the capital to trade at high volumes on their own.

While the use of demo accounts may not appeal to all traders, it’s a key component of FTMO’s risk management strategy.

- It’s worth noting that FTMO is transparent about their use of demo accounts. They clearly state in their FAQ and terms that traders will be provided with simulated accounts. This transparency allows potential traders to make informed decisions about whether FTMO’s model aligns with their trading goals.

Funding Pips

Funding Pips offers a payout system that is both flexible and trader-friendly. The minimum amount for a payout is set at 1% of the initial balance, including the firm's split. This means that once you have reached at least 1% profit on your initial balance, you are eligible to request a payout

If you do not like the restrictive rules of other prop firms, Funding Pips will be your friend.

After putting our own money on the line and navigating through the evaluation process, we can confidently say that Funding Pips is a prop firm that stands out for all the right reasons.

Their trader-centric approach, flexible trading conditions, and the potential for growth make them a top choice for traders in Kenya and beyond.

We were particularly impressed by the flexibility in trading conditions. There’s no pressure of time limits on trading days, allowing you to trade at your own pace.

Plus, the ability to use Expert Advisors (EAs), trade during news events, and manage trades over the weekend offers a level of freedom that’s hard to find elsewhere.

This prop firm has a two-phase evaluation process that is rigorous but fair. It’s designed to truly assess a trader’s ability to be consistent and disciplined.

We found this approach to be a great learning experience, pushing us to refine our strategies and risk management practices.

Funding Pips Pros

- Profit Split: You can earn up to 90% of the profits made on trades, which is a generous share

- Flexible Trading Rules: Funding Pips allows the use of EAs, holding trades over the weekend, and trading during news events

- Quick Payouts: The firm offers payouts every five trading days, which is quite fast compared to industry standards

- Supportive Community: The firm has a reputation for having a helpful and engaging trader community, which can be beneficial for learning and growth.

- Affordable Evaluation Program: Funding Pips offers one of the most affordable evaluation programs in the prop trading industry.

Funding Pips Cons

- Stringent Evaluation: The evaluation process, while beneficial for skill development, is stringent and may be challenging for some traders

- Demo Accounts: All accounts, including the funded ones, are demo accounts. This means you're not trading with real money, which might affect the psychological aspect of trading

- Limited Track Record: As a relatively new prop firm established in 2023, Funding Pips has a limited track record compared to some more established firms.

Funding Pips Prop Firm Details

Funding Pips has a structured two-phase evaluation process designed to identify and nurture trading talent. This process allows traders to demonstrate their skills and strategy effectiveness over two distinct phases – the Student Phase and the Practitioner Phase.

In the Student Phase, traders must achieve an 8% profit target without breaching any rules, while in the Practitioner Phase, the profit target is set at 5%. This approach ensures that only skilled traders progress, maintaining a high standard within the firm.

Once you become a funded trader with Funding Pips, you’ll receive a payout every 5 trading days with an 80% profit split. If you earn a Hot Seat in their firm, you’ll receive on-demand payouts with a 90% profit split.

They process payouts using bank transfers and crypto.

We tested Funding Pips by opening a $100,000 account and trading with their evaluation program. We’re happy to report that we passed both phases and became funded traders.

We found their platform to be reliable and their trading rules to be fair. We also appreciate their focus on trader development and flexible trading rules.

Here are some additional facts about Funding Pips:

- Location: Funding Pips is based in Dubai, with its headquarters located at IFZA Business Park.

- Demo Accounts: All accounts provided to clients, including the Master or funded accounts, are demo accounts.

- Evaluation Program: Traders must pass a two-phase evaluation process to become funded traders, with profit targets set for each phase.

- Risk Management: The firm enforces a 5% Maximum Daily Loss Limit and a 10% Maximum Loss Limit to promote disciplined trading.

- Scaling Plan: Traders can scale their accounts based on performance, with potential increases in account size and more favorable loss limits.

- Profit Split: Traders receive an 80% profit split, which can increase to 90% once they earn a ‘Hot Seat’ at the firm.

- Payouts: Payouts are processed every five trading days, with the minimum amount for a payout being 1% of the initial balance.

- Leverage: The leverage provided is 1:100, allowing traders to amplify their trading positions.

- Trading Instruments: Traders can trade a variety of instruments, including Forex pairs, commodities, indices, and cryptocurrencies.

- Trading Platforms: Funding Pips offers the MT4 and MT5 trading platforms.

- Account Merging: Master/Funded accounts can be merged into one account or kept separately based on the trader’s preference.

- Refund Policy: Traders who pass Phase 1 and Phase 2 of the evaluation process will receive a refund of their fees with their fourth payout.

- IP Address Matching: The region of the IP address used for various stages of the evaluation and trading must match to ensure compliance.

SurgeTrader

We spent countless hours trading on SurgeTrader's platform, analyzing its features, execution speeds, and overall performance. We tested it under various market conditions to gauge its reliability and consistency.

Through our extensive testing, we discovered that SurgeTrader truly shines in several key areas:

- Cutting-Edge Technology: SurgeTrader’s platform is built on state-of-the-art technology, ensuring lightning-fast execution speeds and a seamless trading experience.

- Comprehensive Education: SurgeTrader offers a wealth of educational resources, including webinars, video tutorials, and one-on-one mentorship, to help traders of all levels improve their skills.

- Favorable Profit Splits: SurgeTrader’s profit split structure is highly competitive, allowing traders to keep a significant portion of their profits.

- Responsive Support: We were consistently impressed by SurgeTrader’s customer support team, who provided prompt and knowledgeable assistance whenever we had questions or concerns.

SurgeTrader Pros

- Generous Profit Split: SurgeTrader offers a very favorable profit split percentage, starting at 75% of the profits obtained, which can increase to 90% with an add-on purchase

- Flexible Trading Strategies: The platform allows traders to use any trading strategy

- Simple Evaluation Process: SurgeTrader's evaluation process is straightforward, making it easier for traders to qualify for a funded account

- High Capital Access: Traders have the opportunity to manage up to $1,000,000 of capital

- Affordable Evaluation Program: Funding Pips offers one of the most affordable evaluation programs in the prop trading industry.

SurgeTrader Cons

- Limited Educational Material: One of the main drawbacks is the lack of extensive educational resources for traders

- Demo Accounts: All accounts, including the funded ones, are demo accounts. This means you're not trading with real money, which might affect the psychological aspect of trading

SurgeTrader provides traders with virtual funds to trade in the financial markets. This approach has several implications for you as a trader:

- Risk-Free Environment: Trading with virtual funds means you’re not risking your own capital. This can be a significant advantage, especially for those new to trading or looking to test new strategies without financial repercussions.

- Skill Development: Virtual funds allow you to focus on honing your trading skills and strategies, which is essential for long-term success in the markets.

- Performance-Based Earnings: Your earnings are based on performance. SurgeTrader allows you to keep up to 90% of the gains, which can be quite lucrative if you’re a skilled trader.

Funded Trading Plus

Funded Trader Plus is ideal for experienced day traders looking for flexibility and generous profit split potential. It caters to short-term trading styles and offers the potential to earn high percentages of your target profit goal

Funded Trading Plus offers a range of benefits that make it an attractive option for traders in Kenya:

- Access to Significant Capital: You can get funded with account sizes up to $150,000, allowing you to trade without overleveraging your personal funds.

- High Profit Split: The firm offers a generous profit split of up to 90%, meaning you get to keep the lion’s share of the profits you make.

- Diverse Trading Instruments: Whether you’re interested in Forex, indices, commodities, or cryptocurrencies, Funded Trading Plus provides a wide array of instruments to trade.

- Simulated-Live Environment: Their programs offer a simulated-live trading environment, which means you can practice and hone your strategies without risking real money.

- Support and Training: They provide a comprehensive support package, including courses on scalping and trading psychology, as well as access to a live trade room and direct contact with professional funded traders.

Funded Trading Plus Pros

- No Time Restrictions: During the evaluation phase, there are no time limits to meet your profit targets. This flexibility allows you to trade at your own pace without the pressure of a ticking clock

- Diverse Trading Instruments: With over 250 crypto pairs in addition to forex, indices, and commodities, Funded Trading Plus offers a rich palette for traders of all styles.

- Use of Expert Advisors (EAs): For those who rely on automated trading systems to execute strategies, this is a significant advantage.

- Tailored Trading Programs: Funded Trading Plus doesn't believe in a one-size-fits-all approach. They offer customized trading programs that cater to your individual trading style and goals, providing a more personalized experience.

Funded Trading Plus Cons

- No Overnight Trading: Funded Trader Plus does not allow holding positions overnight, which could limit some trading strategies. Swing traders and investors may find the platform too restrictive

- Maximum Drawdown Limit: Funded Trader Plus imposes a maximum daily drawdown limit, which could challenge funded traders with riskier trading strategies.

Funded Trading Plus Review

Sensible Leverage

Funded Trading Plus offers a leverage of 30:1, striking a balance between providing ample trading power and mitigating the risk of significant losses.

This leverage level is particularly appealing for traders who prioritize risk management and long-term sustainability over high-risk, high-reward strategies.

FundedNext Prop Firm

FundedNext, with its blend of flexibility, transparency, rewarding profit splits, and a supportive community, stands out as a prop firm that genuinely caters to the needs and aspirations of Kenyan traders.

During our comprehensive testing of FundedNext, we delved into every aspect of their platform, leaving no stone unturned. From the user interface and trading tools to the educational resources and customer support, we scrutinized each element with a critical eye.

FundedNext Pros

- Generous Profit Sharing: The 15% profit share offered during the challenge phases is a rare opportunity to earn while you're still proving your mettle

- No Time Pressure: The absence of a time limit on the challenge phase allows you to trade without the stress of a deadline

- High Profit Share Post-Verification: Achieving up to a 95% profit share after passing the verification phase is incredibly rewarding.

FundedNext Cons

- Simulated Environment: Trading in a fully simulated account means you're not participating in the live market. While this eliminates the risk of personal capital loss, some traders may prefer the real-world experience from the get-go.

- Restricted Trading Hours Around Major News Events: Trading around the time of major economic news releases is restricted.

- Limited Trading Freedom: Restrictions on trading hours, leverage, and certain trading styles can feel limiting to traders used to a high degree of freedom in their trading decisions.

More Details About FundedNext

Here’s a detailed look at some of the key aspects of FundedNext that you, as a Kenyan trader, might find appealing:

Profit Sharing During Challenge Phases

FundedNext offers a 15% profit share from the profits you make during the challenge phases. This is quite generous, as many prop firms do not offer profit sharing until you’ve passed the challenge and are trading with a live funded account.

This feature allows you to earn while you prove your trading skills, making the challenge phase more rewarding.

No Time Limit on Challenge Phase

The absence of a time limit on the challenge phase is a significant advantage. It means you can trade at your own pace without the pressure of a ticking clock. This is particularly beneficial if you have a longer-term trading strategy or if you’re someone who prefers not to rush your trading decisions.

Balance Based Drawdown

FundedNext employs a balance-based drawdown system, which offers a more flexible risk management approach. Instead of a fixed drawdown limit, your allowable drawdown will adjust with your account balance, giving you more room to maneuver and manage your trades effectively.

High Profit Share

Once you’ve successfully passed the challenge and verification phases, FundedNext offers up to a 95% profit share, which is among the highest in the industry. This means that the majority of the profits you make are yours to keep, aligning the firm’s interests with your success as a trader.

Trading Platforms

FundedNext supports both MetaTrader 4 and MetaTrader 5, which are widely regarded as some of the best trading platforms available. They offer advanced charting tools, custom indicators, and automated trading capabilities, making them suitable for traders of all levels.

Monthly Contest and Free Accounts

The monthly contest is an exciting opportunity to win cash rewards and unlock free accounts. This adds an element of competition and provides an additional incentive to perform well in your trading.

Express Challenge

The Express Challenge is designed for traders who want to fast-track their way to a funded account. This option allows you to demonstrate your trading proficiency over a shorter period, making it an attractive choice for experienced traders who are confident in their strategies.

Leverage

With a leverage of 1:100, FundedNext offers a balanced approach to leverage, giving you the potential to trade larger positions while still maintaining a level of risk management.

Simulated Account

It’s important to note that a FundedNext account is a fully simulated account. This means that while you are trading in a simulated environment, the skills and strategies you develop are directly transferable to the real markets. The simulated account allows you to trade without risking personal capital, while still providing a realistic trading experience.

Darwinex Zero

Based on our comprehensive testing and personal investment, we believe Darwinex Zero is a compelling option for Kenyan traders. Its unique blend of affordability, risk-free trading, opportunities for seed capital, and a supportive trading environment makes it a standout choice.

Why Darwinex Zero Stands Out for Kenyan Traders

- Affordable Entry and Operational Costs: With a sign-up fee of €95 and a monthly subscription of €38, Darwinex Zero offers an accessible platform for traders at all levels. This cost structure is particularly appealing for Kenyan traders looking for a low-barrier entry into forex trading with a chance to attract seed capital.

- No Capital at Risk: Trading on a simulated account means you’re not putting your own capital at risk. This feature is invaluable for traders who are still refining their strategies or those cautious about the financial commitment.

- Seed Capital Opportunities: The DarwinIA seed capital allocation programme is a unique feature that allows traders to attract seed capital based on their trading performance. This is a game-changer for traders looking to scale their operations without the need for substantial personal investment.

- Flexible Trading Conditions: With no up or out monthly return requirements, Darwinex Zero offers the flexibility to trade according to your long-term vision. This approach aligns well with the needs of Kenyan traders who may prefer a more strategic, less pressured trading environment.

- Comprehensive Asset Range: Access to over 900 tradable assets, including CFDs on stocks, ETFs, indices, commodities, and forex, provides Kenyan traders with a broad spectrum for diversification and strategy testing.

- Technological Excellence: The support for both MetaTrader 4 & 5 platforms ensures traders can use advanced tools and algorithms to refine their trading strategies, offering a competitive edge in the market

Darwinex Zero Pros

- Regulatory Framework: Darwinex operates under a regulatory framework, adding an extra layer of trustworthiness compared to some prop firms that may not have the same level of oversight

- No Personal Financial Risk: Traders use a virtual account to develop their strategies without risking their own capital

- Seed Capital Access: Traders have the opportunity to attract seed capital through the DarwinIA capital allocation program

- Flexible Trading Styles: Traders are free to choose their trading style, which is evaluated based on long-term performance

Darwinex Zero Cons

- Monthly Subscription Cost: Traders must pay a monthly fee of €38, which could add up over time if capital allocation or investor attraction takes longer than expected

- Virtual Trading Only: Initially, traders are limited to virtual trading, which means they won't be handling real capital until they progress through the Darwinex ecosystem

- Performance Fee Share: Traders receive 15% of the profits, which might be lower compared to other prop firms or personal trading where traders keep a larger share of the profits

- Learning Curve: The platform's unique features and progression system may require a learning period for new users to fully understand and navigate